(HedgeCo.Net). The private credit universe — long a poster child of alternative investment growth — is displaying complex cross-currents. On the one hand, significant redemption activity has emerged in some traditional private credit funds. On the other, secondary market vehicles are booming, illustrating how liquidity solutions are reshaping the asset class.

Investors Pull Billions from Core Private Credit Funds

At the tail end of 2025, industry watchers were startled as retail and institutional investors collectively withdrew approximately $7 billion from private credit funds — signaling rising credits quality concerns and risk repricingacross the sector.

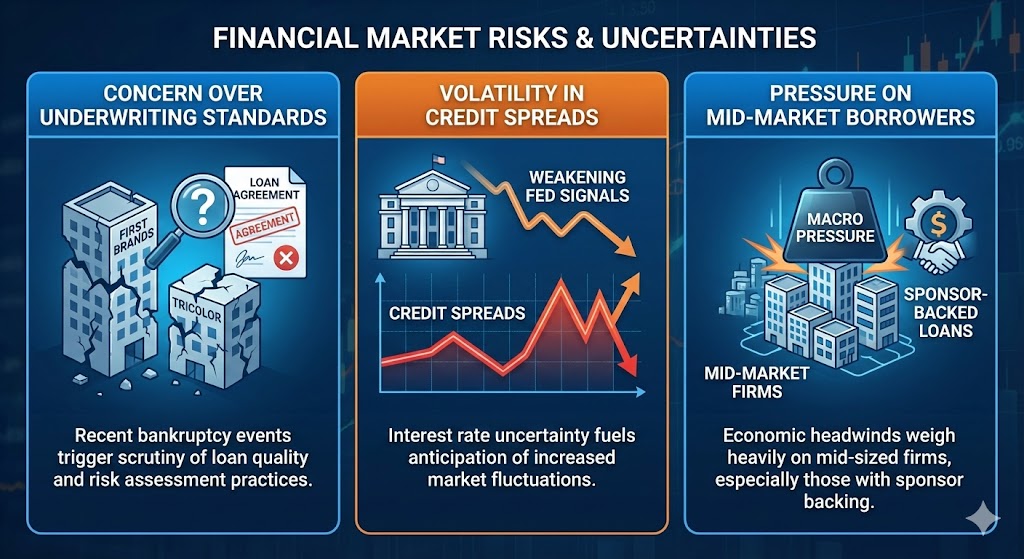

Drivers behind redemptions include:

- Bankruptcy events at companies such as First Brands and Tricolor, which triggered concern over underwriting standards.

- Interest rate uncertainty, following weakening signals from the Federal Reserve — investors are anticipating volatility in credit spreads.

- Macro pressure on mid-market borrowers, especially within sponsor-backed loans.

Despite the redemptions, the narrative isn’t purely bearish — it’s evolving.

Private Credit Secondary Market Gains Momentum

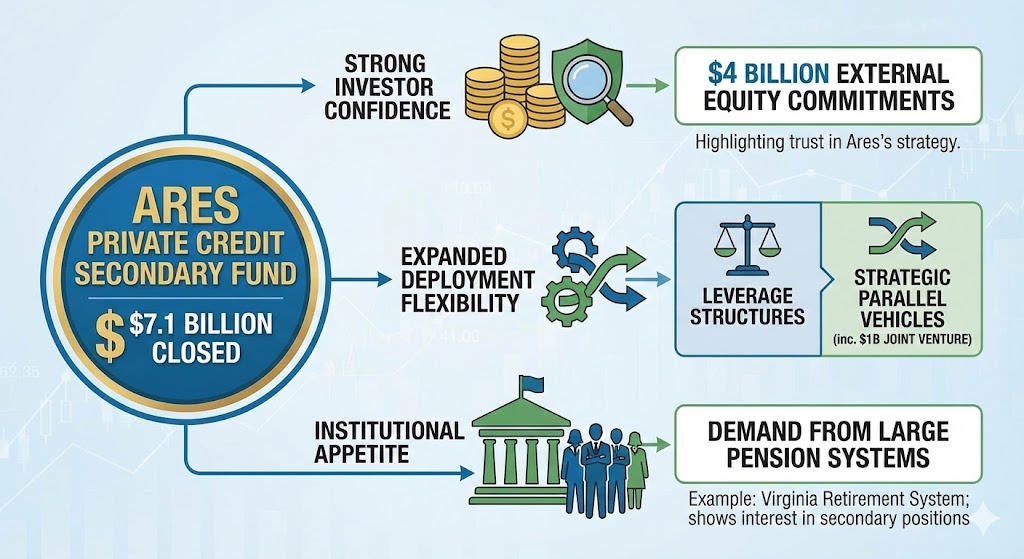

Responding to increased liquidity needs, Ares Management closed $7.1 billion for its first private credit secondary fund, with strong institutional demand.

Key takeaways from Ares’s fund:

- $4 billion of external equity commitments, highlighting strong investor confidence.

- Leverage structures plus strategic parallel vehicles — including a $1 billion joint venture — expand deployment flexibility.

- Demand from large pension systems, like the Virginia Retirement System, shows institutional appetite for secondary positions.

The secondary credit market offers a solution for investors seeking liquidity — one of the core challenges in traditional private credit — while also allowing asset managers to reprice risk, rebalance portfolios, and potentially improve returns.

Geographic Momentum: Asia & Private Credit Expansion

Notably, firms like KKR have successfully raised $2.5 billion for a second Asia-focused private credit fund, nearly doubling from past fundraising levels.

This Asia Pacific focus reflects:

- Growing private credit depth in Japan and India.

- Regional economic stabilization, increasing investor confidence.

- Institutional support for diversified credit strategies beyond North America and Europe.

What This Means for Investors

The private credit narrative in 2026 is multifaceted:

- Risk repricing and selective concerns are causing shifts in capital flows.

- Secondary markets and structured liquidity solutions are rapidly maturing.

- Geographic diversification and targeted funds are emerging as strategic avenues.

For institutional investors and sophisticated allocators, the critical differentiator in private credit going forward will be manager discipline, underwriting quality, and liquidity provisioning — not just size or scale.