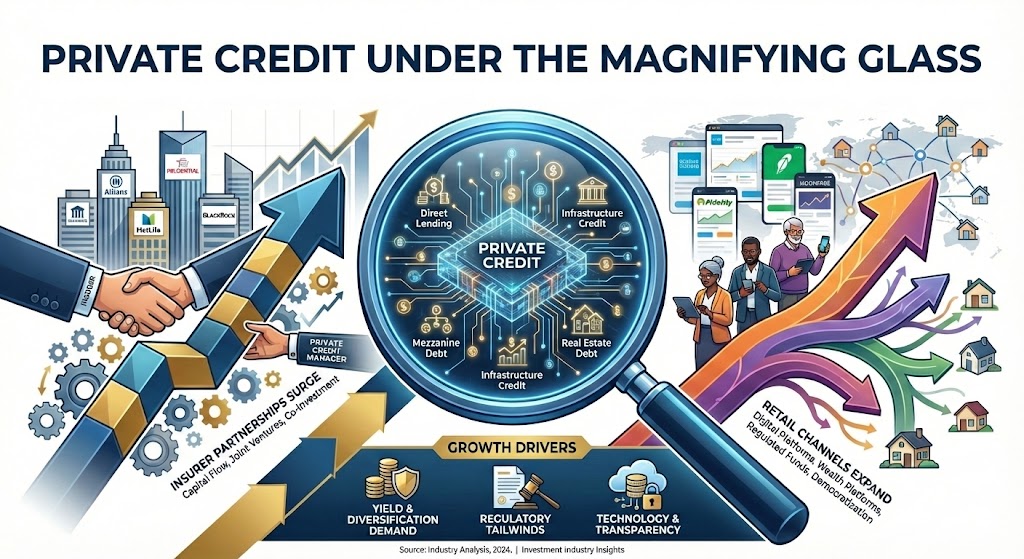

(HedgeCo.Net) Private credit is still one of the most crowded, scaled, and strategically important areas in alternatives—but what’s newright now is the combination of (1) accelerating insurer partnerships, (2) new semi-liquid access vehicles, and (3) public-market signals that investors are becoming more discriminating about the risk and liquidity embedded in the story.

The insurer bid gets bigger—and more structured

Over the past two weeks, the market has seen major insurance-related partnerships that underscore how central balance-sheet capital has become to private credit’s growth.

One of the cleanest examples is Jackson Financial and TPG, announced January 6, 2026: a long-term investment management partnership where TPG will initially manage at least $12 billion for Jackson, with incentives to grow the mandate. The strategic logic is straightforward: insurers need scalable, high-quality yield sources; large private credit platforms need sticky, long-duration capital.

In parallel, CVC’s partnership with AIG (announced January 19, 2026) highlights another dimension: insurers are not only allocating to private credit strategies; they’re increasingly engaging in multi-asset private markets relationshipsthat include private and liquid credit, and that may extend into wealth channels via evergreen structures.

This is the “industrialization” of private credit: institutional mandates, tailored SMAs, regulatory-capital-aware portfolio construction, and product design engineered for insurer constraints.

Wealth channel expansion: interval funds, evergreen structures, and ETF innovation

The second trend is distribution. The interval fund market—one of the main vehicles for delivering private-market exposure to a broader investor base—continues to swell. Reporting this month cited 67 new interval fund launches in 2025, including a meaningful share launched by traditional asset managers leveraging their distribution networks.

And it’s not just private funds. The boundary between “private” and “public wrapper” continues to blur. A press release dated January 20, 2026 spotlighted a private credit ETF milestone and positioned the structure as a lower-fee, liquid alternative to some semi-liquid fund options. Whether or not every investor agrees with the product framing, the direction of travel is unmistakable: the market is experimenting aggressively with wrappers.

The pushback cycle begins: public markets and confidence signals

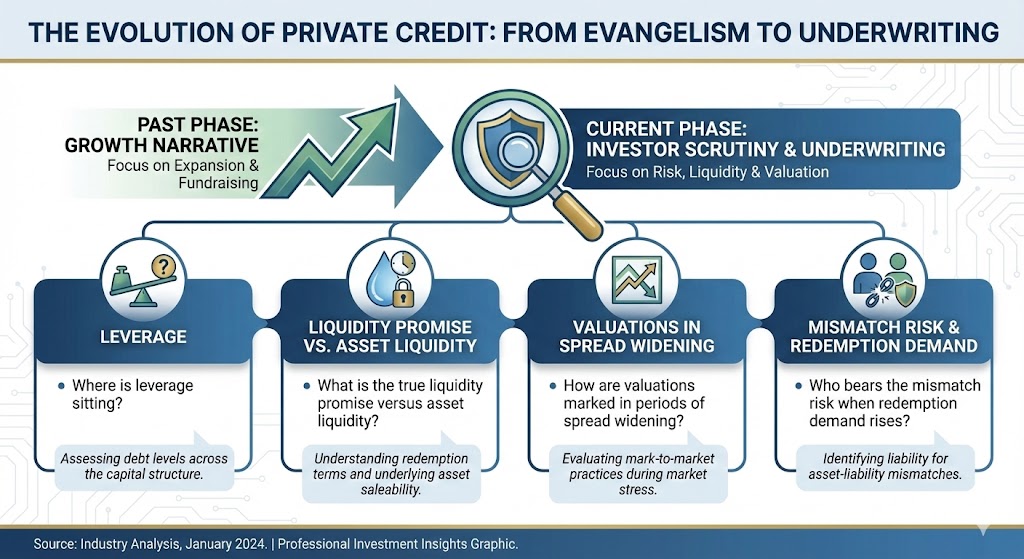

What’s new—and important—is that private credit is no longer in the phase where “growth” is the only narrative. Investor scrutiny is rising. A Bloomberg newsletter from early January pointed to shaky confidence signals in the public market pricing of alternative managers with heavy private credit exposure.

This doesn’t mean private credit is “broken.” It means the market is shifting from evangelism to underwriting:

- Where is leverage sitting?

- What is the true liquidity promise versus asset liquidity?

- How are valuations marked in periods of spread widening?

- Who bears the mismatch risk when redemption demand rises?

What the smart money is doing: moving “up the quality stack”

As the strategy matures, allocators are differentiating across private credit sub-sectors:

- Investment-grade private credit and structured, high-quality asset-based lending for insurers and conservative pools.

- Asset-based finance (ABF) and specialty finance where collateral and cash flows are more idiosyncratic.

- Opportunistic credit where capital can be deployed into dislocation—if and when spreads widen.

Firms are also increasingly marketing “solutions” rather than single sleeves—public/private blended credit, capital relief structures, and portfolios that can rotate across regimes. This is consistent with broader 2026 sector commentary emphasizing hybrid product creation and distribution-driven growth.

The 2026 watchlist: liquidity design, underwriting discipline, and insurer governance

Private credit’s next chapter is about sustainability—not sustainability in the ESG sense, but in the structural sense:

- Liquidity design that aligns with asset reality,

- underwriting discipline as competition rises,

- and governance as insurers, regulators, and public investors demand more transparency.

In 2026, “private credit” won’t trade as a single narrative. It will fragment into a hierarchy of quality, structure, and honesty about risk. The winners will be the platforms that can prove they understand that—and have built the machine accordingly.