(HedgeCo.Net) Financial advisors are pivoting alternatives from boutique to core portfolio building blocks — and asset managers are responding with new, scalable solutions.

The landscape of alternative investments continues its fastest transformation in years. Once the exclusive domain of institutional capital — pension funds, sovereign wealth funds, and ultra-high-net-worth allocators — private markets are now being actively reshaped to meet broader demand. In the opening weeks of 2026, several developments underscore the growing momentum of this trend, from bespoke product launches to record performance in hedge strategies.

A Landmark SMA Rollout for Private Markets:

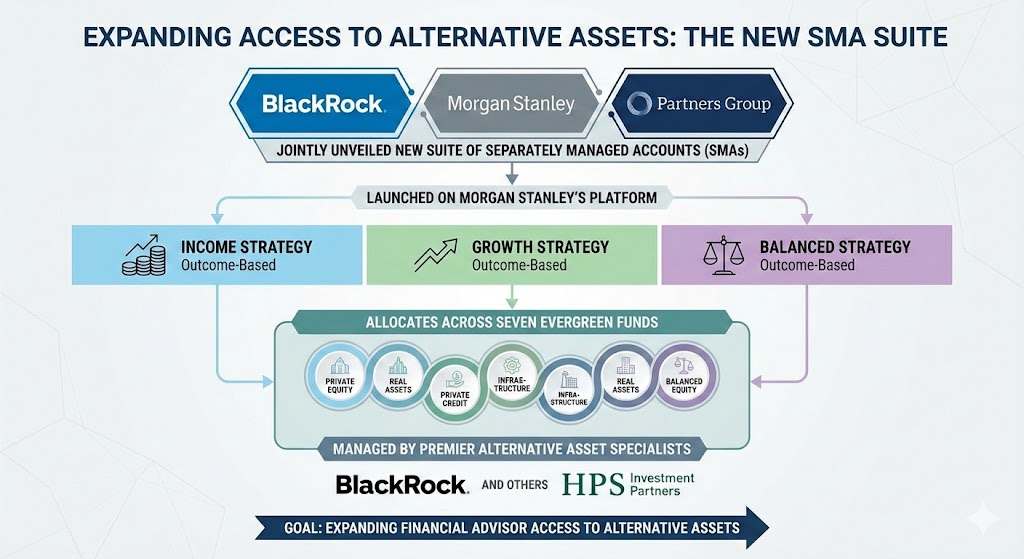

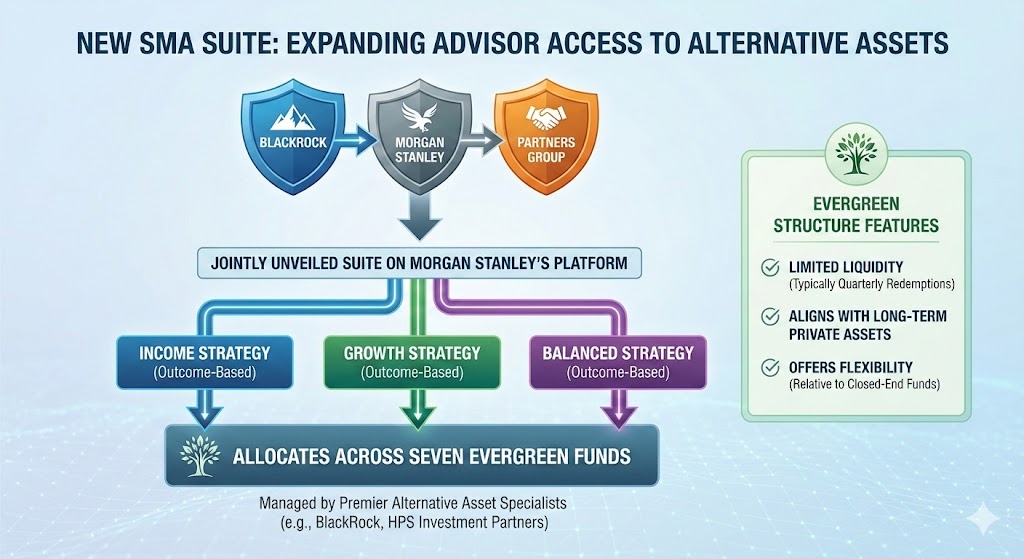

Leading asset managers BlackRock, Morgan Stanley and Partners Group have jointly unveiled a new suite of separately managed accounts (SMAs) aimed squarely at expanding financial advisor access to alternative assets.

This suite — launched on Morgan Stanley’s platform — includes three outcome-based strategies: income, growth and balanced. Each strategy allocates across seven evergreen funds managed by premier alternative asset specialists including BlackRock and HPS Investment Partners. Evergreen structures offer limited liquidity (typically quarterly redemptions), aligning with the long-term nature of private assets while offering some flexibility relative to traditional closed-end funds.

