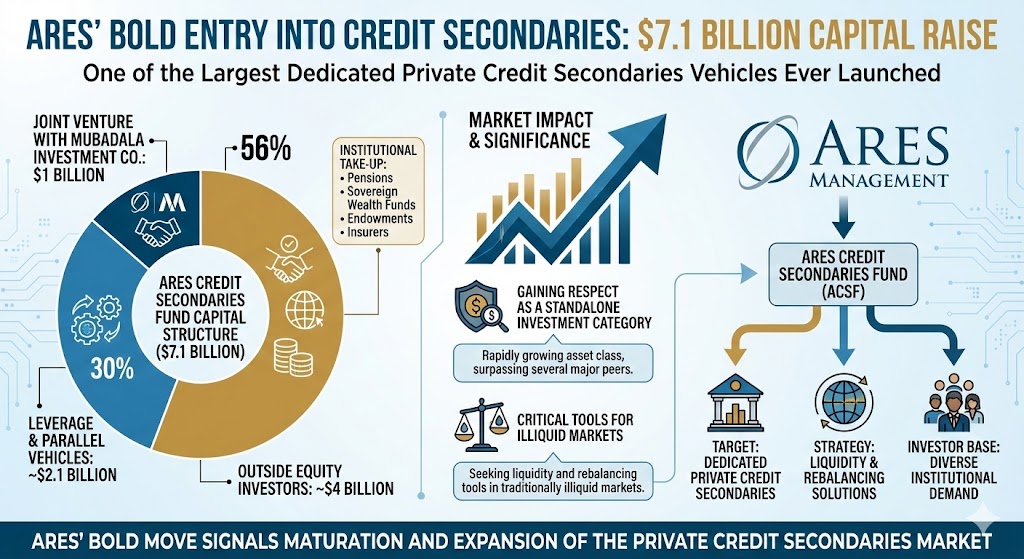

(HedgeCo.Net) The private credit market — long the darling of institutional allocators — is rapidly evolving into a liquid opportunity set of its own. Today’s announcement that Ares Management has raised a massive $7.1 billion for its first private-credit secondaries fund underscores how credit investors are demanding liquidity, flexibility and solutions that go beyond traditional direct lending.

Ares’ Bold Entry into Credit Secondaries

Ares Credit Secondaries Fund, the latest vehicle from Ares Management, has attracted $7.1 billion in initial capital, with roughly $4 billion coming directly from outside equity investors. The remainder is structured through leverage and capital from parallel vehicles — including a striking $1 billion joint venture with Mubadala Investment Co.

This fund stands as one of the largest dedicated private credit secondaries vehicles ever launched, surpassing several major peers in an asset class that’s quickly gaining respect as a standalone investment category. Institutional take-up reflects the demand from pensions, sovereign wealth funds, endowments and insurers seeking liquidity and rebalancing tools in a traditionally illiquid market.

Why Credit Secondaries Matter Now

The private credit market has ballooned into a multi-trillion-dollar ecosystem, fueled by higher yields in a higher-rate environment and banks’ retrenchment from certain lending segments. However, the very success that drove this growth created a new problem: insufficient exit mechanisms and prolonged hold periods for loan portfolios. Secondaries provide:

- Liquidity: Allows GPs (general partners) and LPs (limited partners) to unlock value from aging portfolios.

- Risk-managed returns: Buyers can access seasoned investments with greater cash flow visibility.

- Portfolio management tools: Allocators can rebalance private credit exposure without waiting for natural maturities.

Ares’ strategy will target senior secured, floating-rate and private-equity-backed credit — niches with robust structural protections that perform well across cycles.

Market Implications

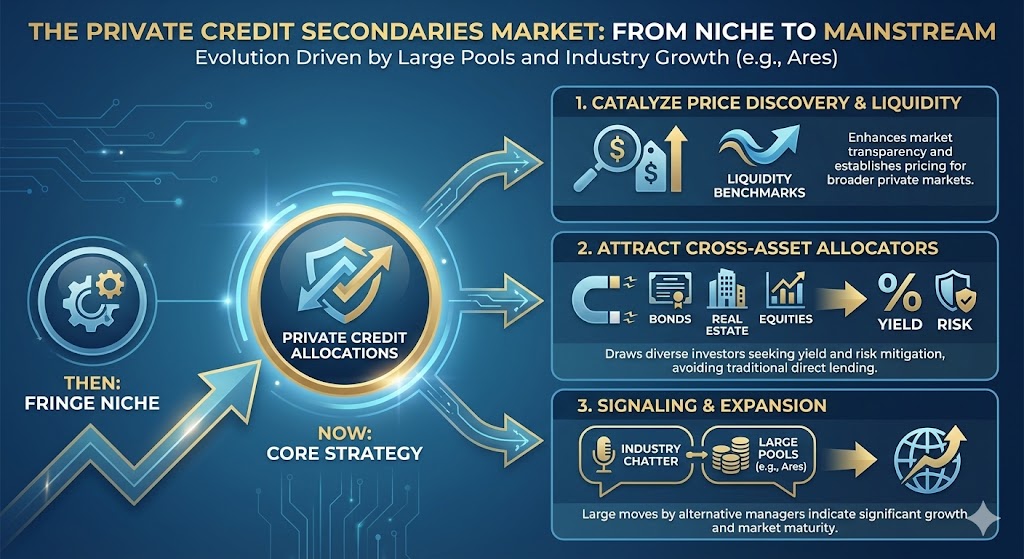

The private credit secondaries market is no longer a fringe niche. With Ares’ large pool and industry chatter signaling similar moves from other alternative managers, secondaries could:

- Become a core strategy in private credit allocations.

- Catalyze price discovery and liquidity benchmarks for the broader private markets.

- Attract cross-asset allocators looking for yield and risk mitigation without traditional direct lending risks.

Ares’ success may prompt other major sponsors to launch similar secondary-focused funds, further expanding the market and deepening liquidity for institutional investors.

What’s Next

Investors should watch several trends closely:

- Pricing transparency: Secondary markets may improve trickier valuation challenges in private credit.

- Regulatory scrutiny: As private credit grows, so does oversight around risk reporting and disclosures.

- Retail pathways: Though still limited, evolving frameworks might allow broader access to similar strategies down the road.

Bottom Line: Ares’ $7.1 billion credit-secondaries fund isn’t just a headline — it represents a structural evolution of how private credit is traded, accessed and integrated into diversified portfolios.