(HedgeCo.Net) Point72 Asset Management may not match Bridgewater, Citadel, or Millennium in raw assets under management, but it epitomizes the most proactive trend among major U.S. hedge funds in 2026: strategic expansion into private credit and hybrid alpha strategies.

What makes Point72’s evolution noteworthy is not just size — it is the intentional diversification of its alpha enginesbeyond traditional equities and quant models into areas more commonly associated with private markets and yield-seeking investors.

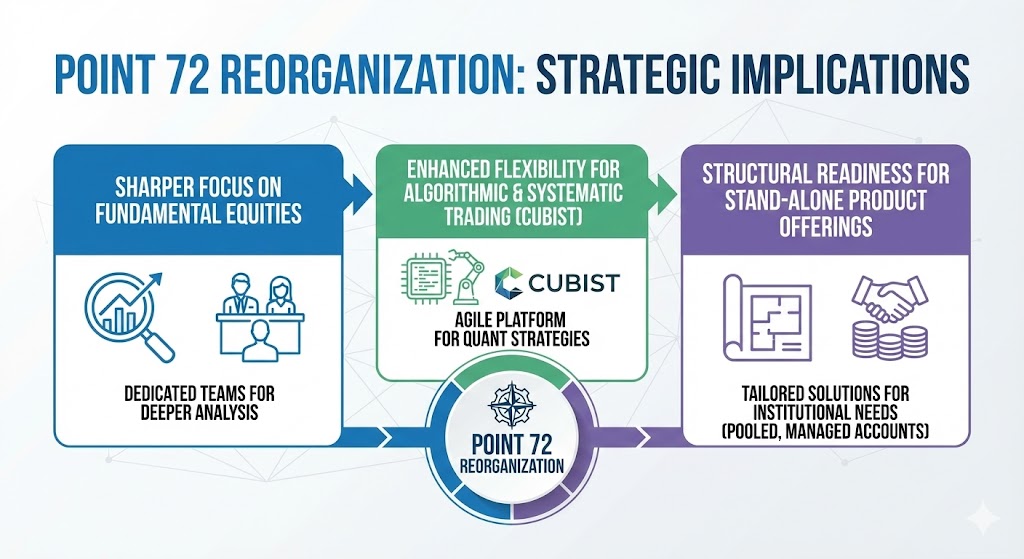

Reorganizing for Performance and Specialization

Late in 2025, Point72 announced a structural reorganization of its equities division — splitting its core equities platform from a newly established affiliate, Valist Asset Management. This transition reflects a broader industry imperative to optimize investment specialization and client access across strategy silos.

This reorganization has several strategic implications:

- Sharper focus on fundamental equities through dedicated teams

- Enhanced flexibility for algorithmic and systematic trading via Cubist

- Structural readiness for stand-alone product offerings — including pooled, managed accounts — tailored to institutional needs

Such specialization aligns with a growing demand from allocators for hedge fund partners that can deliver modular alpha streams rather than monolithic pools of capital.

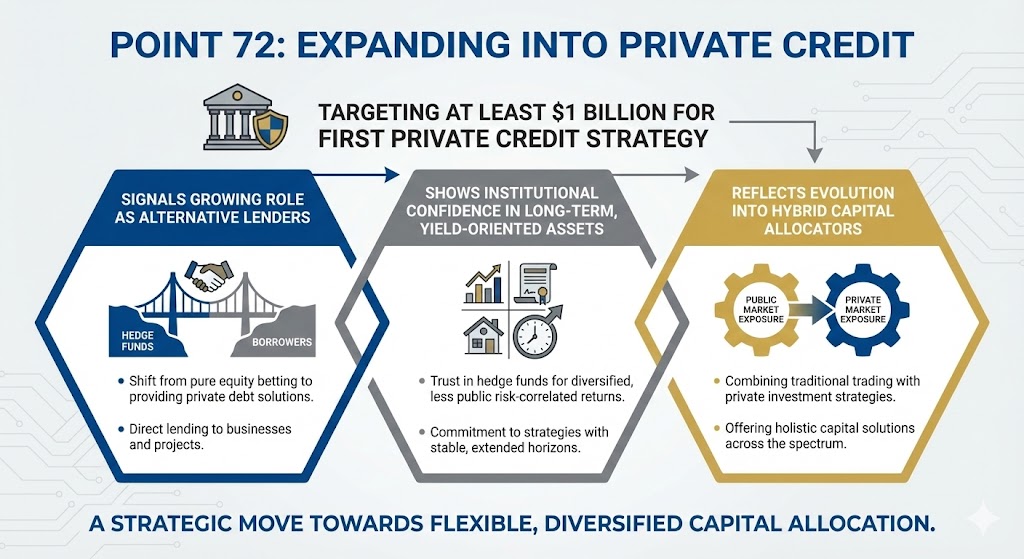

Entering Private Credit: Diversification Meets Yield

One of the most talked-about developments surrounding Point72 is its venture into private credit — a strategic move that echoes a broader industry pattern where hedge funds compete with traditional credit allocators in yield-seeking niches.

Point72 is said to be targeting at least $1 billion in capital for its first private credit strategy, a bet on institutional demand for higher-yield, less public risk-correlated assets. This development is significant for several reasons:

- It signals hedge funds’ growing role as alternative lenders, not just equity bettors.

- It shows institutional confidence in hedge fund diversification into long-term, yield-oriented assets.

- It reflects the evolution of hedge funds into hybrid capital allocators that combine public and private market exposure.

Point72’s move into private credit also aligns with broader hedge fund trends toward expanded strategy mandates, product breadth, and client servicing, where single-style offerings are giving way to multi-product platforms that can compete with private equity and credit managers for institutional allocations.

Quant and Systematic Strength with Cubist

Point72’s Cubist division continues to be a major competence center, especially in systematic and quantitative strategies that leverage alternative data and infrastructure capabilities. Changes in leadership within Cubist signal an ongoing refinement of algorithmic models that incorporate not just price and volume data, but macro indicators, sentiment signals, and machine-led pattern recognition.

This reinforces the broader trend identified by industry researchers: AI, machine learning, and systematic strategies are becoming core differentiators among hedge fund peers — especially in environments where traditional factor inefficiencies are shrinking.

Conclusion

Point72’s pivot toward private credit and its internal reorganization reflect broader structural forces shaping hedge funds in 2026. Institutions want strategy depth, product specialization, and diversified alpha sources — and managers like Point72 are building the frameworks to meet those demands.