(HedgeCo.Net) For the first time in modern hedge fund history, institutional investors are allocating more capital to quantitative hedge funds than to any other hedge fund strategy. The shift marks a profound change in how the world’s largest asset owners—pensions, endowments, sovereign wealth funds, and insurers—define skill, risk management, and repeatability in an increasingly complex market environment.

This is not a cyclical fad or a short-term response to recent performance. It is a structural reallocation driven by advances in data science, dissatisfaction with discretionary outcomes, and a growing preference for strategies that offer transparency, scalability, and systematic risk control.

In short, the hedge fund industry’s center of gravity is moving—from star managers and narrative-driven bets toward machines, models, and measurable process.

A Turning Point in Institutional Allocation Behavior

According to recent allocator surveys and industry reporting, institutional investors managing trillions of dollars in assets now rank quantitative hedge funds as their top destination for new hedge fund capital, overtaking discretionary macro, long/short equity, and multi-manager platforms.

This moment is significant because institutional investors are not trend-chasers. Their allocations tend to lag performance cycles and reflect multi-year conviction. When they move in size, they are expressing a belief that a strategy is structurally advantaged, not just temporarily in favor.

For years, quant funds were viewed as a specialized sleeve—useful, but secondary. Today, they are increasingly seen as core hedge fund exposure.

Why Quant Funds Are Winning the Capital Allocation War:

1. Disappointment With Discretionary Consistency

One of the most important drivers behind the shift is allocator fatigue with inconsistent discretionary outcomes.

While some discretionary hedge funds have delivered strong years, many allocators have struggled with:

- Performance dispersion across managers

- Strategy drift

- Key-person risk

- Crowded trades and correlated drawdowns

- Difficulty separating skill from market beta

Quantitative strategies, by contrast, are evaluated less on personality and more on process durability. Investors can analyze how models behave across decades of data, multiple regimes, and thousands of simulations.

For institutions charged with preserving capital across generations—not quarters—that matters.

2. Volatility Has Become an Asset, Not a Threat:

The post-2020 market environment has fundamentally changed how volatility is perceived.

Rather than something to be feared, volatility is now a raw input for alpha generation, particularly for systematic strategies that thrive on dispersion, relative pricing inefficiencies, and short-term dislocations.

Quant funds have been especially effective in:

Adjusting exposures dynamically as correlations shift

Exploiting cross-asset volatility

Capturing factor rotations

Trading microstructure inefficiencies

The post-2020 market environment has fundamentally changed how volatility is perceived.

Rather than something to be feared, volatility is now a raw input for alpha generation, particularly for systematic strategies that thrive on dispersion, relative pricing inefficiencies, and short-term dislocations.

Quant funds have been especially effective in:

- Exploiting cross-asset volatility

- Capturing factor rotations

- Trading microstructure inefficiencies

- Adjusting exposures dynamically as correlations shift

As markets have become faster, more fragmented, and more data-rich, systematic strategies are structurally better suited to react in real time than discretionary teams dependent on human decision-making.

3. Advances in AI and Machine Learning Have Changed the Game

Today’s quant funds bear little resemblance to the early statistical arbitrage models of the 1990s.

Leading firms now deploy:

- Machine learning and deep neural networks

- Alternative data (satellite imagery, transaction data, web scraping)

- Natural language processing

- Reinforcement learning

- Adaptive signal weighting

This evolution has transformed quant investing from rigid rule-based systems into adaptive decision engines capable of learning from new data and adjusting to regime shifts.

Institutions recognize that data scale and computational power now confer a durable competitive advantage—one that compounds over time and is difficult for smaller or less sophisticated managers to replicate.

The Institutional Case for Quant: Risk Control and Governance:

