(HedgeCo.Net) KKR’s narrative in early 2026 is about breadth: the firm is no longer simply a buyout house—it’s a multi-asset alternatives platform pushing deeper into private credit, infrastructure, and wealth distribution. Recent fundraising and distribution initiatives show KKR trying to win in the two arenas that define mega-manager power: (1) scalable capital formation and (2) repeatable deployment.

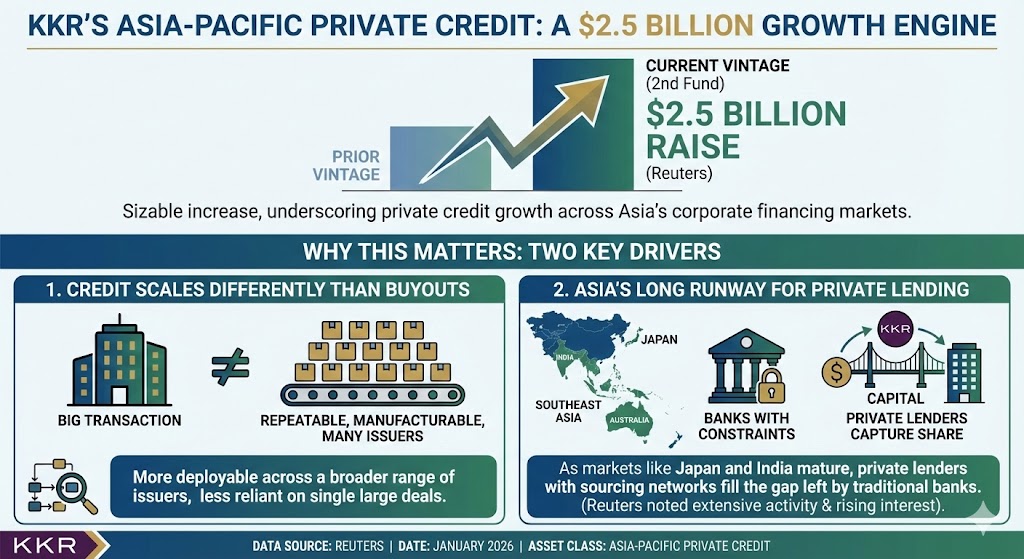

KKR recently completed a $2.5 billion raise for its second Asia-Pacific private credit strategy, according to Reuters—marking a sizable increase from its prior vintage and underscoring that private credit remains a growth engine not just in the U.S. and Europe, but increasingly across Asia’s corporate financing markets.

Why this matters:

- Credit scales differently than buyouts. It’s more repeatable, often more “manufacturable,” and can be deployed across many issuers rather than a few big transactions.

- Asia is a long runway. As banks manage constraints and markets mature (notably in Japan and India), private lenders with sourcing networks can capture share. Reuters noted KKR’s extensive investment activity in the region and rising investor interest.

This fundraise also fits a broader theme: mega-managers are building region-specific credit platforms that can originate locally while distributing globally.

Distribution: Citi partnerships and the private-wealth push

A second “today” signal is distribution. Reporting indicates Citi has tapped alternative managers including KKR and Blackstone to launch evergreen private markets funds aimed at high-net-worth channels in Asia and the Middle East. That’s a meaningful development because it reflects how private markets access is being “productized” for wealth clients beyond the U.S.

If 2010–2020 was the era of institutional alts dominance, 2024–2028 increasingly looks like the era of institutional + private wealth scale. Semi-liquid structures, evergreen funds, and simplified subscription workflows are becoming competitive weapons.

