(HedgeCo.Net) One of the biggest “today” takeaways from the early-January performance reporting is simple: macro and multi-strategy are winning again. Reuters reporting described standout 2025 returns from some of the largest and most systemically important hedge funds, led by Bridgewater and D.E. Shaw—results driven by an AI-fueled equity rally and tradable volatility tied to policy.

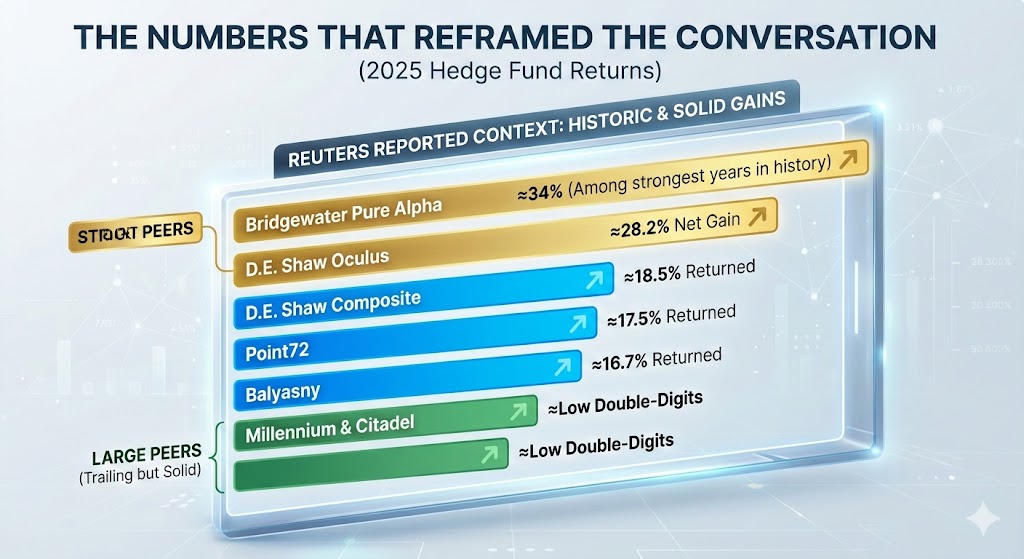

*According to the Reuters report:

- D.E. Shaw’s Oculus posted about a 28.2% net gain in 2025, and Composite returned 18.5%.

- Bridgewater’s Pure Alpha was reported around 34% (also described as among the strongest years in its history).

- Balyasny returned about 16.7%, and Point72 about 17.5%.

- Even large peers that “trailed” still posted solid gains (Reuters cited Millennium and Citadel around the low double-digits in that same context).

What’s important is not the leaderboard itself—it’s what the dispersion says about strategy fit. Macro and multi-strat did well because 2025 delivered both trend and turbulence.

The most tradable markets tend to offer two simultaneous ingredients:

- Persistent themes (trend) — e.g., the AI-led equity surge.

- Disruptive shocks (turbulence) — e.g., policy, geopolitics, rates uncertainty.

Reuters explicitly tied strong hedge fund performance to an AI-fueled stock market rally and volatility linked to U.S. trade and fiscal policy.

That combination is exactly what systematic macro and diversified multi-strategy funds are designed to exploit: they don’t need to be right on one narrative—they need enough narratives moving differently.

Bridgewater’s Pure Alpha performance being described as exceptional (in some reports framed as the best year in decades) is important because macro has been periodically dismissed as structurally impaired in the post-GFC era.

But macro tends to reassert itself when:

- Rates are not pinned

- FX differentials matter again

- Inflation and growth divergence returns

- Geopolitical and policy paths are uncertain

That’s the environment investors have been living in—and, crucially, it’s an environment where “neutral” positioning is costly. When policy is path-dependent, markets overreact, underreact, and then reprice again.

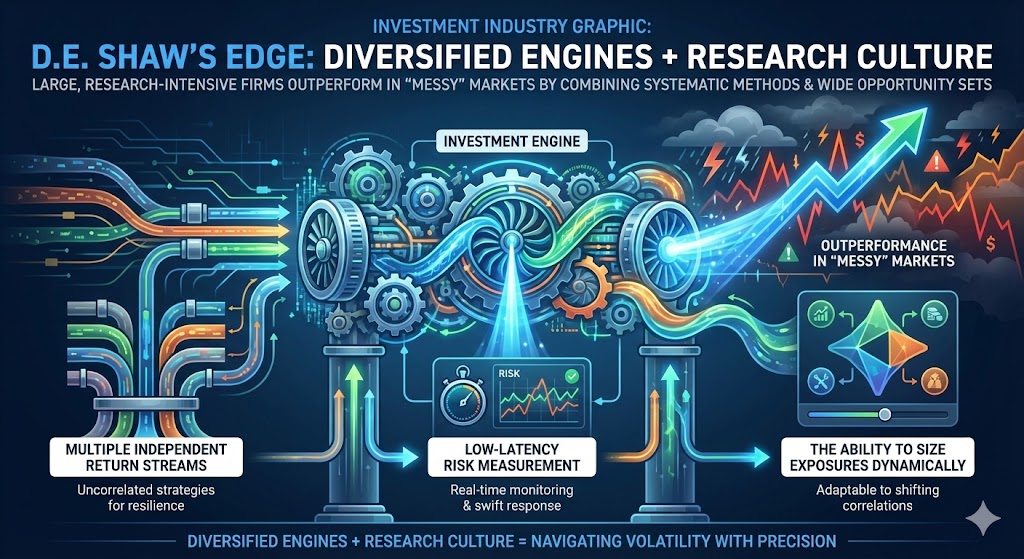

D.E. Shaw’s results reinforce a broader trend: large, research-intensive firms that combine systematic methods with a wide opportunity set tend to outperform when markets are “messy.”

In these regimes, it’s not just about being a quant or a discretionary shop; it’s about having:

- Multiple independent return streams

- Low-latency risk measurement

- The ability to size exposures dynamically as correlations shift

The allocator angle: performance + flows are moving together again

Bloomberg reported hedge funds had their best returns since 2009 and noted improved net inflows during 2025 (a reversal from years of outflows), which helps explain why “today’s” headlines feel more optimistic.

Once flows return, the competitive game shifts:

- More capital chasing pods and PM talent

- Higher compensation bids

- More infrastructure spend

- Increased crowding risk in similar factor exposures

What to watch in 2026: can macro keep the baton?

The risk for macro is not that volatility disappears—it’s that volatility becomes one-directional, compressing opportunity. For example:

- If equity leadership becomes too narrow and too stable, dispersion falls.

- If rates markets become anchored again, macro convexity cheapens.

But the early-2026 setup still looks like a macro playground: policy uncertainty, cross-asset linkages, and faster narrative cycles than the 2010s.

Practical takeaways for readers

- Macro is not “back” as a fad; it’s back as a regime response.

- Multi-strategy platforms remain the default institutional choice for those who want volatility harvesting with tighter drawdown controls.

- The next phase of competition will likely be about risk bandwidth (how much volatility a fund can absorb without forced de-risking).

Bottom line: Bridgewater and D.E. Shaw’s reported 2025 numbers are trending because they validate a 2026 thesis: markets are no longer a single-story tape, and hedge funds built for cross-asset complexity are positioned to thrive.