(HedgeCo.Net) In what many industry insiders are calling the most significant development shaping hedge fund strategy and market positioning in 2026, the United States’ largest hedge funds are benefiting from a remarkably strong performance backdrop in 2025, driving major revenue gains for both the funds themselves and the financial institutions that service them. This performance inflection point — captured most recently in robust prime brokerage results reported by major Wall Street banks — is catalyzing strategic evolution across multi-strategy giants like Citadel, Millennium Management, Bridgewater Associates, and others, while also influencing asset allocation decisions among institutional investors globally.

The implications of this shift are manifold: hedge funds are not only recording their best returns in years, but they are also redefining operational models, strengthening risk management practices, expanding global footprints, and attracting renewed capital inflows after a prolonged period of skepticism among institutional allocators. This article explores why 2026 may mark the year that hedge funds reclaim a central, growth-oriented role in institutional portfolios, and what the largest players are doing to seize this moment.

Strong 2025 Performance Drives Hedge Fund Demand and Bank Revenue

A landmark report released today highlights how hedge fund profits in 2025 have translated directly into significant revenue growth for Wall Street’s prime brokerage engines — the critical infrastructure through which hedge funds access trading, financing, and capital markets services.

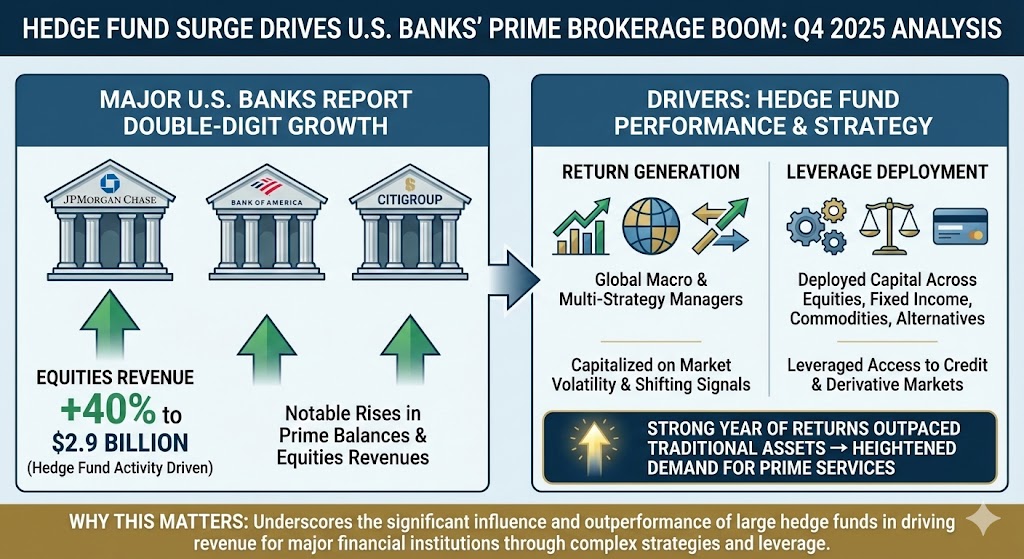

According to sources cited by Reuters, major U.S. banks such as JPMorgan Chase, Bank of America, and Citigroup reported double-digit increases in prime brokerage revenue in the fourth quarter of 2025, largely driven by the robust performance of hedge fund clients. JPMorgan’s equities business, for example, saw a striking 40% revenue increase to $2.9 billion, with much of that gain attributed to hedge fund activity. Citigroup and Bank of America reported similarly notable rises in prime balances and equities revenues.

This performance surge has roots in both return generation and leverage deployment among large hedge funds, particularly global macro and multi-strategy managers. These firms capitalized on market volatility and shifting macroeconomic signals throughout 2025, deploying capital across equities, fixed income, commodities, and alternative asset classes while leveraging access to credit and derivative markets. The result was a strong year of returns that outpaced many traditional asset classes and led to heightened demand for prime brokerage services.

Why This Matters

Prime brokerage revenue tends to be a leading indicator of hedge fund health: rising revenues signal more trading activity, higher leverage use, and greater capital deployment — all signs of confidence from large institutional allocators. For the hedge funds themselves, these results validate strategic allocations and justify the investment in sophisticated trading infrastructure.

This is not just a short-lived “rip-cord” rally; rather, it reflects a structural resurgence in hedge fund performance — the strongest industry-wide gains in more than a decade according to supplemental industry data. Hedge funds posted some of their best annual results since the aftermath of the 2008 financial crisis, with average returns in 2025 significantly above long-term historical norms.

Redefining Strategy: Diversification, Technology, and Risk Management

Beyond raw performance numbers, the largest hedge funds are strategically repositioning themselves to thrive in a world where alpha generation increasingly relies on diversification, technological innovation, and advanced risk frameworks.

