(HedgeCo.Net) In a strategic pivot toward private market solutions for wealthy individuals, Coutts — the legendary UK private bank — is reportedly in discussions with Apollo Global Management and Ares Management to launch private markets investment funds for its elite client base.

A New Frontier: Private Markets for Ultra-High-Net-Worth Investors

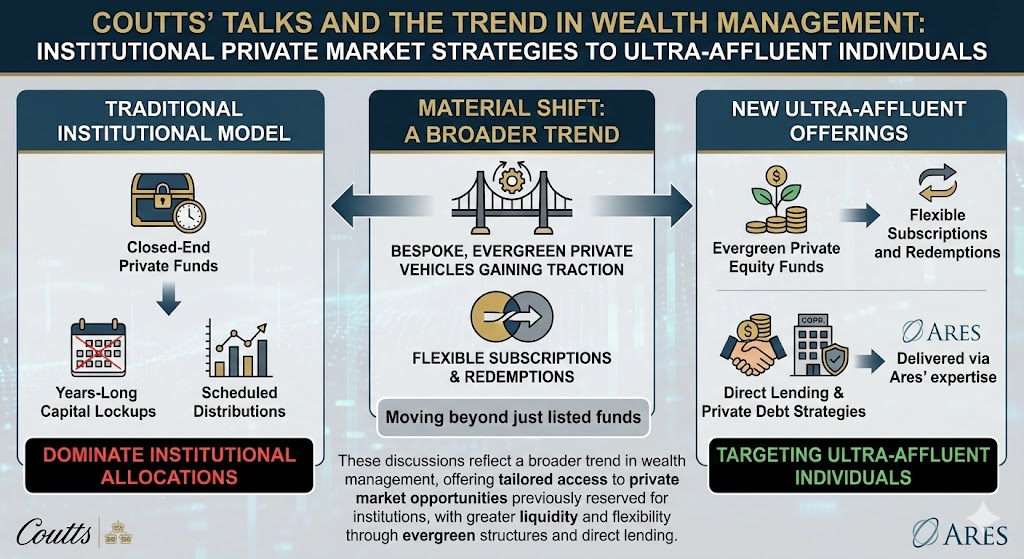

Coutts’ talks with the US private capital giants reflect a broader trend: bringing traditionally institutional private market strategies to ultra-affluent individuals. These discussions signal a material shift in wealth management, where bespoke, evergreen private vehicles — not just listed funds — are gaining traction.

The proposed offerings include:

- Evergreen private equity funds with flexible subscriptions and redemptions.

- Direct lending and private debt strategies delivered via Ares’ expertise.

These offerings differ significantly from closed-end private funds that dominate institutional allocations, which lock up capital for years and rely on scheduled distributions.

Why This Matters

Coutts — long associated with tailored investment solutions — is embracing private markets as a core wealth strategy rather than a niche allocation. Several drivers are fueling this shift:

- Ultra-high-net-worth investors seeking higher returns than public markets.

- A desire for diversification away from traditional equities and bonds.

- The rise of client demand for alternatives as a generational wealth transfer tool.

By arranging structures that are more liquid than traditional private funds, the bank may provide wealthy clients enhanced flexibility without sacrificing the alpha potential common in private strategies.

Industry Context

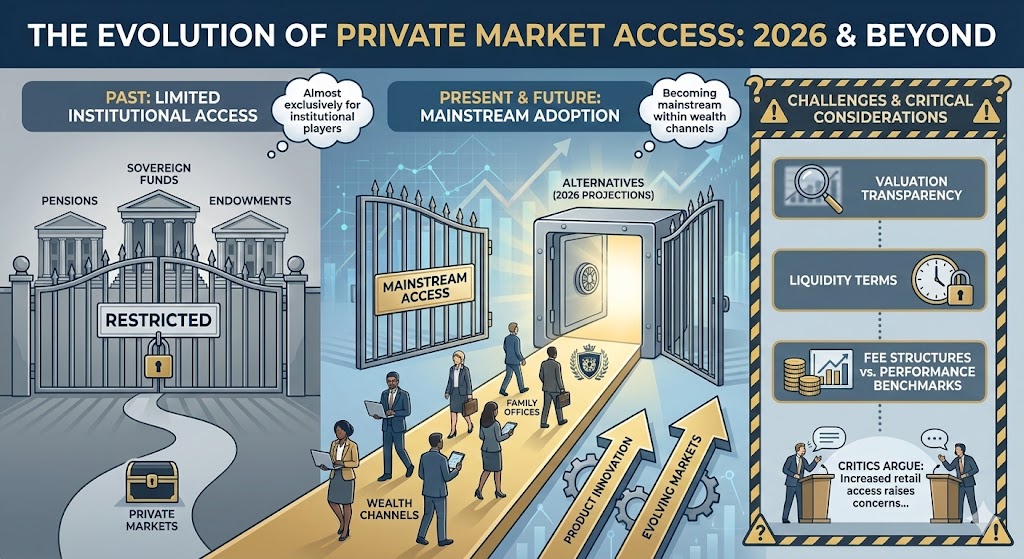

This movement is consistent with 2026 projections showing alternatives becoming mainstream within wealth channels. In the past, private markets were limited almost exclusively to pensions, sovereign funds, and endowments — but evolving markets and product innovation are reshaping access.

However, challenges remain around:

- Valuation transparency

- Liquidity terms

- Fee structures relative to performance benchmarks

Critics argue that increased retail access can heighten risks if liquidity mismatches and performance expectations are not properly managed.

What’s Driving the Shift

Three macro trends underpin this shift:

- Retail demand for yield and diversification

- Regulatory developments encouraging broader access

- Technological platforms enabling fractionalization of private assets

Coutts’ initiative dovetails with a broader industry push to democratize private capital while balancing transparency and investor protections.

Outlook for Wealth Channels

If successful, these offerings could:

- Create equity-like return pathways for individual clients.

- Encourage other private banks and wealth platforms to follow suit.

- Spur innovation in private market vehicles with better liquidity features.

Bottom Line: Coutts’ talks with Apollo and Ares are not just product news — they are emblematic of private markets moving beyond institutional walls into wealth management’s core strategies.