(HedgeCo.Net) Two headline trends dominate hedge fund news today: historic profit milestones for a marquee activist hedge fund and aggressive strategic repositioning — notably talent recruitment — at major multi-strategy firms. Collectively, these signal a sector entering a new growth and competition phase after a strong 2025 performance year.

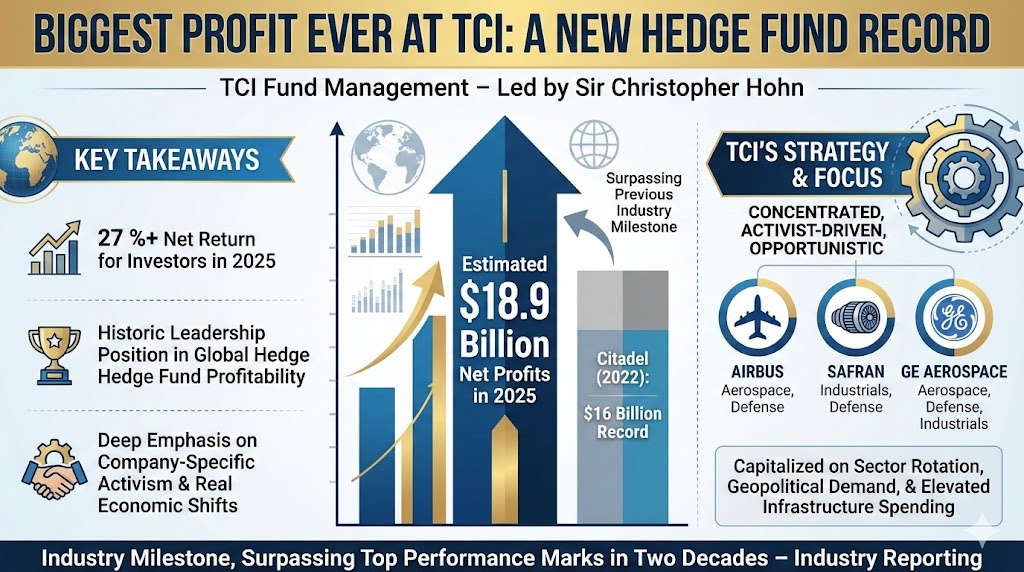

In a stunning industry milestone, TCI Fund Management — led by Sir Christopher Hohn — delivered an estimated $18.9 billion in net profits in 2025, making it the most profitable single hedge fund year on record. This result surpasses Citadel’s 2022 record of $16 billion and eclipses most top fund performance marks in the last two decades, according to industry reporting.

Unlike many hedge funds relying on diversified pods or systematic machines, TCI’s approach remains concentrated, activist-driven, and opportunistic, especially in sectors like aerospace, defense, and industrials. With major positions in Airbus, Safran, and GE Aerospace, the fund capitalized on sector rotation tied to geopolitical demand shifts and elevated infrastructure spending.

Key takeaways from TCI’s record year:

- 27 %+ net return for investors in 2025.

- Historic leadership position among global hedge funds in profitability.

- Deep emphasis on company-specific activism tied to real economic shifts (defense, capex-linked sectors).

This performance doesn’t just reflect skill — it demonstrates how certain hedge fund strategies still outpace broader trend dynamics when markets are dispersion-rich and macro uncertainty is high.

Talent Wars: Balyasny’s Major Strategic Expansion

While performance headlines impact sentiment, actual industry repositioning is happening on the ground — particularly in talent acquisition at top multi-manager firms.

News broke today that Balyasny Asset Management undertook a significant hiring drive, bringing an ex-Eisler Capital portfolio manager — a specialist in interest-rate options — into its London team. The move is part of a much broader recruitment push that includes macro specialists from Goldman Sachs and other boutiques, reflecting a strategic emphasis on global macro and rate-sensitive trading.

Key implications:

- Multi-strategy diversification: By augmenting macro and options expertise, Balyasny is positioning itself to capture market volatility across rate regimes rather than depending purely on equities or credit.

- Geographic repositioning: A strengthened London presence aligns with trends of hedge funds expanding beyond U.S. centers to tap European and Asia allocators.

- Talent as strategic capital: In an industry where alpha sources are ever harder to replicate, human capital — especially specialized traders — is now a competitive edge.

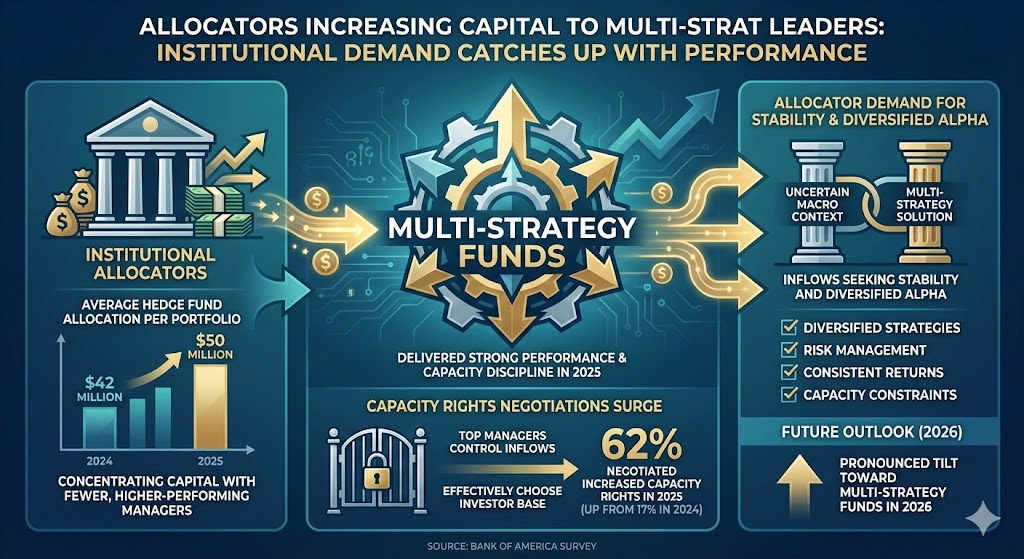

Allocators Increasing Capital to Multi-Strat Leaders

Institutional demand is now catching up with performance. A recent Bank of America survey finds that allocators plan to increase hedge fund allocations in 2026, with a pronounced tilt toward multi-strategy funds that delivered strong performance and capacity discipline in 2025.

- The average hedge fund allocation per portfolio has risen, as investors concentrated capital with fewer but higher-performing managers.

- Capacity rights negotiations surged, signaling that top managers now control inflows and can effectively choose their investor base.

- Multi-strategy funds saw inflows as allocators seek stability and diversified alpha in an uncertain macro context.

This capital shift reinforces that hedge fund investors are not abandoning active management — they are refining it, favoring larger, more established players with proven risk frameworks across market cycles.

What This Means for Hedge Fund Investors

Performance leadership and strategic expansion at major hedge funds signal a renewed era of both specialization and consolidation:

- Record returns at TCI affirm that activist, concentrated strategies can still deliver outsized gains in the right regime.

- Multi-strat managers are capitalizing on scale and diversification to attract institutional flows.

- Talent acquisition and globalization are now central elements of strategic positioning across the biggest firms.

- Allocators continue reappraising hedge funds not as niche diversifiers, but as core components of advanced risk-managed portfolios.

Looking ahead, the duel between concentrated alpha engines and diversified multi-strategy platforms will likely shape hedge funds’ influence on global markets — from capital formation to sector rotations and liquidity provisioning.