1. Diversification Across Asset Classes and Geographies

Leading hedge funds are evolving away from narrow, single-genre mandates toward multi-asset, multi-strategy modelsthat enable them to pivot quickly as markets shift. Firms such as Bridgewater Associates, D.E. Shaw, Millennium Management, and Citadel are expanding their arms of macro, fixed income, quantitative strategies, and even private credit and bespoke managed solutions — all designed to capture return opportunities across different market cycles.

This diversification is not merely about spreading bets; it’s about reducing correlation and improving resilience in portfolios that must perform under varying global conditions — from rising rates to geopolitical disruptions and tech-sector dislocations. Regional presence also matters: firms are enhancing research and trading capabilities in Asia and Europe, where divergent monetary policies and structural dynamics present unique alpha opportunities.

2. AI and Data Integration

Artificial intelligence and machine learning are rapidly becoming core investment tools, not just experimental add-ons. Top hedge funds are building proprietary platforms that ingest alternative and traditional data streams, automate signal generation, and assist with risk forecasting. While human judgment remains central, AI enhances analysts’ capabilities to identify patterns across macro, micro, and behavioral signals.

This trend reflects an industrywide acknowledgment that data superiority can translate directly into competitive advantage — particularly as markets become more fragmented and information complexity grows.

3. Enhanced Risk Management

There is a renewed focus on risk systems that operate in real time rather than post-trade. Firms are adopting intra-day risk monitoring, cross-asset correlation modeling, and firm-wide drawdown controls to ensure that no single desk or strategy can materially impair overall capital. Such rigor reflects lessons from past volatility episodes when risk breaches threw portfolio returns off track. Enhanced risk frameworks are also a key factor behind institutional allocators’ renewed trust in hedge funds, as they seek strategies that provide both alpha and downside protection.

Investor Behavior Shifts: From Tactical to Core Allocations

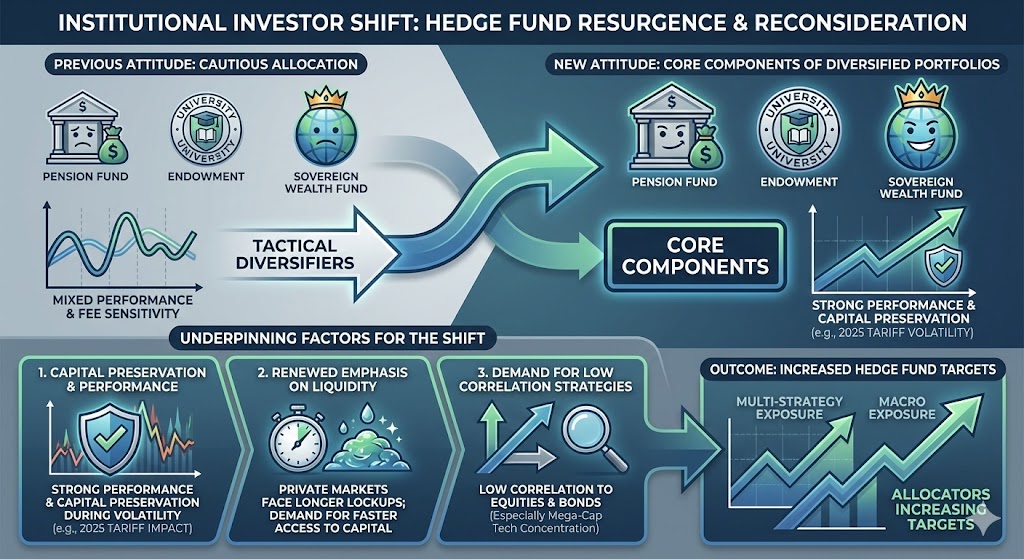

Perhaps the most notable implication of the hedge fund resurgence is a shift in institutional investor attitudes. After years of cautious allocation due to mixed performance and fee sensitivity, many pensions, endowments, and sovereign wealth funds are reconsidering hedge funds as core components of diversified portfolios rather than just tactical diversifiers.

A host of factors underpin this shift:

- Strong performance and capital preservation during volatility periods — particularly during tariff-induced volatility in 2025.

- Renewed emphasis on liquidity as private markets face longer lockups and slower exit timelines.

- Demand for strategies with low correlation to equities and bonds, especially amid valuation concerns tied to concentrated mega-cap tech exposure.

These dynamics have led some allocators to increase their hedge fund targets, particularly in multi-strategy and macro exposures — a development that reinforces the sector’s momentum heading into 2026.

Risks and Challenges Amid Growth

Even as hedge funds enjoy a performance renaissance, significant risks and structural challenges remain — some of which could reshape future growth trajectories.

Leverage and Basis Trades

One of the most talked-about risk factors involves the explosive growth in Treasury basis trading, a strategy that involves selling Treasury futures and buying the underlying bonds with leverage. Recent analysis suggests the size of the basis trade market has ballooned to around $1.5 trillion, raising concerns among regulators and market watchers about systemic risk — particularly if leveraged positions are disrupted during a stress event.

