(HedgeCo.Net) In what many industry insiders are calling a defining early moment for the future of digital assets, major cryptocurrency firms are responding to shifting regulatory landscapes, strategic capital raises, and evolving market dynamics. Today’s headlines reflect a crypto ecosystem balancing institutional expansion, regulatory pressures, and product innovation — signaling that 2026 may be the year the industry transitions from speculative growth to regulated global finance integration.

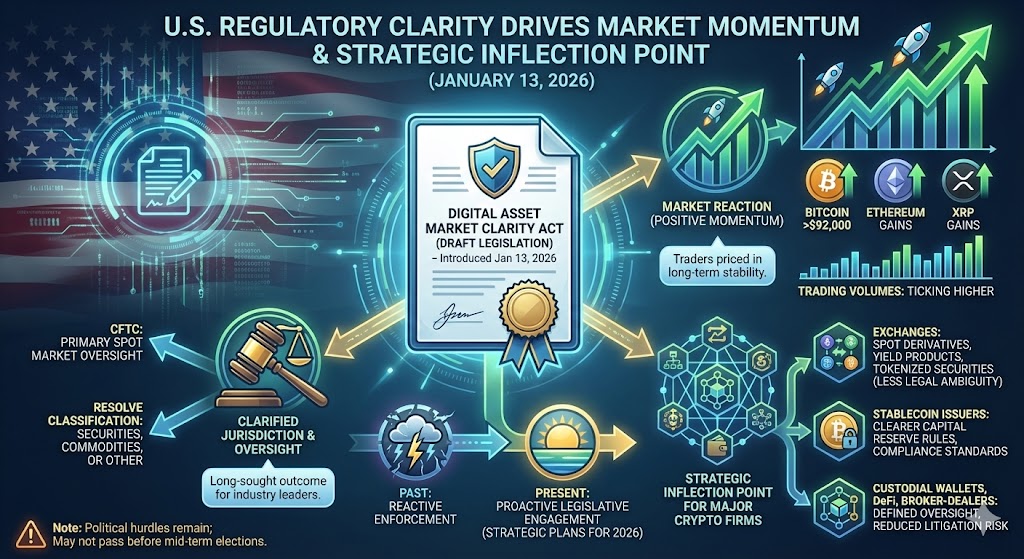

A key catalyst moving markets and corporate strategies this week was the introduction of a comprehensive crypto regulatory bill by U.S. senators on January 13, 2026. The draft legislation — known as the Digital Asset Market Clarity Act — aims to definitively resolve whether digital tokens are securities, commodities, or something else, and clarify oversight roles among regulators. It would assign primary jurisdiction over spot crypto markets to the CFTC, a long-sought outcome for many industry leaders.

Markets reacted positively: Bitcoin climbed above $92,000, Ethereum and XRP also gained, and trading volumes ticked higher as traders priced in potential long-term regulatory stability.

For major crypto firms, regulatory clarity is more than just market headwind relief — it’s now a strategic inflection point:

- Exchanges can plan product rollouts — such as spot derivatives, yield products, and tokenized securities trading — with less legal ambiguity.

- Stablecoin issuers would operate under clearer capital reserve rules and compliance standards.

- Custodial wallets, DeFi platforms, and broker-dealers can structure services with defined oversight rather than ongoing litigation risk.

While the bill still faces political hurdles and may not sail through before mid-term elections, its emergence marks a major shift from reactive enforcement to proactive legislative engagement — a trend many CEOs and boards have factored into strategic plans for 2026.

Crypto Firms Respond to Regulation — Licensing and Compliance Prioritized

Regulation isn’t just taking shape in Washington — Europe is moving aggressively, and firms are scrambling to adapt globally.

In France, the financial regulator AMF warned that about one-third of crypto firms are not yet compliant with the EU’s Markets in Crypto-Assets (MiCA) framework, which requires licensing by mid-2026 to operate across the bloc.

For major players like Coinbase, Circle, Binance, and Revolut, this doesn’t come as a surprise — these firms have already secured MiCA authorizations. But for mid-tier exchanges and service providers, the licensing deadline is acting as both a motivator and a deadline: firms are accelerating applications or, in some cases, preparing exit or wind-down plans where compliance may not be viable.

