(HedgeCo.Net) On January 27, 2026, the cryptocurrency industry finds itself at a critical juncture — marked by regulatory momentum in Washington, evolving institutional participation, and heightened macroeconomic forces reshaping investor behavior. After years of debate over how digital assets should be regulated, the U.S. legislative and financial systems are signaling a new era in which crypto is neither fringe finance nor laissez-faire experimentation — but an asset class that requires clear rules and engagement from policymakers and institutions alike.

Today’s top headlines — from the progression of the Clarity Act in the U.S. Senate to stablecoin pressure on traditional banks — reflect deepening intersections between digital assets and broader financial systems. This article unpacks these developments and analyzes what they mean for market participants, institutional investors, and the future of blockchain innovation.

Regulatory Progress: The Clarity Act Advances

A major piece of legislation, known as the Clarity Act, has overcome a significant obstacle in the U.S. Senate after a contentious amendment was dropped. Originally, the bill sought to address not only digital-asset regulation but also swipe fee competition on credit cards — a provision that drew considerable political pushback. With that provision removed, the bill now has a clearer path toward passage.

At its core, the Clarity Act aims to provide legal clarity to digital assets, specifying regulatory jurisdiction and anti-fraud protections while reducing ambiguity that has long clouded institutional engagement. For years, financial institutions and crypto firms alike have expressed concern that inconsistent regulation — or the threat of sudden enforcement actions — has hampered capital deployment in digital markets.

The Clarity Act addresses these issues by articulating more explicit SEC and CFTC authority over specific token categories, easing compliance burdens, and potentially insulating stablecoin issuers from retroactive enforcement risk. While final provisions and the Senate’s ultimate vote outcome remain to be determined, the momentum behind the bill signals bipartisan acknowledgment that crypto integration into the financial system is no longer optional — it’s inevitable.

Stablecoins and Banking: A Looming Disruption

Amid legislative progress, stablecoins are emerging as a potent force capable of reshaping traditional finance. Standard Chartered estimates stablecoins could siphon an estimated $500 billion from U.S. bank deposits by 2028.

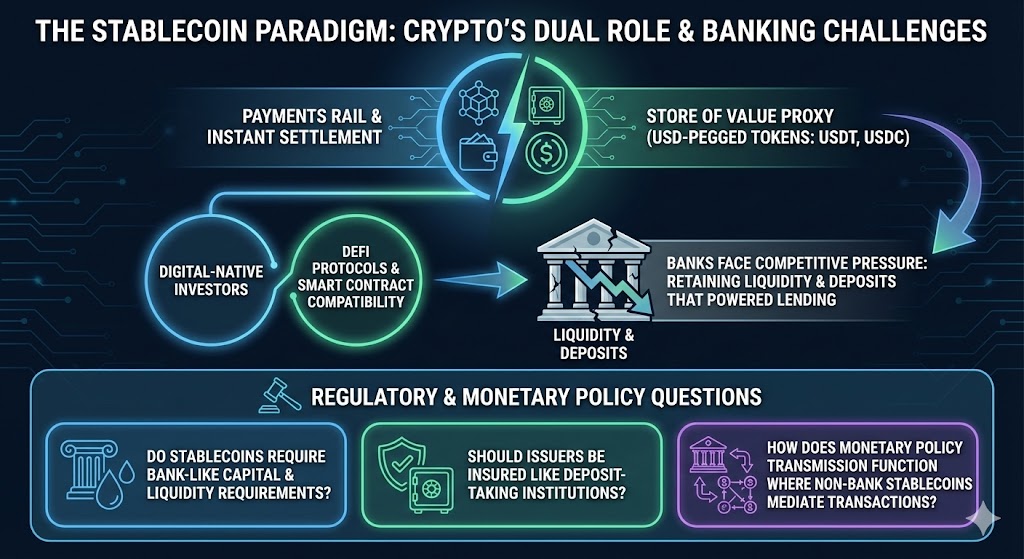

This projection reflects stablecoins’ twin role as both payments rail and store of value proxy. U.S. dollar-pegged tokens such as USDT and USDC provide users with instantaneous settlement and smart-contract compatibility — features that appeal to digital-native investors and DeFi protocols. As usage grows, banks face competitive pressure to retain liquidity and deposits that historically powered lending businesses.

