(HedgeCo.Net) As we enter 2026, several macro and thematic forces are reshaping alternative investment strategies. Recent institutional outlooks from major asset managers and private banks highlight three core themes driving alternatives in this decade: Artificial Intelligence (AI), liquidity evolution in private markets, and portfolio resilience.

Theme 1: The Next Phase of AI Across Alternatives

While AI has dominated headlines, its integration into alternative investments is now moving from concept to infrastructure:

- Private market strategies increasingly target AI support ecosystems — including energy infrastructure, data centers, and real-world applications of machine learning.

- These innovations are not limited to tech startups but extend to operational transformations within private companies.

Industry analysts point out that AI is no longer just an allocation theme — it’s a lens through which alternative investments are being restructured.

Theme 2: Quest for Portfolio Durability

In a world of economic cross-currents, investors are increasingly treating alternatives as strategic building blocks — not tactical diversifiers. Liquidity-managed private market structures, such as listed private equity funds, evergreen vehicles, and extension-period funds, are bridging the gap between illiquidity and expanded investor participation.

Liquid alternatives (or “liquid alts”) continue to grow, challenging the traditional notion that alternatives must be illiquid to generate superior returns.

Theme 3: Evolving Liquidity in Private Markets

Liquidity innovation remains central. Regulatory momentum, including potential expansion of 401(k) private market access, is set to broaden the investor base. Meanwhile, secondary markets and publicly traded alternatives continue to mature, allowing investors to balance risk with tradability.

Macro Forces and Alts Integration

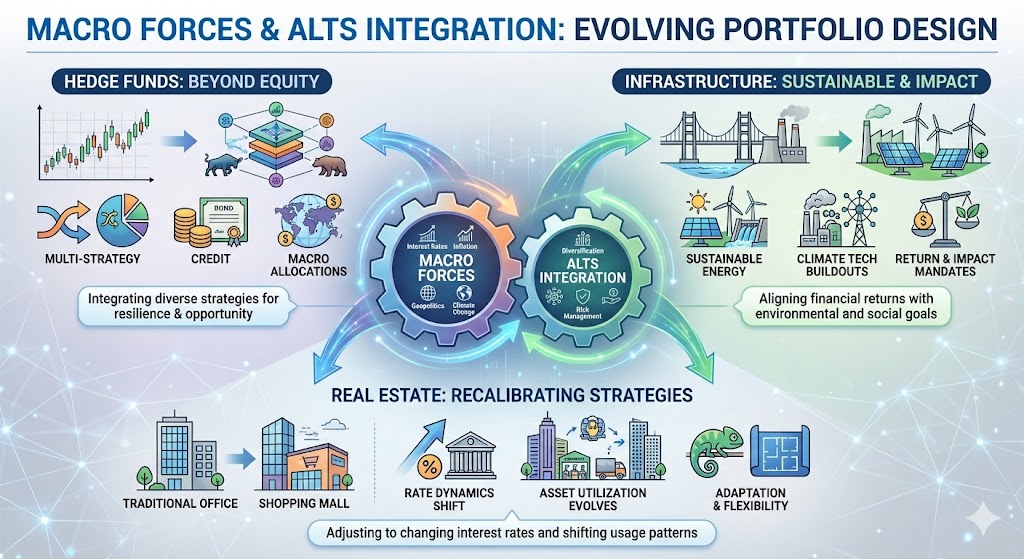

Alts integration into core portfolio design is not limited to private markets:

- Hedge funds continue evolving beyond equity-centric models, integrating multi-strategy, credit, and macro allocations.

- Infrastructure funds tap sustainable energy and climate tech buildouts, aligning with both return and impact mandates.

- Real estate strategies are recalibrating as rate dynamics shift and asset utilization evolves.

The evolving landscape underscores that 2026 will likely be a year of inflection — not stagnation — for alternative investment strategies across sectors.