(HedgeCo.Net) At the World Economic Forum in Davos this month, Ken Griffin emphasized that bond markets are signaling deep concerns about fiscal policy and sovereign debt risks — particularly in the United States.

According to Griffin, the recent Japanese bond-market sell-off — where long-dated yields spiked sharply — should be viewed as an explicit warning for U.S. policymakers to address fiscal imbalances and deficit spending before markets demand a price. He said that “bond vigilantes” — investors who sell government debt to pressure fiscal policy — may emerge as a force in the United States if fiscal discipline erodes further, with potentially far-reaching consequences for markets and government borrowing costs.

This view underscores Griffin’s belief that macro fundamentals matter for asset prices — including alternative investments — and that fiscal policy isn’t just a political topic but a market risk driver.

2. Inflation, Gold & Alternative Hedges

Griffin has also discussed inflationary pressures and investor behavior in 2026. He has articulated concern that persistent inflation, combined with heightened geopolitical and fiscal uncertainty, is prompting investors to allocate to non-traditional safe havens such as gold and even crypto assets.

He commented that gold’s record rally and the “unbelievable” performance of cryptocurrencies may reflect a broader search for hedges against U.S. risk — with investors treating these assets as alternatives to traditional dollar-denominated plays.

This suggests Griffin sees alternative assets not just as return generators, but as macro hedges when confidence in traditional fiat currency and fixed-income markets is under pressure.

3. Geopolitical Risk & Trade Policy

Beyond macro and financial markets, Griffin has been vocal about geopolitics. At Davos, he characterized strains in U.S.–Europe relations — driven by tariff policy and broader trade friction — as concerning for global economic stability and investor confidence. He argued that uncertainty around tariffs disrupts long-term capital allocation decisions and can have inflationary consequences.

That commentary feeds directly into how hedge funds and alternative investors think about risk premia: macro, geopolitical, and policy risks are increasingly part of asset valuation models.

4. AI: A Long-Term Opportunity — But Cautious About Near-Term Hype

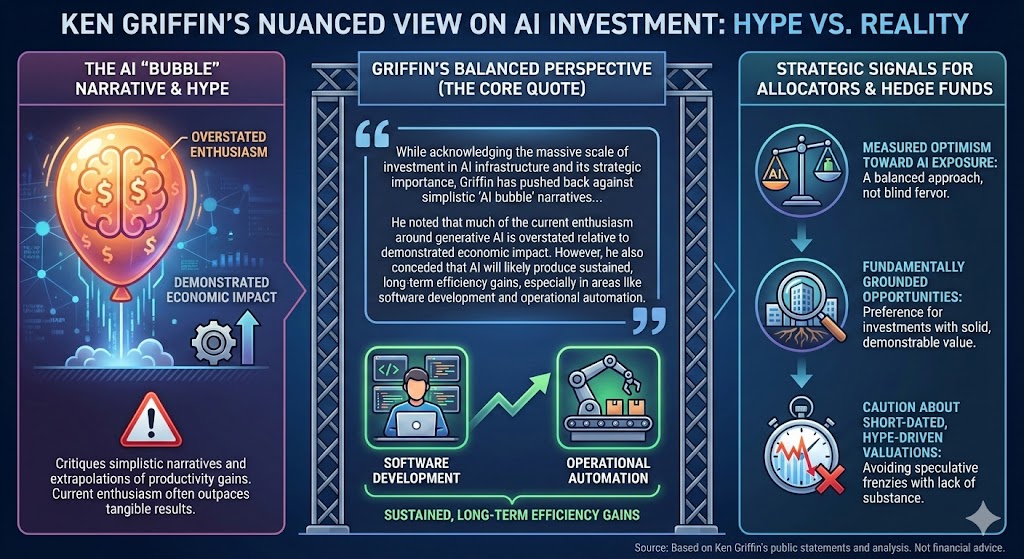

Griffin’s stance on artificial intelligence — which is a central theme across alternative investment theses in 2026 — is nuanced.

While acknowledging the massive scale of investment in AI infrastructure and its strategic importance, Griffin has pushed back against simplistic “AI bubble” narratives and hype-driven extrapolations of productivity gains. He noted that much of the current enthusiasm around generative AI is overstated relative to demonstrated economic impact. However, he also conceded that AI will likely produce sustained, long-term efficiency gains, especially in areas like software development and operational automation.

For allocators and hedge fund strategists, this signals:

- Measured optimism toward AI exposure

- Preference for fundamentally grounded opportunities

- Caution about short-dated, hype-driven valuations

5. Monetary Policy & Central Bank Independence

Griffin has also stressed the importance of preserving the independence of central banks — particularly the Federal Reserve — as a cornerstone for long-term market stability. He has argued that political interference with monetary policy risks undermining confidence in the asset pricing environment and capital formation, which matters for both traditional and alternative investments.

This reflects a broader concern: stable monetary policy frameworks help alternative strategies thrive by reducing unintended risk shocks and improving signal clarity for risk-adjusted returns.

Implications for Alternative Investments in 2026

While Griffin’s comments haven’t focused explicitly on detailed allocation strategies across private equity, private credit, or infrastructure, his public remarks embody several high-level themes that shape alternative investment positioning:

? Macro Risk & Hedge Fund Opportunity Sets

- Griffin’s voice reinforces the idea that hedge funds and alternative managers should internalize macro fundamentals — including sovereign risk, inflation dynamics, and geopolitical policy — in their models.

- Bond markets are not just interest rate indicators but risk signals that can influence asset allocation and hedging strategies.

? Alternative Assets as Risk Diversifiers

- Gold, cryptocurrencies, and other real assets may serve as alternative hedges in environments where traditional safe havens are deteriorating.

- Griffin’s comments suggest that allocators are likely to treat alternative assets both as hedges and alpha engines depending on macro context.

? AI & Innovation Exposure with Disciplined Valuation

- Griffin’s skepticism toward near-term AI productivity claims but acceptance of its long-term potential points to a disciplined approach toward innovation exposure — favoring fundamental value and cash flow prospects over narrative-driven capital flows.

? Policy & Structural Risk Awareness

- Hedge funds and alternative investors increasingly incorporate policy risk into scenario models.

- Griffin’s critiques of fiscal, regulatory, and trade policy indicate that macro policy is a core risk factor in asset pricing that influences alternative strategies.