(HedgeCo.Net) Private equity continues to make major structural moves — and today’s most significant story comes from the intersection of insurance capital and alternative asset management. On January 19, 2026, CVC Capital Partners announced a $3.5 billion strategic partnership with American International Group (AIG). This deal represents one of the largest alliances between a global private equity firm and a major insurer to date, reshaping how alternative asset capital flows are structured.

A Shift in Institutional Capital Deployment

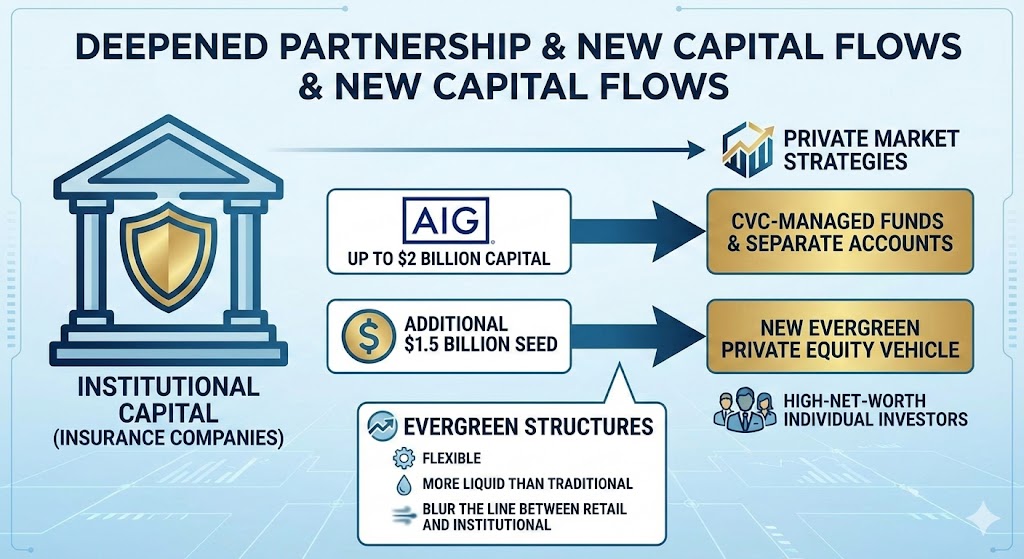

For decades, institutional capital — particularly from insurance companies — has been a core source of long-term funding for private market strategies. However, this partnership deepens that relationship in new ways:

- AIG will contribute up to $2 billion in capital to CVC-managed funds and separate account mandates.

- An additional $1.5 billion will seed a new evergreen private equity vehicle geared toward high-net-worth individual investors.

Evergreen structures are flexible and more liquid than traditional locked-up private equity commitments. They increasingly blur the line between retail and institutional capital markets, providing broader access without wholesale changes to risk-return profiles.

Strategic Implications for the Private Equity Ecosystem

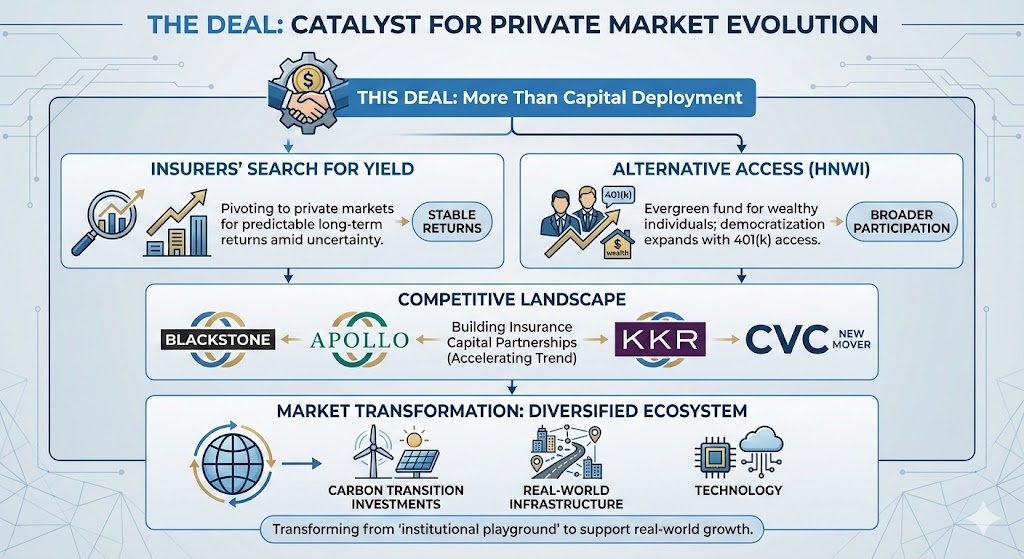

This deal is more than capital deployment — it reflects broader trends:

- Insurance companies’ search for yield: With persistent macro uncertainty and slow public market returns, insurers are pivoting toward private markets for predictable long-term returns.

- Alternative access for high-net-worth investors: The launch of an evergreen fund targeting wealthy individuals represents a continued democratization of private markets — especially as 401(k) access expands.

- Competition among alternative managers: Firms like Blackstone, Apollo, and KKR are already building insurance capital partnerships — but CVC’s move accelerates this trend.

Market commentary suggests that these types of insurance-capital alliances could transform private markets from being an “institutional playground” into a more diversified capital ecosystem — one that supports real-world infrastructure, technology, and carbon transition investments.

What This Means for Investors

- Institutional portfolios may see alternative allocation growth as insurers diversify away from traditional bond exposures.

- Wealth investors gain more structure and access to private equity strategies previously available only to pensions and endowments.

- Secondary market liquidity is likely to become even more important — as investors in evergreen vehicles seek paths to tradability.

Bottom line: Today’s CVC-AIG news marks a turning point in how and who invests in private equity — with implications for capital flows, investor access, and the broader alternative investment landscape.