(HedgeCo.Net) J.P. Morgan Asset Management has released its eighth annual Global Alternatives Outlook, a 12–18 month forward view across major alternative asset classes—real estate, infrastructure, transportation, timberland, hedge funds, private equity, and private credit—framing 2026 as a year when private markets are no longer a portfolio “satellite,” but a structural pillar of global finance.

The central message is clear: the next phase of the AI boom is not only a technology story—it’s a capital expenditure story. As AI-driven buildouts accelerate, investors are entering a cycle defined by power demand, industrial reshoring, supply-chain reconfiguration, and large-scale infrastructure upgrades. That environment, J.P. Morgan argues, strengthens the case for alternatives as both return engines and portfolio diversifiers, especially as traditional diversification has become less reliable.

A new era of “public-private convergence”

J.P. Morgan’s Outlook positions 2026 at a pivotal moment in which public and private markets are increasingly converging, while many leading companies stay private longer. The firm notes that private markets have expanded dramatically in size—estimated at nearly $20 trillion, a step-change from a decade ago—creating deeper opportunity sets across strategies and vintages.

In the press release accompanying the Outlook, Jed Laskowitz, Global Head of Private Markets, emphasizes the breadth of opportunity as private markets deepen: investors, he says, now have a large and diverse toolkit to build more resilient portfolios, supported by J.P. Morgan’s multi-decade investing footprint. Anton Pil, Global Head of Alternatives Solutions, adds a macro framing: as hyper-globalization fades, AI investment accelerates, and stock-bond correlations trend upward, private markets and real assets can play a bigger role in diversification—while private equity and private credit can provide access to the drivers of structural change.

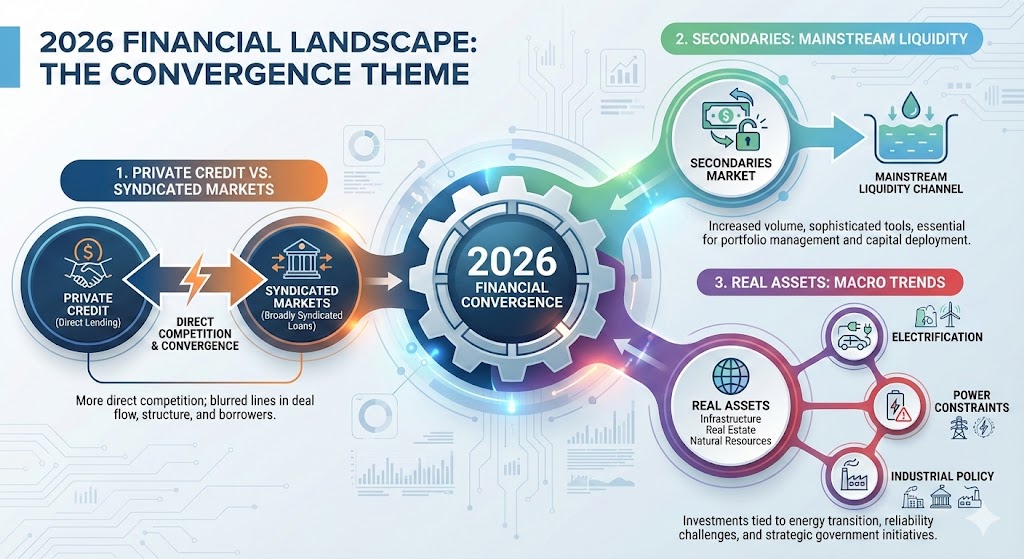

That “convergence” theme is particularly important for 2026. In practice, it shows up in:

- private credit competing more directly with syndicated markets,

- secondaries becoming a mainstream liquidity channel, and

- real assets increasingly tied to electrification, power constraints, and industrial policy.

Real estate: recovery, but led by quality—and powered industrial demand

On real estate, J.P. Morgan argues a durable global commercial real estate recovery is underway heading into 2026, with high-quality assets leading performance. The report highlights a normalization dynamic: for much of the past few years, real estate capital stacks were inverted—often offering higher yields in debt than equity for the same asset—reflecting dislocated capital markets. The Outlook expects that inversion to unwind as rates normalize, improving transaction activity and supporting a more typical relationship between cap rates and debt costs.

The firm also stresses that nationalism and reshoring are reshaping industrial geography, while power availabilityhas become central to site selection—an “AI meets infrastructure” point that ties real estate back to the capex cycle. The press release underscores rising demand for high-powered industrial space and highlights continued strength in structurally undersupplied residential markets, including single-family rentals and attainable multifamily.

The key investment implication for 2026: the opportunity is not “real estate broadly,” but quality-first real estatealigned with modern constraints—power, logistics, premium office locations, and housing undersupply.

