(HedgeCo.Net) For much of the past decade, hedge funds lived under a persistent cloud of skepticism. After the global financial crisis, accommodative monetary policy, low volatility, and relentless equity-market gains made it increasingly difficult for active managers to outperform cheap, passive alternatives. Fee pressure mounted, assets flowed out, and the term “alpha winter” entered the industry’s vocabulary—a shorthand for years in which skill appeared dormant and returns struggled to justify complexity.

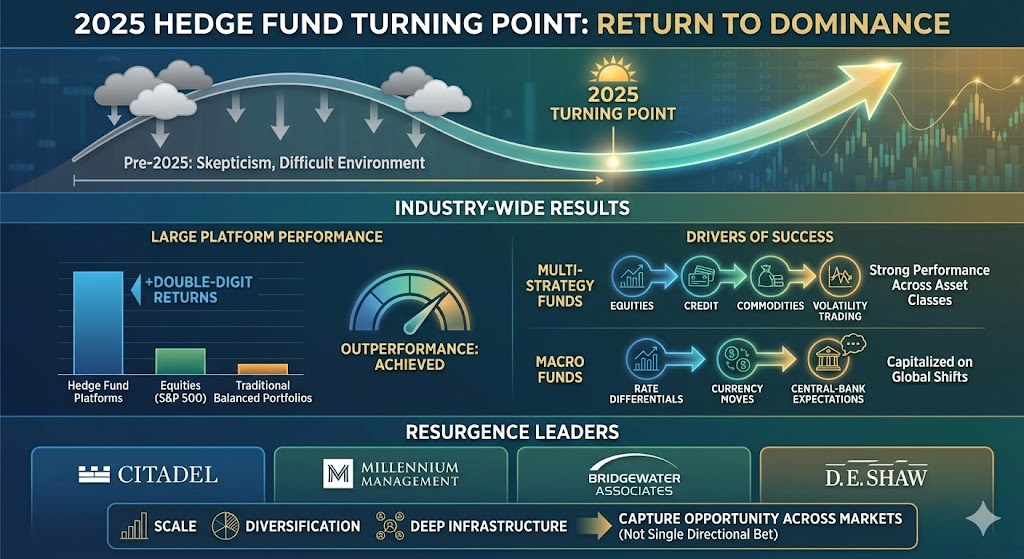

In 2025, that narrative decisively changed. Hedge funds, particularly large multi-strategy and macro-oriented firms, delivered their strongest collective performance in more than a decade. Entering 2026, allocators are once again asking a question that had faded from prominence: How much hedge fund exposure is enough?

The answer is still evolving, but one thing is clear—hedge funds are back on top, and the conditions that fueled their resurgence may prove more durable than many expect.

The End of the Alpha Winter

The “alpha winter” was not caused by a lack of talent. It was structural.

From roughly 2010 through 2021, global markets were dominated by a narrow set of forces: falling interest rates, massive central-bank liquidity, and steadily rising equity multiples. Dispersion was low, volatility was suppressed, and correlations across assets were unusually high. In such an environment, stock-picking skill and macro insight mattered less than simply being long beta.

Hedge funds—designed to exploit inefficiencies, relative mispricings, and regime shifts—were effectively starved of opportunity. Even sophisticated strategies struggled to differentiate themselves when fundamentals were overwhelmed by liquidity.

That regime has now broken.

Higher interest rates, persistent inflation risk, geopolitical fragmentation, and uneven economic growth have restored dispersion across asset classes, sectors, and regions. Volatility has returned—not as a one-off shock, but as a structural feature of markets. And dispersion, not direction, is where hedge funds thrive.

A Breakout Year for Performance:

Industry-wide results in 2025 marked a clear turning point. Large hedge fund platforms posted double-digit returns, often outperforming both equities and traditional balanced portfolios. Multi-strategy funds benefited from strong performance across equities, credit, commodities, and volatility trading. Macro funds capitalized on rate differentials, currency moves, and shifting central-bank expectations.

Firms such as Citadel, Millennium Management, Bridgewater Associates, and D. E. Shaw exemplified the resurgence. Their scale, diversification, and deep infrastructure allowed them to capture opportunity across markets rather than rely on a single directional bet.

Importantly, these gains were not driven by leverage alone. While leverage has increased across the industry, returns were primarily generated through tactical positioning, relative-value trades, volatility strategies, and disciplined risk management—hallmarks of skilled active management.