The strategic intent is clear: simplify the path to alternatives. Instead of advisors completing separate “shoebox” paperwork for multiple private market funds, they can onboard a single SMAs wrapper. BlackRock calls it a “holistic private markets solution” — a designation that reflects both simplicity and a broader trend: embedding alts into core client recommendations rather than relegating them to niche allocations.

Financial advisory surveys suggest this shift is not just thematic, but tactical. A leading survey by Hamilton Lane (data referenced within market reporting) found that 86% of advisors plan to increase exposure to alternative strategies in the year ahead — testament to enduring advisor confidence in the long-term case for private markets.

What This Means for Core Portfolio Construction

Traditionally, private equity, private credit and real assets were considered supplemental to traditional equity and fixed-income portfolios. But as distribution vehicles expand — from SMAs to private asset model portfolios and private-inclusive target date funds — alternatives are increasingly positioned as core allocations.

Wealth managers and asset allocators point to several drivers of this shift:

- Diversification benefits in an era where public markets face persistent volatility.

- Liquidity innovations such as evergreen strategies and longer redemption windows that better align with long-term investor horizons.

- Democratization pressures, including regulatory momentum toward broader investor access.

These forces raise a crucial point for advisors: alternatives are no longer “exotic” — they are essential infrastructure in a multi-asset portfolio.

Performance Signals and Hedge Fund Momentum:

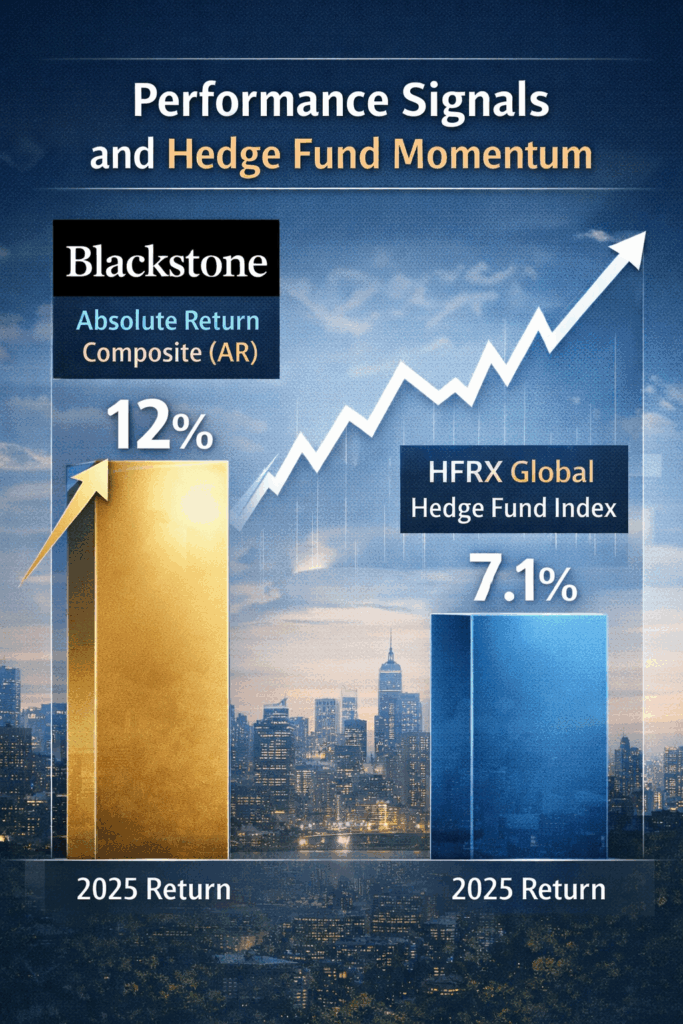

The private markets push comes amid fresh performance signals from core alternatives. Blackstone’s largest hedge fund platform, the Absolute Return Composite (AR), delivered a 12% return in 2025, significantly outperforming the HFRX Global Hedge Fund Index’s 7.1% gain.

That result reflects multiple strength vectors: equities exposure, algorithmic trading signal capture, nimble credit strategies, and macro execution that navigated 2025’s shifting landscape. Blackstone’s AR platform also posted 33 consecutive months of positive net gains — a compelling track record at a time when investors are increasingly performance-sensitive.

For advisors, such results reinforce the view that diversified hedge strategies — long seen as risk-mitigating complements — remain resilient contributors to portfolio returns.

The Face of Expansion: Product Innovation Meets Regulatory Tailwinds

Growth in advisor adoption and product innovation is meeting a broader regulatory narrative. Over the past year, policy initiatives in the U.S. have signaled a greater willingness to facilitate alternative asset access for qualified retirement plans — including 401(k)s. While regulatory paths remain in progress and implementation timelines are evolving, the direction is unmistakably more inclusive.

Bottom Line: Private Markets Integration Is Accelerating

As alternatives continually innovate their distribution pathways — whether through SMAs, platform integrations, private-inclusive model portfolios, or 401(k) access windows — the strategic shift from niche to mainstream is materially underway. For financial advisors, the imperative is clear: understanding product structures, liquidity terms, and performance behavior will be as critical as ever.