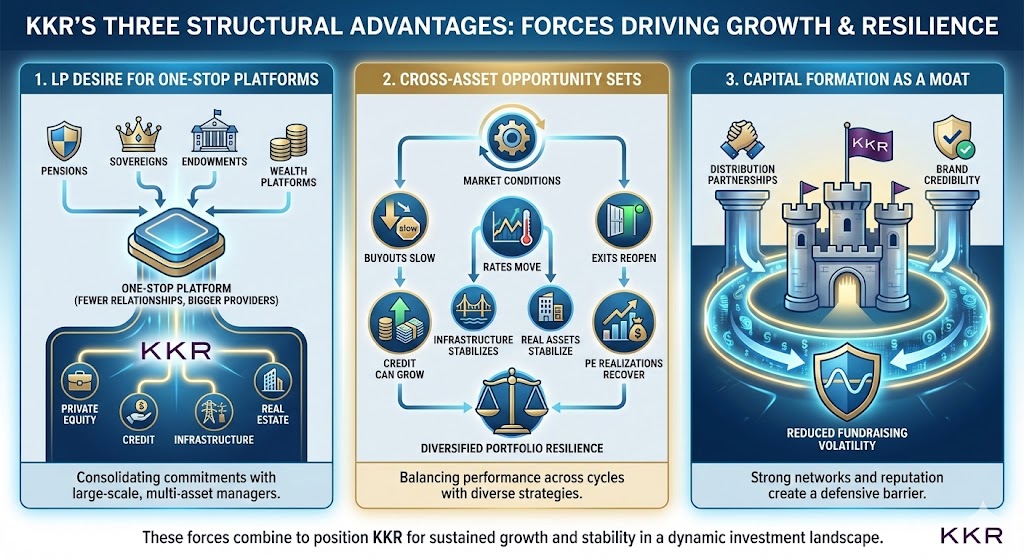

Platform breadth: why KKR’s model is built for this moment

- LP desire for one-stop platforms. Pensions, sovereigns, endowments, and increasingly wealth platforms want fewer relationships with bigger providers.

- Cross-asset opportunity sets. When buyouts slow, credit can grow; when rates move, infrastructure and real assets can stabilize; when exits reopen, private equity realizations recover.

- Capital formation as a moat. Distribution partnerships and brand credibility reduce fundraising volatility.

Industry commentary and manager communications often emphasize AUM scale and diversification as competitive edges. Even within HedgeCo’s own sector coverage, KKR has been described as reaching major AUM milestones and evolving into a broad “alternatives powerhouse.”

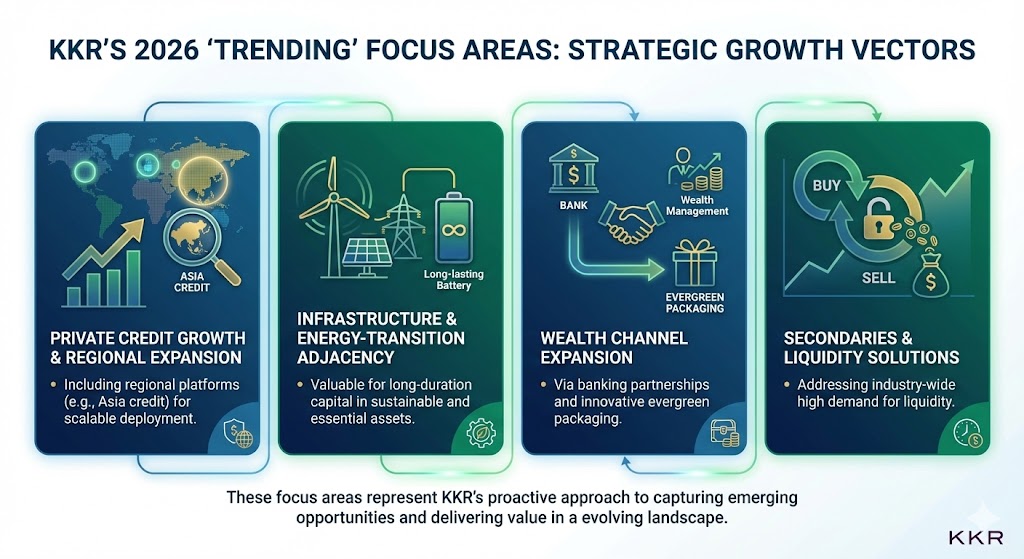

2026 playbook: where KKR is likely leaning in

Based on current signals, KKR’s 2026 “trending” focus areas look like:

- Private credit growth (including regional platforms such as Asia credit)

- Infrastructure and energy-transition adjacency (where long-duration capital is valuable)

- Wealth channel expansion via banking partnerships and evergreen packaging

- Secondaries and liquidity solutions (industry-wide demand remains high)

What to watch: the “exits and fees” test

As always, the big question for any alternative platform is: can it convert AUM into sustainable fee-related earnings while also producing realizations that keep LPs happy?

Watch for:

- Realizations pace if public markets remain supportive and M&A continues to recover

- Credit performance as refinancing needs rise

- Product structure discipline in evergreen vehicles (liquidity management and valuation practices)

KKR’s advantage is that it can win even in a mixed environment—so long as it keeps fundraising diversified and deployment disciplined.