Why This Cycle Looks Different

Skeptics may argue that hedge funds have enjoyed brief periods of success before, only to fade again. But several structural changes suggest this resurgence may be more enduring.

1. A Higher-Volatility World

Volatility is no longer episodic—it is structural. Inflation uncertainty, shifting fiscal policy, and geopolitical realignment have made sudden repricing events more common. For hedge funds, volatility is not a risk to avoid but a raw material to monetize.

2. Greater Cross-Asset Dispersion

Equity markets are no longer moving in lockstep. Sector leadership rotates quickly, regional growth diverges, and capital flows are increasingly selective. Credit markets, meanwhile, show growing differentiation between strong and weak borrowers. Dispersion creates opportunity for long/short equity, relative-value credit, and macro strategies alike.

3. The Return of Rates as a Signal

For years, near-zero interest rates dulled one of the most powerful signals in financial markets. With rates now meaningful again, yield curves, real rates, and carry trades have re-emerged as drivers of returns—particularly for macro and fixed-income hedge funds.

Multi-Strategy Platforms Take the Lead:

One of the defining features of the post-alpha-winter era is the dominance of large, diversified hedge fund platforms.

Multi-strategy firms allocate capital dynamically across dozens or even hundreds of independent teams. This structure allows them to harvest uncorrelated sources of alpha while tightly controlling downside risk. When equity strategies struggle, credit or macro may thrive. When volatility spikes, options desks step in.

This diversification has proven especially valuable in choppy, regime-shifting markets. Rather than making a single macro call, multi-strategy funds can express views through relative-value trades, market-neutral positioning, and short-duration opportunities.

As a result, allocators increasingly view these platforms less as “hedge funds” in the traditional sense and more as alternative alpha utilities—providers of consistent, risk-adjusted returns across cycles.

Macro Makes a Comeback

If multi-strategy funds represent breadth, macro hedge funds represent conviction.

After years of underperformance, macro strategies reasserted themselves as rates, currencies, and commodities became more volatile and policy-driven. Central banks no longer move in unison. Growth trajectories diverge across regions. Energy and commodity markets are shaped as much by geopolitics as by supply and demand.

In this environment, macro managers can once again express high-conviction views on inflation paths, yield curves, currency regimes, and cross-border capital flows. For institutional investors seeking diversification from equity risk, macro hedge funds have regained their appeal as portfolio stabilizers.

Quant Strategies: Lessons Learned, Models Evolving

Quantitative hedge funds played a complex role in the alpha winter. While some struggled with crowded trades and low signal efficacy, the current environment is pushing quant models to evolve.

Rather than relying solely on historical correlations, modern quant strategies increasingly incorporate regime awareness, alternative data, and adaptive risk controls. The result is a new generation of systematic approaches better equipped for non-linear markets.

Importantly, the recent challenges faced by some quant funds have reinforced the value of diversification—both within quant strategies and across discretionary and systematic approaches.

Capital Is Flowing Back

Performance changes behavior, and allocators are responding.

After years of muted flows, hedge funds are once again attracting institutional capital. Pension funds, endowments, and sovereign wealth funds—many of which reduced hedge fund exposure during the alpha winter—are reassessing their allocations. The logic is straightforward: in a world of higher uncertainty, diversification and downside protection matter again.

At the same time, wealth channels are opening new avenues for hedge fund access. While still tightly regulated, structured and semi-liquid vehicles are gradually expanding the investor base beyond traditional institutions.

Risks Remain—and Discipline Still Matters

Despite the renewed enthusiasm, hedge funds are not immune to risk.

Leverage levels have risen, increasing sensitivity to sudden market shocks. Crowding remains a concern in popular trades. And regulatory scrutiny—particularly around leverage, liquidity, and transparency—is likely to intensify as hedge funds regain prominence.

The firms that succeed in this new era will be those that resist complacency. Alpha is cyclical, and markets will inevitably evolve again. Discipline, diversification, and risk management remain non-negotiable.

A Structural Re-Rating of Hedge Funds

The return of hedge fund outperformance is more than a cyclical rebound—it represents a structural re-rating of active management in a more complex world.

Passive strategies excel in stable, trending markets. Hedge funds excel in uncertain, fragmented ones. The past few years have made it clear which environment investors now inhabit.

After a long alpha winter, hedge funds are once again doing what they were designed to do: exploit inefficiency, manage risk dynamically, and deliver differentiated returns when markets become harder to navigate.