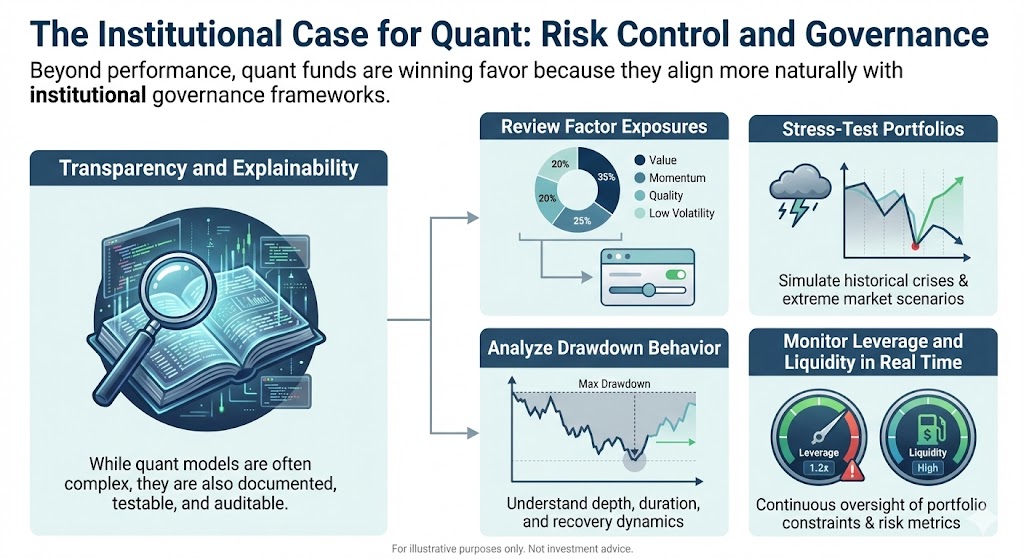

Beyond performance, quant funds are winning favor because they align more naturally with institutional governance frameworks.

Transparency and Explainability

While quant models are often complex, they are also documented, testable, and auditable. Allocators can:

- Review factor exposures

- Stress-test portfolios

- Analyze drawdown behavior

- Monitor leverage and liquidity in real time

This contrasts with discretionary strategies where decision-making may be opaque, idiosyncratic, or difficult to replicate.

Reduced Key-Person Risk

Quant platforms are typically team-based and system-driven. The departure of a single portfolio manager, while disruptive, is less likely to impair the strategy’s core intellectual property.

For pension boards and investment committees, this institutional resilience is a major advantage.

Capital Is Concentrating at the Top

The rise of quant investing is also accelerating capital concentration within the hedge fund industry.

Large, well-capitalized platforms—such as Citadel, Two Sigma, D. E. Shaw, and Millennium Management—are uniquely positioned to benefit because:

- They can invest heavily in technology and data

- They attract elite engineering and research talent

- They operate at scale across asset classes and geographies

- They continuously reinvest profits into model improvement

For allocators, backing these platforms increasingly looks like backing infrastructure rather than individual bets.

What This Means for Traditional Hedge Fund Strategies

The rise of quant funds does not mean discretionary hedge funds are obsolete—but it does mean the bar has moved.

Discretionary managers now face pressure to:

- Demonstrate clear, repeatable edge

- Integrate systematic tools into decision-making

- Improve risk transparency

- Deliver differentiated exposure that quant models cannot easily replicate

Many of the most successful discretionary platforms are responding by hybridizing—combining fundamental insight with systematic signal generation and risk management.

The future is not purely quant or purely discretionary. It is increasingly quant-informed.

Implications for Portfolio Construction in 2026 and Beyond

Institutional portfolios are being reshaped accordingly.

Quant hedge funds are increasingly used as:

- Core diversifiers alongside equities and credit

- Volatility absorbers during market stress

- Return engines independent of economic growth

- Liquidity-aware alternatives to private markets

As private equity and private credit face longer holding periods, valuation scrutiny, and liquidity constraints, quant hedge funds offer a liquid, adaptive complement that can be rebalanced dynamically.

A Philosophical Shift: From Stories to Systems

At a deeper level, the allocator shift toward quant reflects a philosophical evolution in investing.

For decades, hedge fund investing was dominated by stories—about insight, intuition, and exceptional individuals. Today, the dominant narrative is about systems—about data, process, feedback loops, and continuous improvement.

Top investors are not abandoning human judgment. They are embedding it where it matters most: in model design, risk oversight, and strategic direction—while letting machines handle execution at scale.

The Bottom Line

The fact that institutional investors are now allocating more capital to quantitative hedge funds than to any other hedge fund strategy is not a headline anomaly—it is a structural inflection point.

It reflects:

- The maturation of data-driven investing

- The institutionalization of hedge fund governance

- The premium placed on repeatability and resilience

- The recognition that markets have become too complex, too fast, and too interconnected for intuition alone

As 2026 unfolds, the hedge fund industry will not be defined by whether it embraces quantitative investing—but by how effectively it integrates it.