(HedgeCo.Net) For years, “largest hedge funds” meant liquid markets: equities, rates, credit trading, macro, quant, and event-driven. Now, one of the most important strategic trends today is that top hedge fund complexes are pushing deeper into private credit and private-market-style products—a move driven by client demand for yield, fee durability, and diversification of revenue streams.

Point72’s private credit plan: a clear signal from a major liquid-markets franchise

Reporting has indicated Point72 has been in discussions to raise at least $1 billion for a new private credit fund, with leadership tied to a senior hire to build private capital capabilities, and with the structure described as an “evergreen” style product in some coverage.

Point72 itself has also publicly framed its business as multi-strategy across fundamental equities, systematic, macro, private credit, and venture—reinforcing that private credit is no longer “adjacent,” but part of the core identity it wants investors to underwrite.

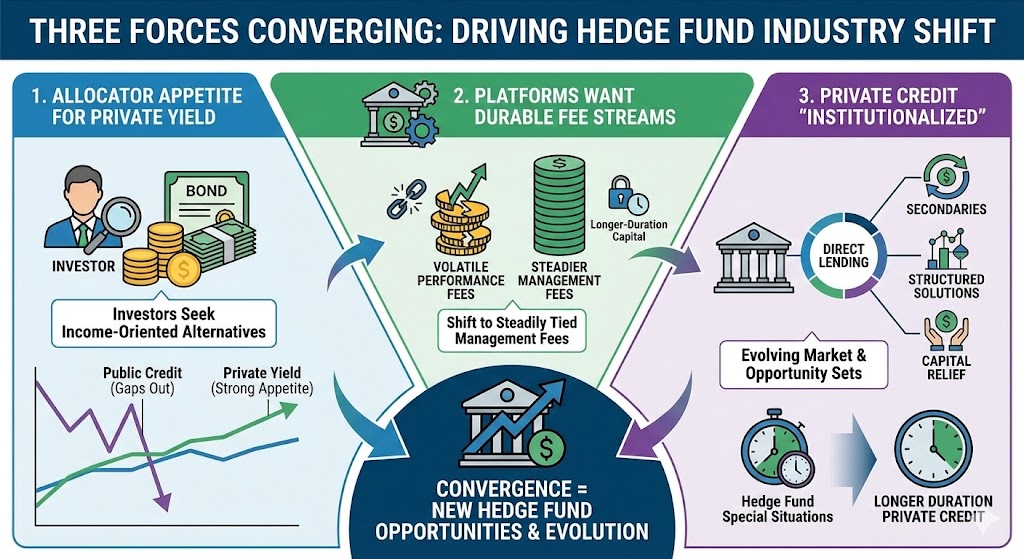

Why this is happening now:

- Allocator appetite for private yield remains strong. Even with more scrutiny on private credit, investors continue to seek income-oriented alternatives, particularly in an environment where public credit can gap out during stress.

- Platforms want more durable fee streams. Performance fees are volatile; management fees tied to longer-duration capital are steadier.

- Private credit is becoming more “institutionalized.” The market is evolving beyond direct lending into secondaries, structured solutions, and capital relief—opportunity sets that resemble hedge fund “special situations,” but with longer duration.

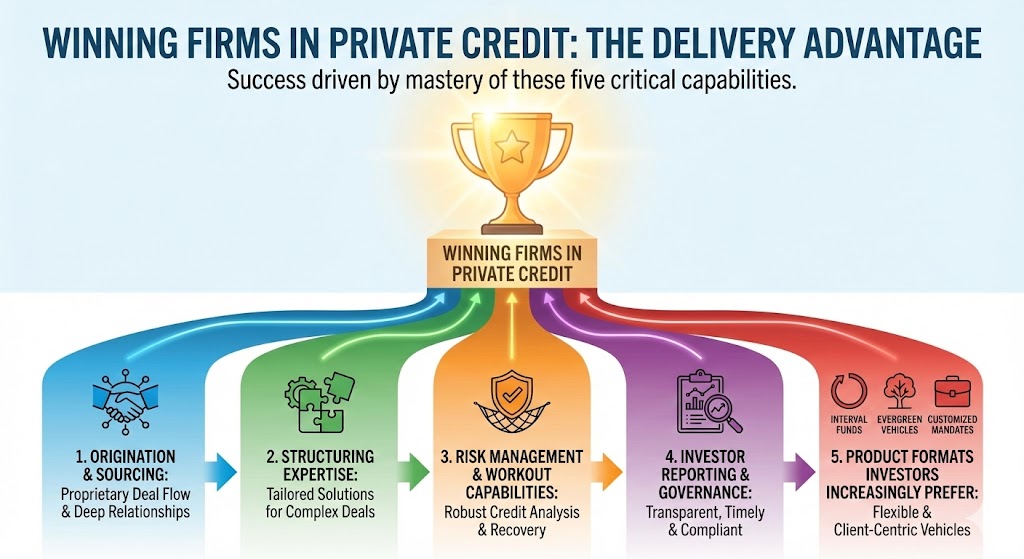

The competitive nuance: private credit isn’t just an asset class—it’s a distribution product

