(HEedgeCo.Net) The alternative investment industry has reached a defining moment. For decades, private equity, private credit, and other alternative strategies were designed almost exclusively for institutional investors—pension funds, sovereign wealth funds, endowments, and ultra-high-net-worth individuals. Illiquidity, complexity, and regulatory constraints formed a high barrier to entry. In 2026, that wall is beginning to crack.

In a landmark move, Blackstone, Apollo Global Management, and Ares Management have partnered with OneDigital to introduce private market exposure into professionally managed 401(k) portfolios.

This is not a marketing experiment. It is a strategic statement: the largest alternative asset managers in the world now believe private markets are mature enough, scalable enough, and defensible enough to sit inside the core of U.S. retirement infrastructure.

A Structural Shift in Capital Access

Defined contribution plans represent one of the largest and most stable pools of capital globally. U.S. 401(k) assets alone exceed $8 trillion, yet allocations have historically been confined to public equities, fixed income, and target-date funds.

For years, alternative firms watched from the sidelines. Liquidity constraints, valuation mechanics, and fiduciary risk made retirement plans a difficult fit. What changed is not just regulatory interpretation—it is confidence that long-duration capital and private markets are structurally aligned.

Private assets are designed to be held through cycles. Retirement capital, by definition, is patient. The alignment was always there; the infrastructure was not.

How the Structure Works:

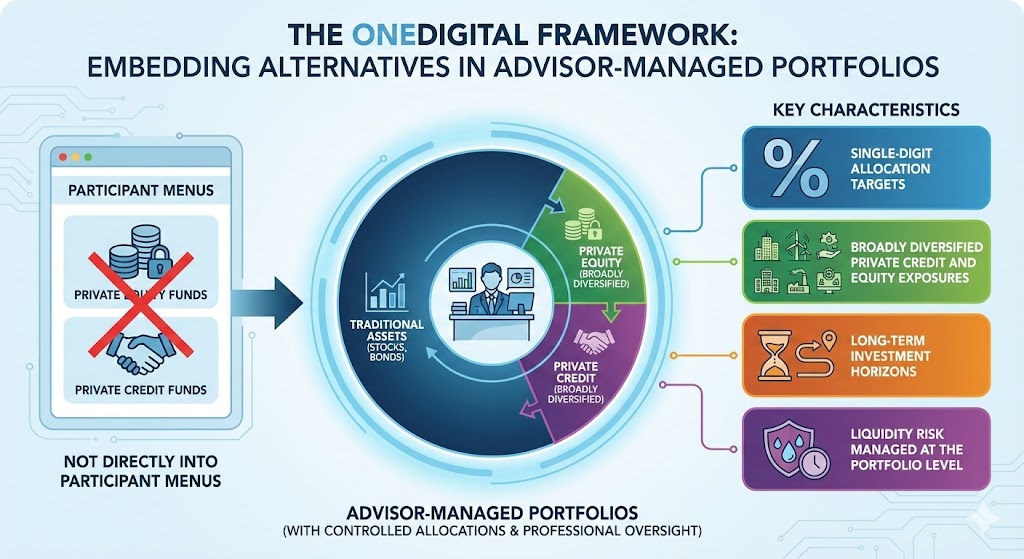

The OneDigital framework does not place private equity or private credit funds directly into participant menus. Instead, alternatives are embedded inside advisor-managed portfolios, with controlled allocations and professional oversight.

Key characteristics:

- Single-digit allocation targets

- Broadly diversified private credit and equity exposures

- Long-term investment horizons

- Liquidity risk managed at the portfolio level

This design shifts decision-making away from individual participants and toward fiduciary-guided portfolio construction—critical for regulatory acceptance.

Why These Firms Are Leading

Blackstone brings unmatched scale and experience in regulated vehicles, semi-liquid funds, and insurance-linked strategies. With over $1 trillion in AUM, the firm has repeatedly signaled that future growth depends on broader distribution, not just institutional capital.

Apollo approaches the opportunity through a credit-first lens. Its expertise in yield-oriented, asset-backed, and long-duration strategies aligns naturally with retirement objectives—particularly income stability.

Ares is widely considered the architect of modern private credit. Its underwriting discipline and senior-secured positioning make its strategies attractive candidates for cautious integration into retirement portfolios.

Private Credit Takes Center Stage

While buyouts capture headlines, private credit is likely the real beneficiary of this shift. Floating-rate exposure, contractual income, and senior positioning offer characteristics that traditional fixed income has struggled to deliver post-2022.

For retirement portfolios navigating volatility and inflation risk, private credit offers a middle ground between public bonds and equities.

Risks and Fiduciary Scrutiny

Critics raise legitimate concerns: liquidity mismatches, valuation opacity, fees, and complexity. Regulators will closely monitor how these portfolios behave during market stress, particularly during periods of elevated withdrawals.

Proponents counter that long-term capital, modest allocations, and professional oversight mitigate these risks—and that ignoring private markets may itself become a fiduciary risk.

Why This Matters for the Industry

If even a small portion of defined contribution assets flows into private markets, the implications for fundraising, deal activity, and asset growth are enormous. Capturing just 5% of DC assets would translate into hundreds of billions in new capital.

This is not the end of institutional dominance—but it is the beginning of a much larger addressable market.

Conclusion

The move by Blackstone, Apollo, and Ares into 401(k) portfolios marks a historic inflection point. It signals confidence in private markets as a permanent feature of diversified portfolios and opens a new growth chapter for alternative asset managers.

The walls separating institutional capital from everyday retirement savings are no longer theoretical—they are coming down in real time.