(HedgeCo.Net) As the crypto industry matures beyond pure price speculation, deep structural trends are rewriting the playbook for digital assets in 2026. While market prices grab headlines, innovation layers — from tokenization to AI integration, institutional adoption, and stablecoin infrastructure — are quietly redefining value creation and utility across ecosystems.

1. Institutional Capital Finally Goes Vertical

Institutional investment in crypto is no longer a fringe narrative — it’s becoming mainstream infrastructure. From multi-billion-dollar ETF filings to strategic corporate allocations, traditional finance is increasingly embracing digital assets.

Morgan Stanley’s recent filings for Bitcoin and Solana ETFs underscore this shift — with expectations that regulated funds will broaden access and scale institutional inflows. Analysts say such developments reinforce confidence among wealth managers and pension funds that have been on the sidelines due to custody and regulatory concerns.

Moreover, asset managers are building custom crypto solutions — from segregated accounts to tokenized fixed-income exposure — that fit fiduciary risk profiles. This momentum reflects a broader trend documented in industry forecasts emphasizing institutional capital, stablecoins, and real-world asset (RWA) tokenization as pillars of growth.

2. Tokenization & Real-World Asset Bridging

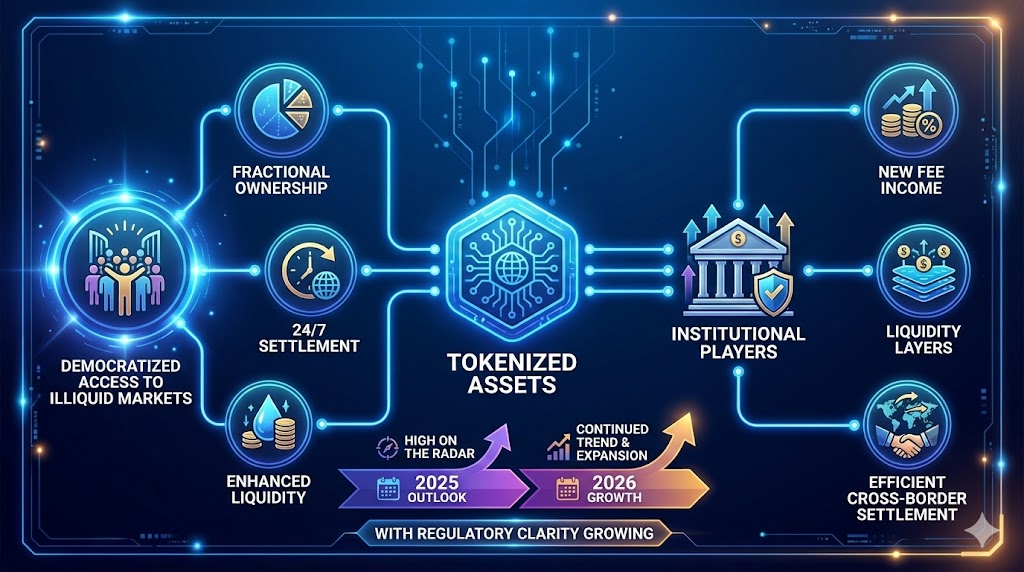

Tokenization is surging from concept to execution. Beyond smaller pilot projects, real-world assets — including commercial real estate, private credit pools, and commodities — are being digitized on blockchains.

Tokenized assets promise fractional ownership, 24/7 settlement, and enhanced liquidity, which in turn democratizes access to previously illiquid markets. Institutional players are taking notice due to the potential for new fee income, liquidity layers, and efficient cross-border settlement. This trend was high on the radar in 2025 crypto outlooks and continues in 2026 as regulatory clarity grows.

3. Stablecoins: Infrastructure, Payments & Scale

Stablecoins are transcending speculative labels, instead becoming core infrastructure for digital finance. Their transaction volumes continue steep year-over-year growth, rivalling legacy payment networks.

This massive adoption — driven by both remittances and payments — is encouraging central banks and regulators to scrutinize frameworks that balance innovation with financial stability. The result: clearer rules that may integrate stablecoins into broader banking structures, including potential partnerships with regulated trust companies and stablecoin-backed lending products.