- Origination and sourcing

- Structuring expertise

- Risk management and workout capabilities

- Investor reporting and governance

- Product formats investors increasingly prefer (interval funds, evergreen vehicles, customized mandates)

For hedge funds entering the space, the challenge is credibility: private credit investors want to know you’re not simply transplanting a liquid trading mentality onto illiquid risk.

“Evergreen” structures: the battle for flexible capital

One reason the Point72 story resonates is the broader rise of evergreen and semi-liquid product design in alternatives. These structures can be attractive because they:

- Smooth fundraising cycles

- Potentially broaden the investor base

- Provide a more stable AUM foundation

But they come with a constraint: you must manage liquidity promises against illiquid assets—a mismatch risk that becomes acute in a downturn.

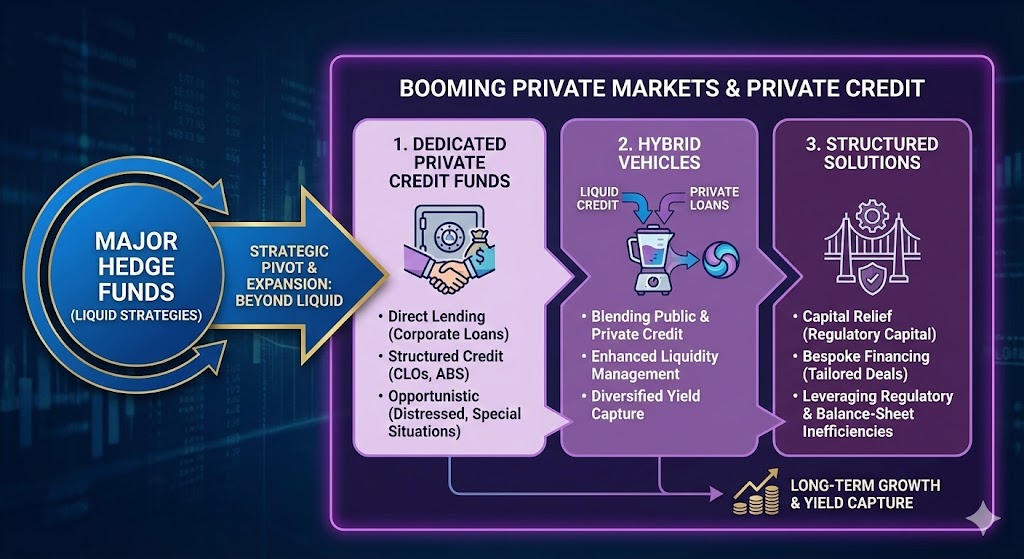

The broader trend: hedge funds expanding into private markets

Industry coverage has pointed to “major hedge funds” expanding into booming private markets and private credit, reflecting a wider strategic pivot beyond purely liquid strategies.

In practice, this expansion often takes one of three forms:

- Dedicated private credit funds (direct lending, structured credit, opportunistic)

- Hybrid vehicles blending liquid credit with private loans

- Structured solutions leveraging regulatory and balance-sheet inefficiencies (capital relief, bespoke financing)

What this means for 2026: the new questions allocators will ask

As this land grab accelerates, investors will pressure-test:

- Sourcing: Where do deals come from, and is the funnel proprietary?

- Underwriting: Are covenants real, and are assumptions conservative?

- Liquidity design: What happens under stress—gates, side pockets, slower redemptions?

- Conflict management: How are deals allocated across vehicles and strategies?

And crucially: does the firm have the operational muscles to manage private assets at scale?

How this intersects with the “best year in 16 years” hedge fund narrative

Hedge funds are coming off a year described as their best since 2009, with improved flows.

That matters because strong performance years give big firms the confidence—and the investor goodwill—to launch adjacent products. Private credit is a natural target: it’s large, still growing, and offers a path to multi-year capital.

What to watch next

- Confirmed details of Point72’s vehicle (fees, liquidity terms, target strategy mix) as fundraising progresses.

- Whether more liquid-heritage hedge funds follow with similar products (and how they differentiate).

- Whether increased scrutiny on private credit (valuation, leverage, liquidity) changes product design in 2026.

Bottom line: The most important “trending today” strategic shift at the largest hedge funds is that they’re not just competing for alpha in liquid markets anymore—they’re competing for permanent capital in private credit, and the winners will be those who can match hedge-fund speed with private-market discipline.