Across Asia, regulators are also tightening controls. India’s Financial Intelligence Unit (FIU) recently rolled out live selfie verification and geo-tagging requirements for crypto onboarding — measures that drastically raise Know-Your-Customer (KYC) and Anti-Money Laundering (AML) expectations.

These shifts are forcing major firms to beef up compliance teams, internal controls, transaction monitoring systems, and global licensing strategies. Crypto firms that once competed primarily on fee structures and token listings now judge success by regulatory reach and compliance robustness.

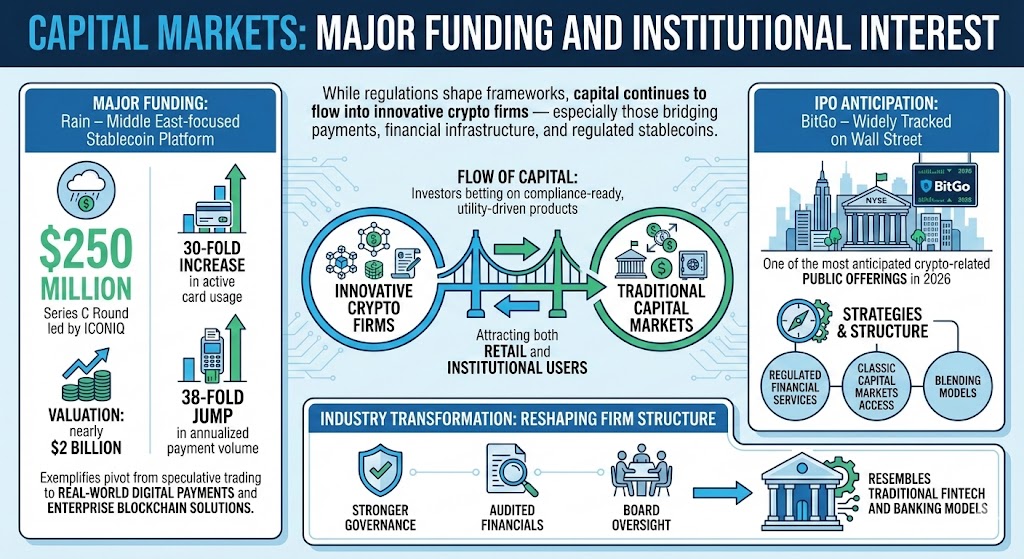

While regulations shape frameworks, capital continues to flow into innovative crypto firms — especially those bridging payments, financial infrastructure, and regulated stablecoins.

Rain, a Middle East-focused stablecoin platform, announced a $250 million Series C round led by ICONIQ, lifting its valuation to nearly $2 billion.

Rain’s growth — which includes 30-fold increases in active card usage and a 38-fold jump in annualized payment volume — exemplifies how firms are pivoting from speculative trading services toward real-world digital payments and enterprise blockchain solutions. Investors are betting that compliance-ready, utility-driven products will attract both retail and institutional users.

Similarly, IPO anticipation is shaping strategies at other firms. BitGo is widely tracked on Wall Street as one of the most anticipated crypto-related public offerings in 2026. Although specific IPO dates are not yet confirmed, the firm’s anticipated NYSE debut highlights the industry’s push to blend regulated financial services with classic capital markets access.

These capital markets developments are reshaping how crypto firms structure themselves — with stronger governance, audited financials, and board oversight that resembles traditional fintech and banking models.

Crypto Meets Banking: Trust Charters and Financial Integration

Another major trend reshaping strategy among large firms is the pursuit of trust and banking licences — which would allow crypto firms to offer services more akin to traditional financial institutions.

In a high-profile example, World Liberty Financial — backed by the Trump family — applied for a U.S. national banking charter that would allow the issuance of its stablecoin under federal oversight.

This move mirrors recent preliminary approvals granted to firms like Ripple and Circle, which were cleared to establish national trust banks — a huge step toward crypto-native financial infrastructure integrated into the mainstream banking system.

Securing these licences would enable crypto firms to offer:

- Crypto custody under federal charter protections

- Stablecoin issuance and redemption with regulatory oversight

- Payments and possibly lending services that bridge fiat and digital asset ecosystems

These moves aren’t without controversy: lawmakers and regulators continue to debate oversight boundaries between banking regulators and financial markets agencies. But the momentum toward regulated banking status for digital asset firms is unmistakable.

