(HedgeCo.Net) If macro defines the risk environment of 2026, multi-strategy hedge funds define its execution. At the top of that hierarchy sit Citadel and Millennium Management — two firms that have become essential allocations for institutional investors seeking consistent, risk-adjusted returns.

Their dominance is no accident. It is the result of a deliberate evolution in how hedge funds in 2026 are built, managed, and scaled.

The Rise of the Hedge Fund “Platform”

Citadel and Millennium no longer resemble traditional hedge funds. They operate as capital allocation platforms, deploying hundreds of independent teams across asset classes under centralized risk control.

This model offers three decisive advantages:

- Rapid adaptation to market conditions

- Tight control of downside risk

- Continuous internal competition for capital

In volatile, fast-changing markets, that structure is extraordinarily effective.

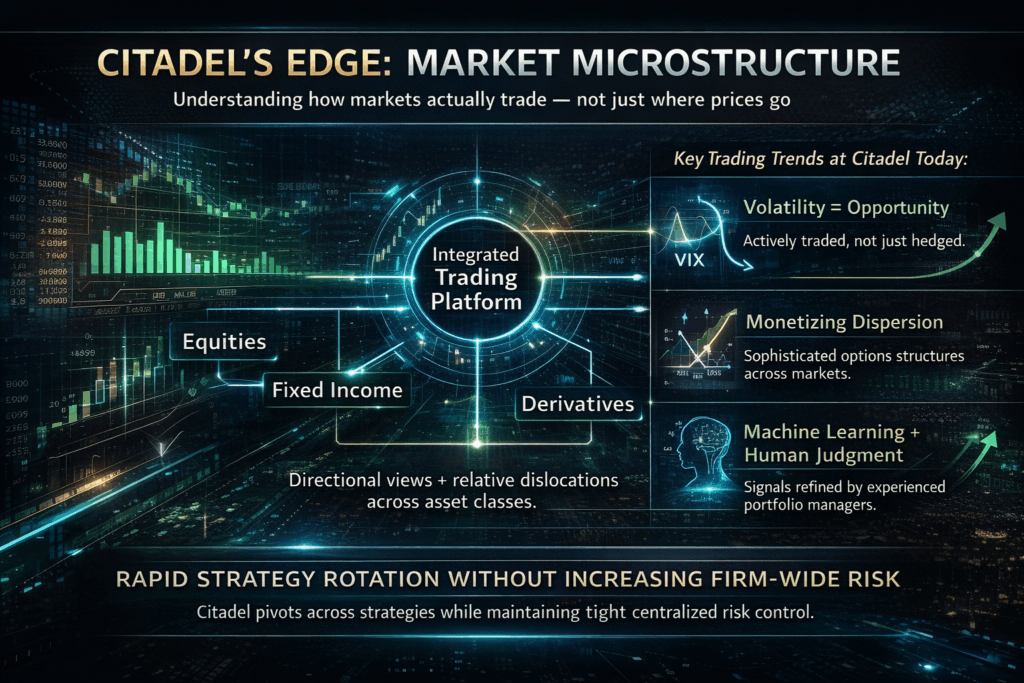

Citadel: Liquidity, Data, and Market Structure

Citadel’s edge lies in its understanding of market microstructure. With deep involvement across equities, fixed income, FX, and derivatives, the firm profits from both directional views and relative dislocations.

Key trends at Citadel today include:

- Increased use of volatility as a trading instrument

- Sophisticated options structures to monetize dispersion

- Integration of machine-learning signals with human judgment

Citadel’s ability to pivot across strategies without increasing firm-wide risk makes it uniquely resilient during regime shifts.

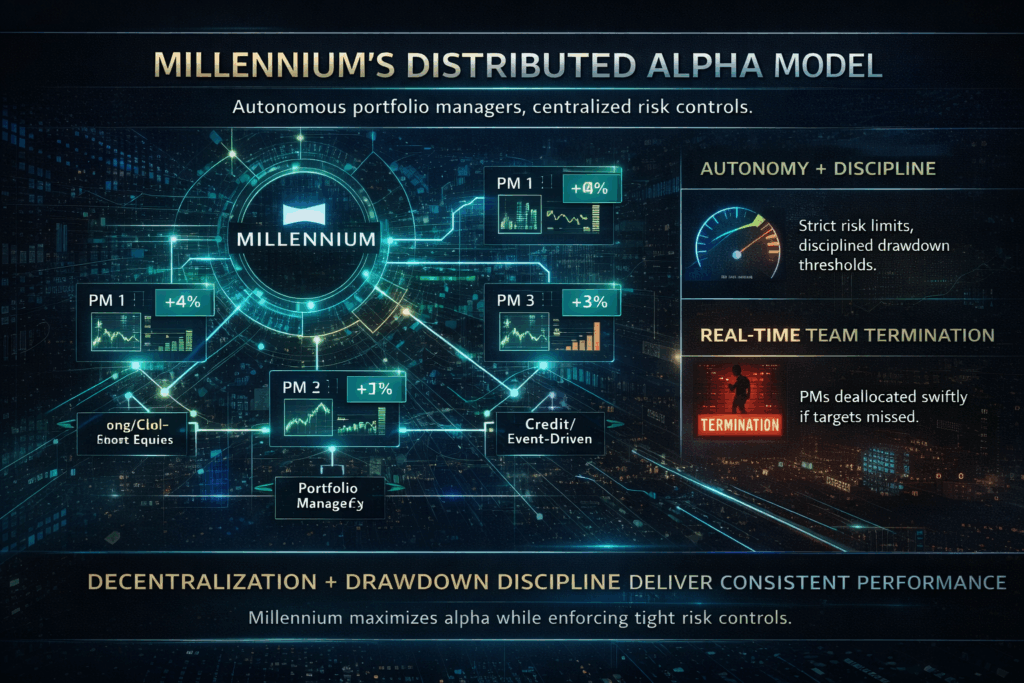

Millennium’s Distributed Alpha Model

Millennium’s model emphasizes decentralization. Portfolio managers operate with autonomy — but within strict drawdown and risk limits.

This creates:

- Thousands of independent alpha decisions

- Minimal reliance on any single strategy

- Rapid termination of underperforming teams

In 2026, this structure is attracting record allocator interest, particularly from pensions and endowments seeking low-volatility hedge fund exposure.

Why Allocators Are Concentrating Capital

Institutional investors are increasingly consolidating hedge fund allocations. Rather than spreading capital across dozens of niche managers, they are favoring:

- Fewer relationships

- Larger, more stable platforms

- Firms with robust infrastructure

Citadel and Millennium check all those boxes.

The Broader Implication

The success of multi-strategy giants is reshaping the hedge fund industry:

- Smaller single-strategy funds face pressure

- Risk management is becoming centralized

- Technology and data budgets are exploding

This is a scale game now — and the largest platforms are pulling away.

Conclusion

In 2026, hedge fund success is less about predicting markets and more about engineering portfolios that survive them.

Citadel and Millennium have mastered that engineering — and in doing so, they are redefining what it means to be a hedge fund.