For regulators and commercial banks alike, this raises thorny questions:

- Do stablecoins require bank-like capital and liquidity requirements?

- Should issuers be insured like deposit-taking institutions?

- How does monetary policy transmission function in an economy where non-bank stablecoins mediate transactions?

Failure to address these questions risks a structural realignment of payment systems — one that could diminish bank deposit franchises and accelerate crypto’s integration into core financial plumbing.

Mainstream Adoption — Crypto Payments on the Rise:

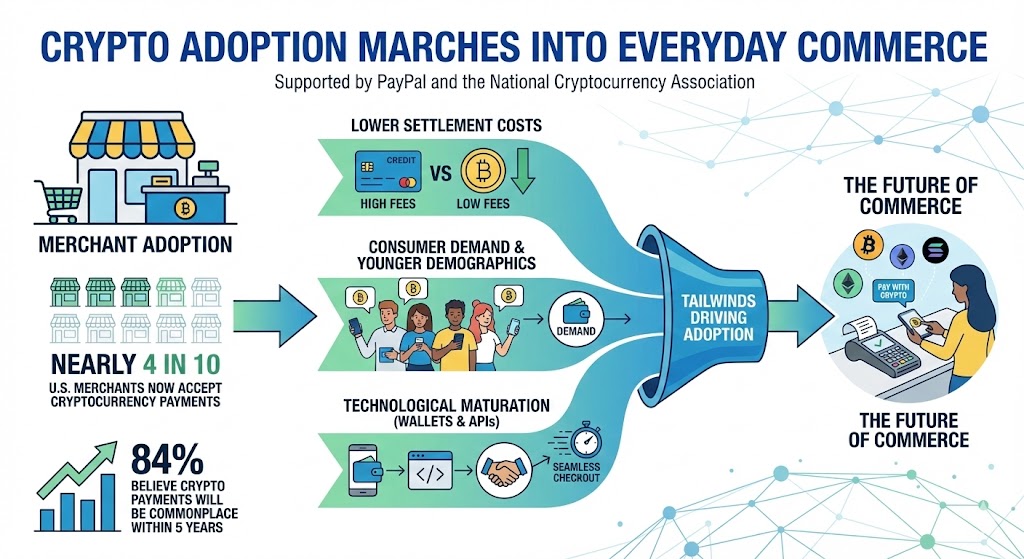

In parallel with institutional and regulatory developments, crypto adoption continues its march into everyday commerce. New research — supported by PayPal and the National Cryptocurrency Association — finds that nearly 4 in 10 U.S. merchants now accept cryptocurrency payments at checkout, and 84 % believe such payments will be commonplace within five years.

This adoption trajectory reflects multiple tailwinds:

- Merchant preference for lower settlement costs versus credit card rails.

- Consumer demand for alternative payment options, especially among younger demographics.

- Technological maturation of wallets and payment APIs enabling seamless checkout experiences.

For crypto advocates, this is a milestone: the narrative has shifted from speculative trading to practical utility. However, merchant adoption also brings regulatory scrutiny around AML/KYC compliance, tax reporting, and consumer protection — all issues likely to be addressed in detail by emerging legislation like the Clarity Act.