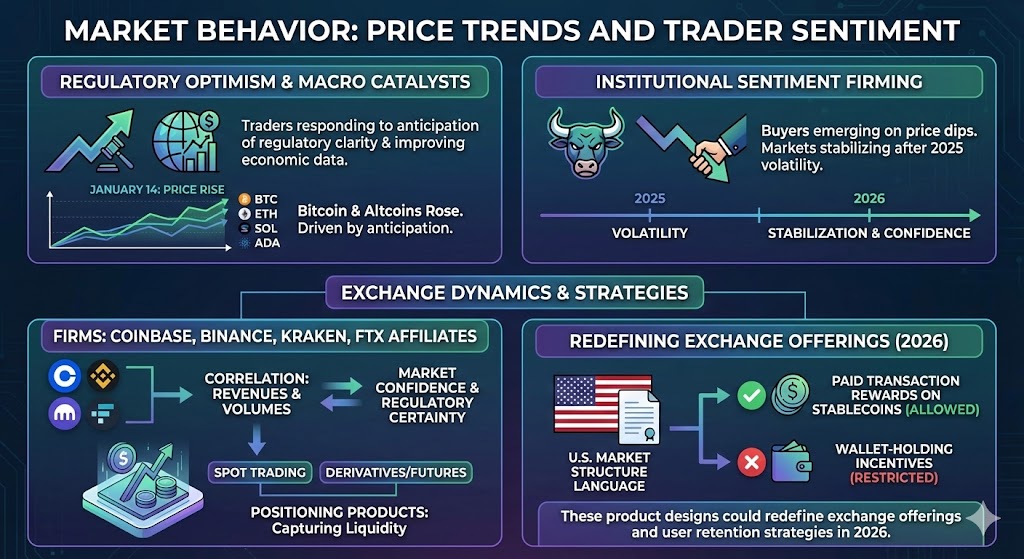

Meanwhile, in financial markets, traders are responding to regulatory optimism and macro catalysts.

Bitcoin and major altcoins rose on January 14, driven by anticipation of regulatory clarity and improving economic indicators. Sentiment among institutional buyers appears to be firming up, particularly on price dips — a sign that markets may be stabilizing after the volatility of 2025.

One key dynamic for firms such as Coinbase, Binance, Kraken, and FTX affiliates is that exchange revenues and trading volumes are highly correlated with market confidence and regulatory certainty. As such, firms are increasingly positioning trading products and futures instruments to capture both spot and derivatives liquidity.

Some exchanges are also testing new trading incentives and token rewards based on upcoming U.S. market structure language that would allow paid transaction rewards on stablecoins but restrict wallet-holding incentives. These product designs could redefine exchange offerings and user retention strategies in 2026.

Security and Compliance: Hacks Still a Concern

Despite all the progress, security risks remain a core vulnerability. High-profile hacks continue to challenge firms’ reputations and capital integrity — a reminder that infrastructure security must evolve as fast as innovation does.

Major firms from custodial wallets to decentralized finance platforms are investing in:

- Multi-party computation (MPC) security

- Formal verification and smart contract audits

- Cross-chain risk management

- Real-time market surveillance

Establishing industry-wide threat intelligence sharing and coordinated defense frameworks is now a competitive priority, not merely a compliance checkbox.

Industry Outlook: What Crypto Firms Are Preparing Next

Looking ahead, several themes are shaping strategies among major crypto firms:

1. Regulatory Preparedness as Competitive Advantage

Companies that secure licences early — whether under U.S. federal law, MiCA in Europe, or national frameworks in Asia — will gain first-mover positioning for institutional capital and large-scale adoption.

2. Banking Integration and Stablecoin Leadership

Crypto firms are striving to operate with banking-like services, which could dramatically broaden use cases for stablecoins and digital wallets, especially in corporate treasury and cross-border payment flows.

3. Institutional Capital Inflows

With clearer rules, firms are launching products and capital raises (including IPOs) that appeal to traditional and institutional investors — bringing traditional finance liquidity into the digital-asset ecosystem.

4. Security and Compliance Engineering

Robust cybersecurity and AML/KYC compliance are fundamental — measured not only by regulatory outcomes but also by investor confidence and enterprise adoption.

5. Product Innovation Amid Macro Trends

From decentralized finance (DeFi) platforms to tokenized real-world assets (RWA), crypto firms are expanding beyond exchange and payment rails into broader financial infrastructure services.