(HedgeCo.Net) 2025 closed with a striking signal for the private equity world: the largest funds are capturing an unprecedented share of capital, consolidating industry influence as both fundraising dynamics and LP behavior shift in response to a challenging exit environment and heightened liquidity needs. This trend is now redefining how large private equity firms raise, deploy and monetize capital in 2026 — with implications for deal flow, competition and portfolio risk profiles across the global buyout landscape.

Record Capital Concentration at the Top

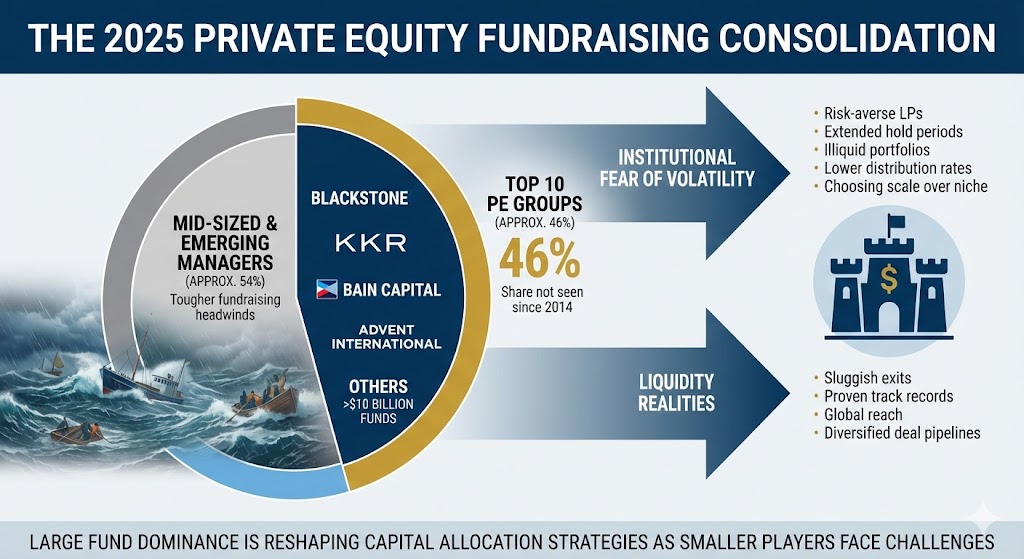

According to recent data, the top 10 private equity groups captured roughly 46 % of U.S. PE fundraising in 2025, a share not seen since 2014. Established giants such as Blackstone, KKR, Bain Capital, Advent International and others each raised funds north of $10 billion, while mid-sized and emerging managers faced tougher fundraising headwinds.

This concentration reflects two major forces:

- Institutional fear of volatility: Limited partners (LPs) are increasingly risk-averse after years of extended hold periods, illiquid portfolios and lower distribution rates, choosing scale over niche strategies.

- Liquidity realities: With exits remaining sluggish, investors are more comfortable with managers that have proven track records, global reach and diversified deal pipelines.

Large fund dominance is reshaping capital allocation strategies as smaller players struggle to keep pace, especially in the current exit environment where companies sit on sponsor books longer than expected.

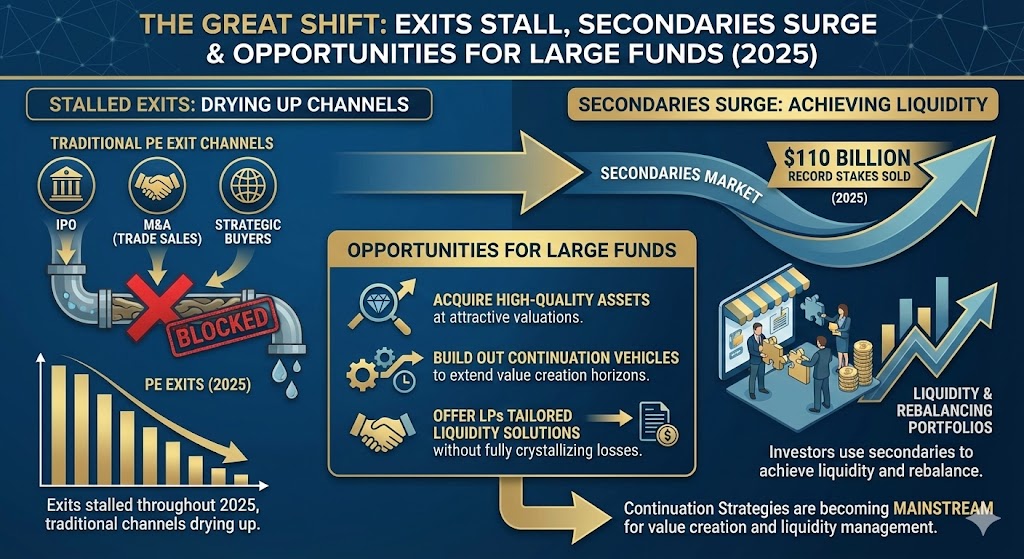

Exits Stall, Secondaries Surge

A major undercurrent amplifying these trends is the drying up of traditional PE exit channels. As exits stalled throughout 2025, private capital investors sold a record $110 billion of stakes in ageing funds, using the secondaries market to achieve liquidity and rebalance portfolios.

