(HedgeCo.Net) As Steven Cohen’s Point72 Asset Management enters 2026 with roughly $41.5 billion in assets under management, the firm is evolving far beyond its traditional hedge fund roots. Across strategy lines from equities to private credit, systematic trading to macro, Cohen is orchestrating a carefully calibrated expansion — blending deep fundamental investing with forward-looking alternative strategies that reflect both market opportunity and investor demand.

In a year where many multi-strategy firms are diversifying, Point72 appears intent on strengthening its core while layering in new engines of growth, all under a framework that balances performance discipline with creative capital allocation — a signature approach of Cohen’s tenure.

? AUM Discipline and Performance Momentum

Point72’s managers enter 2026 on the heels of strong performance in 2025, with industry reports citing preliminary returns near 17.5 % for the year, part of a string of consistent double-digit results that stand out in the multi-strategy world.

This performance has been driven by a disciplined equities playbook combined with sophisticated risk management — including hedges and tactical positioning — that has allowed the firm to navigate market shifts without loosening its grip on downside protection.

Cohen has long emphasized capital efficiency and execution, and in late 2025 the firm even returned several billion in capital to investors while positioning the business for sustainable returns rather than mere scale. This capital discipline reflects a nuanced balance between growth and return quality at one of the world’s largest alternative managers.

? Reinventing the Equities Franchise: Valist and Point72 Equities

One of the most tangible shifts heading into 2026 is Point72’s restructuring of its fundamental equities arm. The firm announced a split of its equities operations into two distinct units: Point72 Equities and a new brand, Valist Asset Management, both of which will operate independently within the firm’s broader architecture.

This structural change is not merely cosmetic — it signals a strategic pivot toward giving high-performing portfolio teams more autonomy and better access to company management, as well as the potential to attract external capital or incubate emerging leaders.

The move reflects a longer-term lesson learned across hedge fund land: specialized units often outperform monolithic operations, particularly when empowered to innovate and inform each other through internal competition and shared research infrastructure.

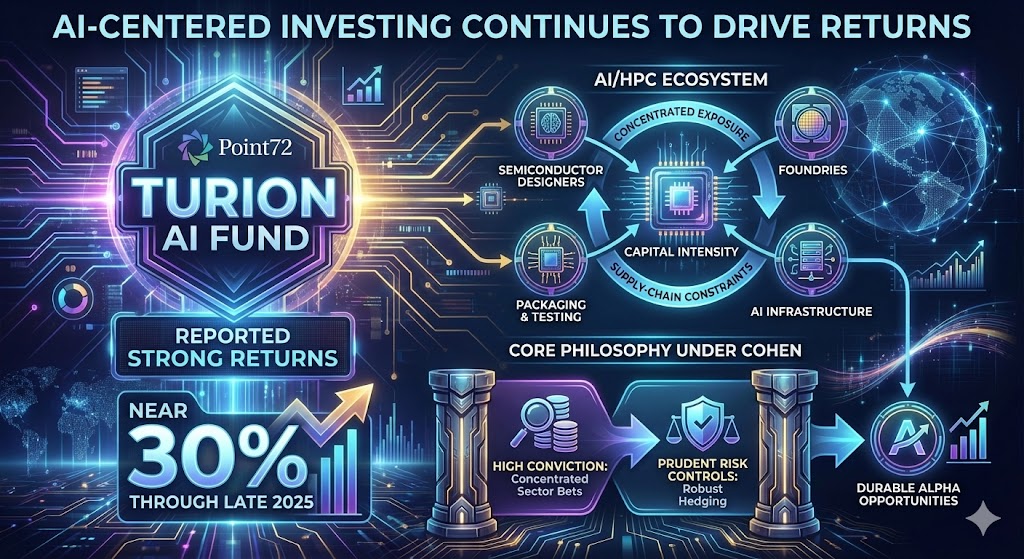

? AI-Centered Investing Continues to Drive Returns

Point72’s strategy in recent years has leaned heavily into artificial intelligence and technology sector opportunities, and that theme looks set to deepen in 2026. The firm’s Turion AI Fund — a dedicated vehicle focused on AI infrastructure and semiconductor ecosystems — has reportedly delivered strong returns since its launch, with some estimates near 30 % through late 2025.

Turion’s concentrated exposure to AI/HPC trends — including major positions in semiconductor designers, foundries, packaging and testing — underscores a broader conviction within the firm that AI’s capital intensity and supply-chain constraints present durable alpha opportunities.

Point72’s approach — combining concentrated sector bets with robust hedging — highlights a core philosophy under Cohen that high conviction should be married with prudent risk controls.