Market Dynamics: Bitcoin Below $88K, Cautious Investor Sentiment:

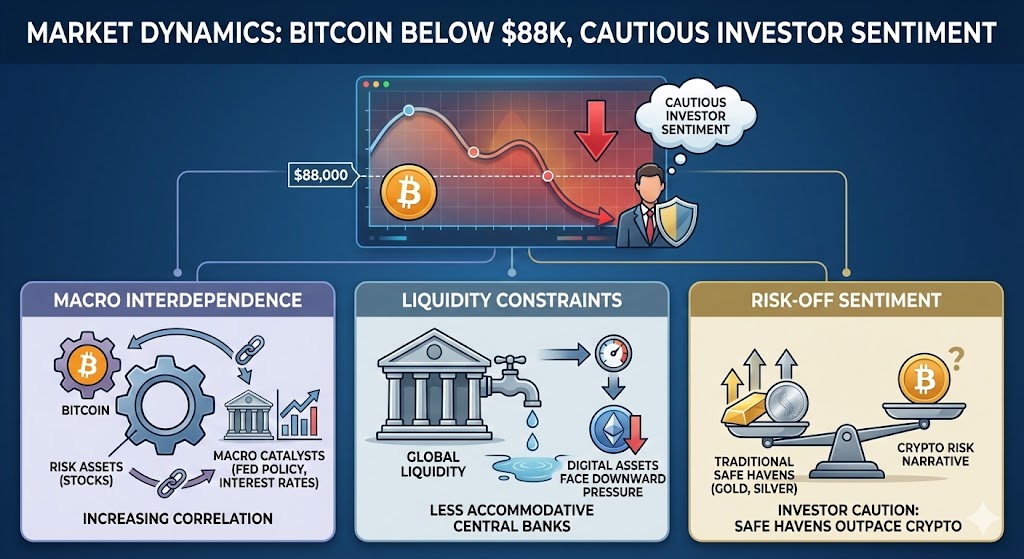

Despite the macro momentum, crypto asset prices have trended cautiously. On Tuesday, Bitcoin — the market’s bellwether — slipped under $88,000 as investors awaited the outcome of the Federal Reserve’s policy decisions and gauged broader economic risks.

This price action underscores several persistent themes:

- Macro interdependence: Cryptocurrencies are increasingly correlated with risk assets and macroeconomic catalysts like interest rate expectations.

- Liquidity constraints: With central banks less accommodative than in prior cycles, digital assets face downward pressure from tighter global liquidity.

- Risk-off sentiment: Traditional safe havens like gold and silver have outpaced crypto’s risk narrative in recent headlines, reflecting investor caution.

As the market digests these forces, volatility is likely to remain a fixture — not as a bug, but as a feature of crypto’s evolving role in diversified portfolios.

Institutional Interest: From Hedge Funds to Private Banking Platforms

Institutional appetite for crypto persists, though it has evolved from pure speculation to strategic deployment.

Notably, Galaxy — the investment firm led by Mike Novogratz — is planning to launch a $100 million crypto hedge fund aimed at capturing volatility and inefficiencies in digital markets this year.

Meanwhile, UBS — a behemoth in global banking — is exploring crypto investment products for private banking clients, potentially including Bitcoin and Ether allocations.

These developments highlight a shift:

- Hedge funds are viewing crypto as an alpha source during market gyrations.

- Private banks are treating Bitcoin and Ether as strategic allocations for high-net-worth portfolios.

Both trends suggest a maturation in how institutions conceive digital assets: not as speculative novelties, but as financial building blocks integrated across risk-managed portfolios.

Conclusion — The Road Ahead: Regulation, Integration, and Conviction

Today’s crypto landscape reflects a deeply transformative moment: policy frameworks are forming, stablecoins loom as systemic alternatives to bank deposits, merchant adoption is growing, and institutional engagement is expanding beyond headline speculation.

Market volatility — with Bitcoin trading below $88,000 — is not a sign of decay, but rather a reflection of digital assets grappling with macroeconomic adjustment, regulatory signal interpretation, and evolving investor expectations.

For market participants — from retail holders to Wall Street funds — the challenge will be to balance innovation with compliance, adoption with risk management, and conviction with macro realism.

In this environment, the winners will be those who understand that crypto’s future is not only about price charts, but about integration into real economic and financial systems — a phase that appears to have truly begun in 2026.