(HedgeCo.Net) In 2026, activist investing is back in force — and few firms embody that resurgence more clearly than Elliott Management. After several years in which activism was constrained by elevated equity valuations, abundant liquidity, and accommodative capital markets, today’s environment has re-opened the door for aggressive shareholder engagement.

Rising interest rates, tighter financing conditions, and uneven equity performance have exposed inefficiencies across corporate America — exactly the conditions in which Elliott historically thrives.

Activism Re-Emerges as a Core Strategy:

During the 2020–2022 bull market, activist campaigns often struggled to gain traction. Management teams could point to rising share prices as validation of strategy, while cheap capital allowed underperforming businesses to mask operational weaknesses.

That insulation is gone.

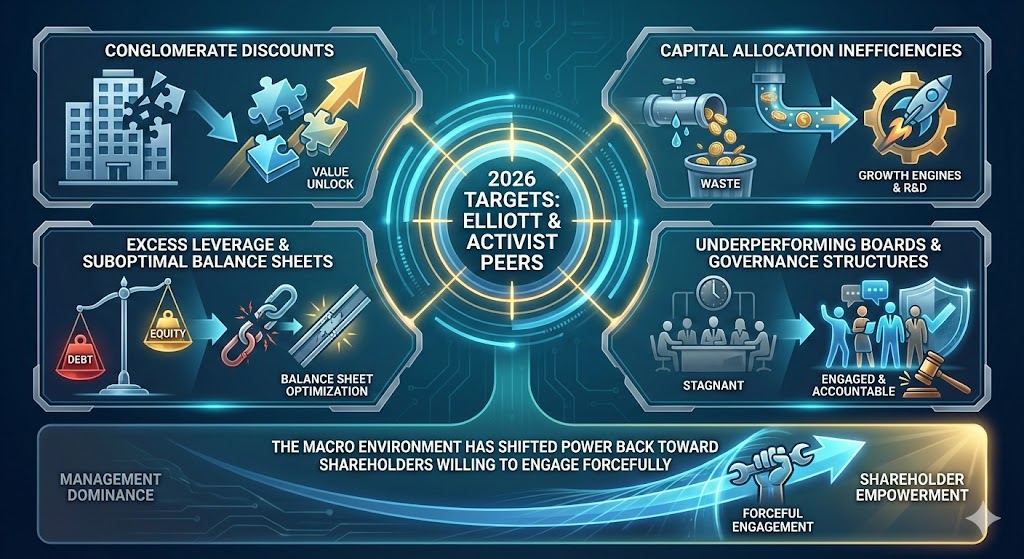

In 2026, Elliott and its activist peers are targeting:

- Conglomerate discounts

- Capital allocation inefficiencies

- Excess leverage and suboptimal balance sheets

- Underperforming boards and governance structures

The macro environment has shifted power back toward shareholders willing to engage forcefully.

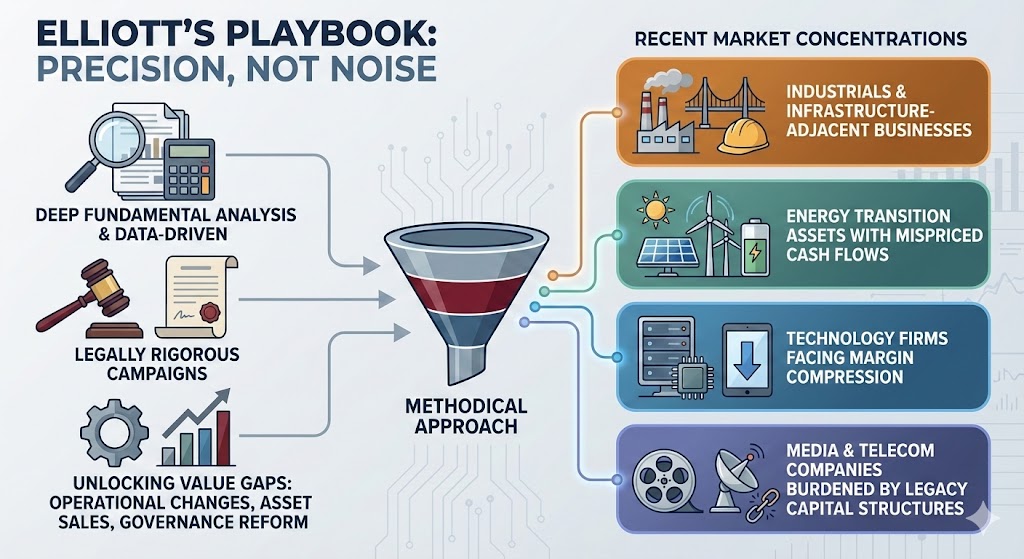

Elliott’s Playbook: Precision, Not Noise:

Unlike more public-facing activists, Elliott’s campaigns tend to be methodical, data-driven, and legally rigorous. The firm focuses on deep fundamental analysis, identifying value gaps that can be unlocked through operational changes, asset sales, or governance reform.

Recent market chatter suggests Elliott is concentrating on:

- Industrials and infrastructure-adjacent businesses

- Energy transition assets with mispriced cash flows

- Technology firms facing margin compression

- Media and telecom companies burdened by legacy capital structures

Elliott’s influence often extends beyond individual campaigns. The firm’s involvement alone can catalyze strategic reviews, leadership changes, or asset divestitures — even before public confrontation.

Why Activism Works Again

Several structural forces are converging in activists’ favor:

- Higher cost of capital forces discipline

- Equity dispersion creates valuation gaps

- Debt refinancing risk pressures management teams

- Shareholder fatigue with stagnant returns

In this environment, activists are increasingly viewed not as disruptors, but as capital allocators of last resort — stepping in where boards have failed to adapt.

Implications for Allocators

For institutional investors, activist hedge funds offer differentiated return streams that are less correlated with traditional market beta. Elliott’s campaigns are idiosyncratic, event-driven, and often resilient during broader equity drawdowns.

In 2026, activism is no longer a niche allocation. It is once again a core hedge fund strategy.