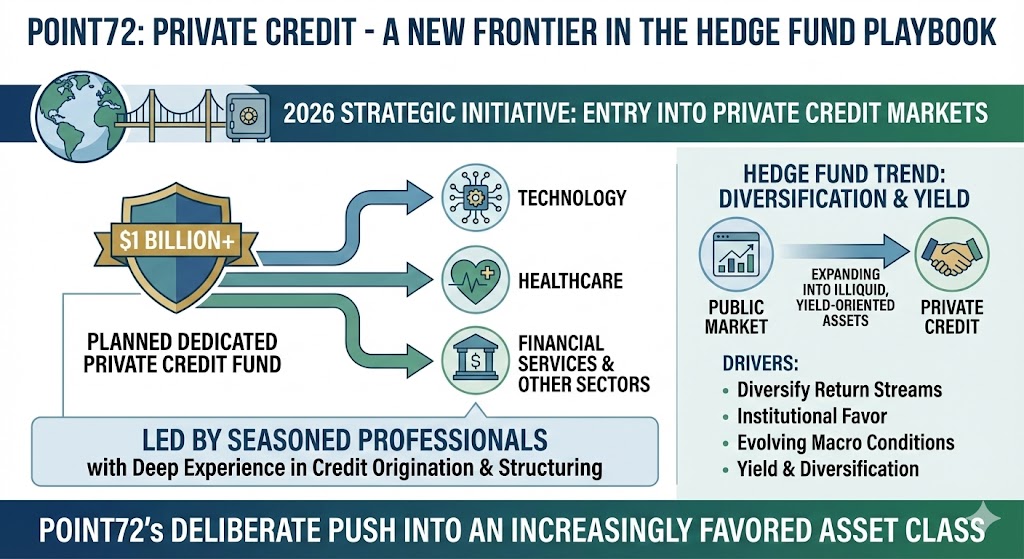

? Private Credit: A New Frontier in the Hedge Fund Playbook

Perhaps the most eye-catching strategic initiative for 2026 is Point72’s planned entry into private credit markets. The firm is gearing up to raise at least $1 billion for a dedicated private credit fund focused on lending strategies that could span technology, healthcare, financial services and other sectors.

Steve Cohen’s move into private credit mirrors a broader trend in the hedge fund world, where managers are expanding into illiquid, yield-oriented assets to diversify return streams away from traditional public markets.

Point72’s private credit initiative — led by seasoned professionals with deep experience in credit origination and structuring — represents a deliberate push into an asset class that institutional investors have increasingly favored for yield and diversification, especially as macro conditions evolve.

? Macro and Systematic Growth: Cubist and Global Strategies

Beyond discretionary equities and private credit, Point72’s systematic and macro strategies continue to form the backbone of the firm’s diversification. The firm’s Cubist Systematic Strategies division — a quant-driven arm employing algorithmic and data-intensive models — underwent a leadership transition in late 2025, signaling a renewed emphasis on innovation and agility within its systematic engine.

Meanwhile, the firm’s macro platform has expanded, supporting cross-asset positioning across interest rates, FX, commodities, and global CGX markets, helping cushion portfolios against sector rotations and volatility episodes. This expansion reflects Cohen’s belief in the value of multi-horizon risk exposures that can capture trends with both systematic precision and discretionary insight.

? Leadership and Strategic Shifts

Recent leadership changes indicate that Point72 is evolving its strategic DNA. The departure of Chief Strategy Officer James Malick — a seasoned hedge fund strategist — underscores that as the firm grows in scale and complexity, it is streamlining decision-making structures while placing greater emphasis on business unit leadership and execution.

This suggests a broader shift toward decentralized strategy formulation, where investment teams are empowered directly rather than operating through a centralized strategy office — an approach that can accelerate responsiveness in rapidly changing markets.

? What’s Next: Commodities, Talent and Innovation

While not officially announced, industry observers say Cohen has contemplated expanding into commodities trading— an asset class that many multi-strategy peers are exploring for its potential to generate returns independent of traditional equities or fixed income beta.

And while Cohen himself stepped back from trading his own portfolio years ago, he remains deeply involved in talent development, mentorship and firm-wide strategy. Known for his hands-on mentoring of portfolio managers and deep commitment to developing trading talent, Cohen’s ongoing leadership ensures the firm’s intellectual capital remains a core focus.

? Conclusion: A Multi-Axis Strategy for a New Era

As 2026 unfolds, Steven Cohen’s Point72 is positioning itself as more than a hedge fund — it is an integrated alternative investment platform that blends traditional equities expertise with emerging strategies that capture structural shifts in capital markets.