This surge in secondary sales has created significant opportunities for large funds to:

- Acquire high-quality assets at attractive valuations.

- Build out continuation vehicles that extend value creation horizons.

- Offer LPs tailored liquidity solutions without fully crystallizing losses.

Continuation strategies are becoming a vital tool in the PE toolkit, enabling sponsors to retain strong portfolio companies for longer while satisfying LP liquidity needs — effectively balancing fund life cycles with market realities.

Why LPs Are Favoring Large Sponsors

Institutional investors — sovereign wealth funds, pensions and endowments — are gravitating toward mega managers for several reasons:

- Scale and diversification: Larger funds can underwrite more deals and hold more diversified portfolios, reducing idiosyncratic risk.

- Proven execution: Deep resources and established networks allow large funds to navigate complex deals and downturns more effectively.

- Secondary market access: Big sponsors often lead secondary buyouts and continuation vehicles, capturing premium opportunities.

Industry allocators tell us that “brand name” carries increasing weight when committing capital, which explains why the largest managers’ fundraising share ballooned last year. This is especially true as many LPs confront portfolio rebalancing needs and seek managers with robust LP-alignment mechanisms.

Spotlight: Advent International’s Global Strength

One of the standout firms benefiting from these dynamics is Advent International, which manages an estimated $100 billion in private equity assets and continues to deploy across North America, Europe, Latin America and Asia. Its global scope and sector expertise have made it a preferred destination for large LP commitments.

Advent’s focus on international buyouts and strategic restructuring plays well with LPs seeking seasoned partners capable of navigating diverse regulatory frameworks and competitive deal landscapes.

Geographic Shift and Sector Focus

Large PE funds are also increasingly global in their deployment strategies. In addition to traditional hubs in the U.S. and Europe, strong activity is emerging across:

- Asia-Pacific mid-market: renewed deal flow and growth opportunities amid economic normalization.

- Tech and infrastructure: driven by AI adoption, digital infrastructure buildouts and cybersecurity investments.

- Healthcare and financial services: sectors with resilient demand and defensive traits in uncertain macro climates.

LPs appreciate that scale enables access to these diverse opportunities, often with dedicated sector teams that can source proprietary deal flow.

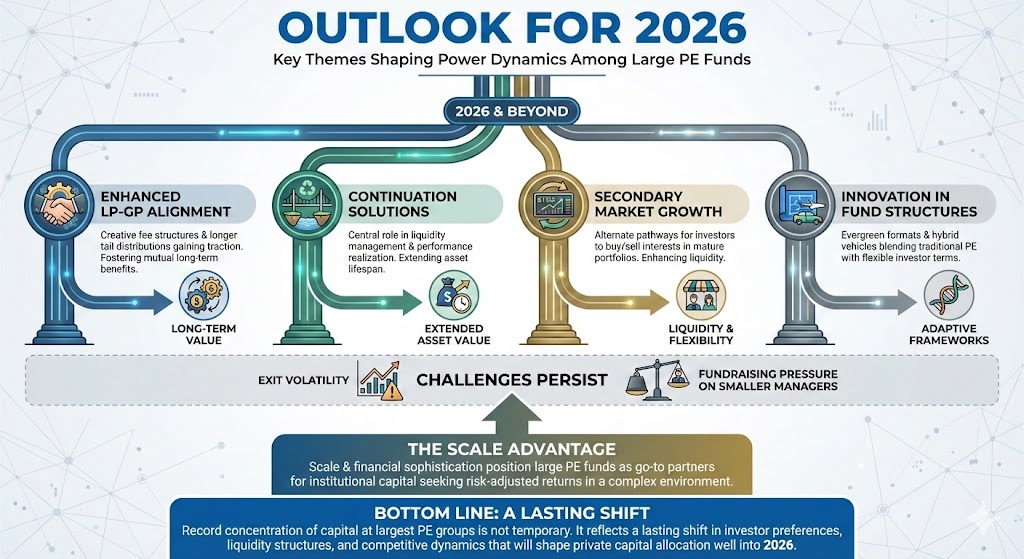

Outlook for 2026

As we move deeper into 2026, several key themes are likely to shape the power dynamics among large private equity funds:

- Enhanced LP-GP alignment: with creative fee structures and longer tail distributions gaining traction.

- Continuation solutions: playing a central role in liquidity management and performance realization.

- Secondary market growth: providing alternate pathways for investors to buy/ sell interests in mature portfolios.

- Innovation in fund structures: such as evergreen formats and hybrid vehicles that blend traditional private equity with flexible investor terms.

Though challenges persist — notably exit volatility and fundraising pressure on smaller managers — the scale and financial sophistication of large PE funds continue to position them as the go-to partners for institutional capitalseeking risk-adjusted returns in a complex environment.

Bottom Line: The record concentration of capital at the largest private equity groups is not a temporary trend — it reflects a lasting shift in investor preferences, liquidity structures and competitive dynamics that will shape private capital allocation well into 2026.