4. DeFi Renaissance with Risk & Reward

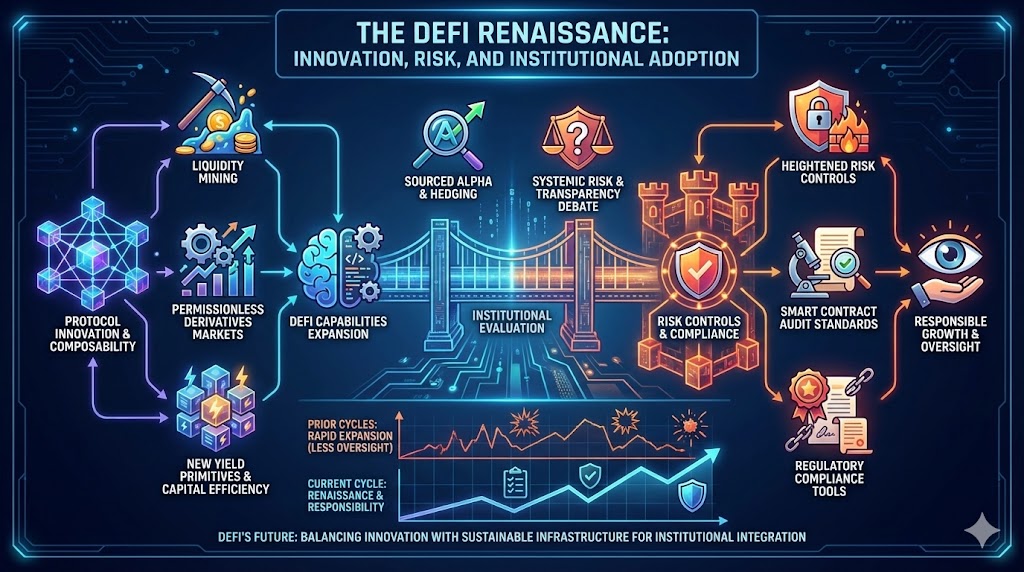

Decentralized finance (DeFi) is experiencing a renaissance of protocol innovation and composability. From liquidity mining to permissionless derivatives markets, DeFi’s capabilities are expanding with greater capital efficiency and new yield primitives.

However, this renaissance coexists with heightened attention to risk controls, smart contract audit standards, and regulatory compliance tools that were largely absent in prior cycles. Institutional counterparts are evaluating DeFi for sourced alpha and hedging applications, despite ongoing debates about systemic risk and transparency.

5. AI, Agents & Next-Gen Market Intelligence

Artificial intelligence integration is no longer futuristic — it’s operational. Traders and institutions utilize AI-driven agents for signal analysis, risk control, and execution efficiency, enhancing decision-making across turbulent markets. Recent academic work shows agentic frameworks synthesizing web data with price signals to mitigate volatility and tail risk.

The emergence of AI-enhanced protocols, from prediction-market insights to automated liquidity provision, represents a natural evolution of decentralized and algorithmic trading ecosystems.

6. Regulation & Compliance Redefining User Journeys

Regulatory momentum is reshaping the user experience in meaningful ways. India’s deployment of live selfie and geo-location requirements for crypto platform onboarding illustrates how regulators are prioritizing AML/KYC scrutiny over frictionless access.

While these measures enhance traceability and protect against illicit activity, they also introduce onboarding overhead and privacy considerations that platforms must navigate carefully.

Simultaneously, U.S. legislative hearings on stablecoin oversight and decentralized finance highlight deeper engagement between policymakers and industry leaders. The goal is not merely to regulate but to institutionalize frameworks that encourage innovation with consumer safeguards.

7. Emerging Geographies & Adoption Hotspots

Globally, regulatory approaches vary widely:

- Some regions, like Vietnam, have enacted comprehensive digital asset legislation setting the stage for regulated industry growth.

- Others, including parts of the Middle East and Africa, are developing crypto hubs focused on investment, payments, and blockchain startups.

- Meanwhile, traditional markets such as the U.S. and Europe pursue granular regulation with investor protection as a key priority.

These varied landscapes create both challenges and opportunities for multinational organizations and local innovators.

8. Education, Onboarding & Retail Dynamics

As structural narratives solidify, retail participation clearly reflects selective engagement — with newer participants focusing on utility (e.g., payments, staking) over speculation, while seasoned traders hedge macro exposures via ETFs, options, and smart beta crypto products.

Platforms increasingly invest in educational initiatives, compliance tooling, and user safeguards as differentiators in a crowded exchange landscape.

Looking Ahead — 2026’s Defining Themes

As we progress through 2026, several defining trends are likely to shape the narrative:

? Macro Linkage: Crypto’s correlation with macro data — inflation, monetary policy, and risk appetite — will continue to influence price behavior near-term.

? Institutional Integration: Continued influx of institutional capital and regulated products will push the asset class closer to mainstream allocation buckets.

? Structural Innovation: Tokenization, stablecoin rails, DeFi protocols, and AI-enabled finance will define the next chapter of utility and adoption.

? Regulatory Maturity: Policymakers worldwide will balance innovation with protection, leading to diverse regulatory blueprints that could either accelerate or constrain growth.

In this evolving environment, industry participants — from builders to institutional allocators — must remain adaptive, discerning, and forward-looking.