Leverage can amplify hedge fund returns, but it also increases sensitivity to liquidity shocks and market dislocations. For giant multi-strategy firms that deploy this tool extensively, rigorous risk oversight will be essential to maintain investor confidence and avoid forced unwinds that could trigger market volatility.

Crowded Trades in Tech and Market Concentration

Another challenge identified in the latest data stems from persistent crowding in tech positions. According to a Hazeltree crowdedness report released today, hedge funds maintained heavily populated long exposures in mega-cap technology stocks — including Alphabet, Microsoft, and Meta — as of the end of 2025, while short bets centered on names such as IBM and MicroStrategy.

Crowded long positions can lead to correlated risk if sentiments shift abruptly, increasing drawdown potential across multiple hedge funds simultaneously. This scenario compounds challenges when market sentiment turns, as seen historically in concentrated sectors like biotech or internet stocks.

Talent Competition and Leadership Turnover

Talent remains a core differentiator. The departure of senior strategy leaders at major firms is underlining how critical human capital is — both in investment and operational roles. For example, Millennium Management recently saw its corporate strategy head exit, emphasizing the ongoing competitive battle for top strategic and analytical talent in the industry.

Retaining and attracting talent in areas such as quantitative research, trading, engineering, and risk management will be an ongoing priority, particularly as hedge funds intensify investments in technology and data science.

What’s Next for the Largest Hedge Funds in the U.S.

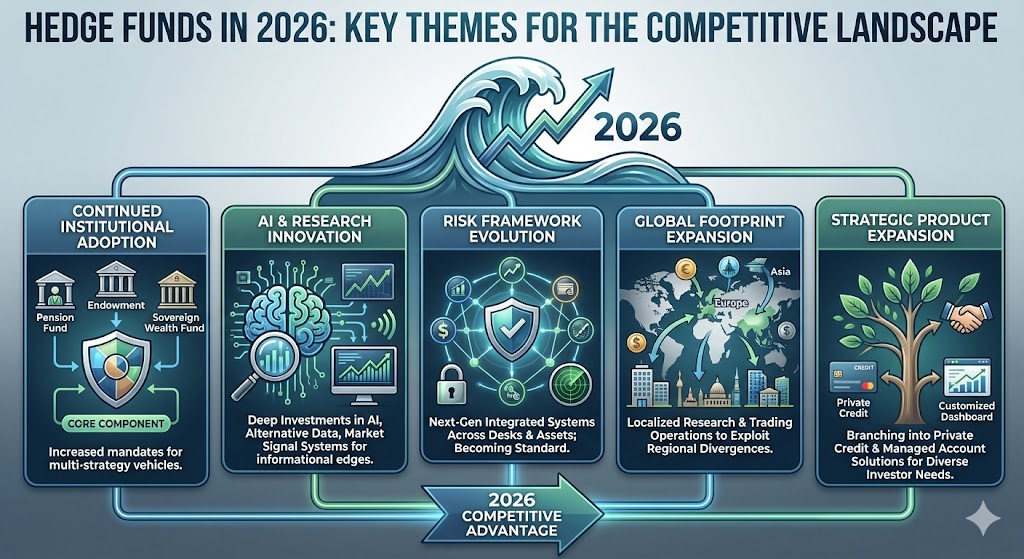

As hedge funds enter 2026 riding the crest of a strong performance wave, several key themes will define the competitive landscape:

- Continued Institutional Adoption — Expect more institutional mandates that allocate hedge funds as core portfolio components, especially in diversified multi-strategy vehicles.

- AI and Research Innovation — Firms will deepen investments in AI, alternative data, and market signal systems to gain informational edges.

- Risk Framework Evolution — Next-generation risk systems — integrated across desks and assets — will become standard.

- Global Footprint Expansion — Hedge funds will further localize research and trading operations in Europe and Asia to exploit regional divergences.

- Strategic Product Expansion — Large hedge funds will continue branching into private credit and managed account solutions to appeal to diverse investor needs.

Conclusion

Today’s strongest story impacting the largest hedge funds in the U.S. is not a single event — but a confluence of performance resurgence, strategic reinvention, and investor reappraisal. Supported by exceptional 2025 returns and reflected in prime brokerage revenue growth across Wall Street, hedge funds are redefining their role in global finance. They are expanding their horizons beyond traditional mandates, embracing advanced technology, and reasserting themselves in institutional portfolios after years of uneven performance.

However, risks related to leverage, crowded positions, and talent dynamics underscore that headlines of growth must be balanced with vigilance. Institutional allocators and hedge fund leaders alike are closely watching how these forces shape not just performance metrics, but the long-term structure and resilience of the industry.

As hedge funds take center stage again in 2026, the path ahead promises both opportunity and complexity — and the largest players are positioning to lead.