Infrastructure: the inflection point is energy—especially power utilities

Infrastructure is where the AI boom most directly becomes investable. J.P. Morgan’s Outlook frames core infrastructure at an inflection point, with capital expenditure projected to materially outpace depreciation for the first time this century, driven by energy demand, energy security, and the energy transition.

The press release highlights power utilities as a focal point, arguing that vertically integrated utilities may be best positioned to capture near-term upside while maintaining defensive characteristics. This is a critical signal: AI-driven data center buildouts, electrification, and grid modernization pull infrastructure returns away from purely “bond-like” defensiveness and toward a hybrid profile—durable cash flows with visible growth capex.

For allocators, 2026 may be less about asking “Do we own infrastructure?” and more about “Do we own the parts of infrastructure tied to power constraints and grid investment?”

Transportation: replacement cycles, constrained supply, and modern asset scarcity

In transportation, the Outlook emphasizes what many leasing and real-asset investors are watching: an unusually strong asset replacement cycle as aging global fleets meet evolving trade patterns. The press release points to high demand for modern, energy-efficient assets and notes that supply is constrained by limited manufacturing capacity and costly production—creating a favorable supply-demand balance for lessors.

The takeaway is that transportation is being reframed as a real asset strategy linked to:

- modernization (efficiency standards and energy costs),

- supply constraints (manufacturing bottlenecks), and

- durability of global consumption and trade needs.

Hedge funds: higher dispersion and volatility revive opportunity for tacticians

J.P. Morgan’s 2026 view on hedge funds aligns with what allocators have been leaning into: higher rates, elevated volatility, and rising equity dispersion create a market built for stock-pickers and tacticians. The Outlook specifically calls out managers focused on relative value, statistical arbitrage, and targeted long/short and event-driven strategies as finding renewed opportunity.

Inside the report, J.P. Morgan notes that rising dispersion and declining correlations can create fertile ground for alpha—particularly in macro and relative value—while policy-driven volatility and pricing dislocations can generate tradeable opportunities.

In practical portfolio terms, this supports a 2026 hedge fund posture that is:

- diversified across strategy types,

- designed to monetize single-stock volatility and dispersion,

- balanced between macro/reactive and relative-value/structural alpha.

Private equity: a more balanced 2026, with liquidity and innovation back on the table

For private equity, the Outlook highlights historical alpha and points to 2026 as a more fertile environment as the post-pandemic reset gives way to improving deal conditions. The report notes that private equity has outperformed public equity over the past decade in a diversified global buyout index by about 500 basis points per year. It also argues that by late 2025, key constraints were easing—rates coming down, sellers adjusting price expectations, and the exit environment improving—setting up 2026 for stronger deal momentum.

One of the most important structural points: secondaries are becoming a core feature of the private equity ecosystem, not just a niche. The report cites secondary activity scaling materially—after multiple years above $100B, reaching $160B in 2024 and tracking to exceed $200B in 2025. For LPs, that implies more tools to manage pacing, rebalance exposures, and generate liquidity without waiting solely on IPO/M&A windows.

Private credit: still attractive—but discipline matters as spreads compress

Private credit remains a pillar theme, but with an important nuance: opportunity persists, while selectivity becomes more valuable. In the report’s macro framing, J.P. Morgan says private credit continues to offer a premium versus public credit, with senior-secured U.S. direct lending described as particularly attractive—offering yields roughly 200 bps above leveraged loans and ~300 bps above U.S. high yield (at the time of the report’s data).

At the same time, the report acknowledges stress signals and renewed scrutiny—referencing borrower defaults in late 2025 that refocused attention on credit quality and pricing, while suggesting those events appeared more issuer-specific than systemic. It also notes spread compression pressures and intensifying competition, arguing that investment discipline, selectivity, and relative value will be essential through the cycle.

The report cites private credit’s growth trajectory—$1.7T global AUM at the start of 2025, projected to $3.5T by 2029 (citing Preqin). That scale is exactly why manager differentiation and underwriting rigor matter more in 2026 than in the earlier, less crowded phases of the market.

What this means for allocators in 2026: three portfolio-level conclusions

Across asset classes, J.P. Morgan’s Outlook is essentially a playbook for building alternatives exposure around structural change—especially the AI capex cycle and a shifting macro regime.

1) Think in systems, not silos. AI demand pulls through power grids, industrial real estate, transportation modernization, and infrastructure capex. The most durable opportunities are where these systems bottleneck (power, supply chains, modern fleets).

2) Diversification is being redefined. If stock/bond diversification is less dependable, “diversification” increasingly means pairing real assets and private markets with liquid diversifiers like hedge funds positioned for dispersion and volatility.

3) Liquidity and underwriting discipline are now core alpha inputs. Secondaries and private credit selectivity aren’t side topics—they are central to how portfolios manage pacing, risk, and return durability in a maturing private markets ecosystem.

J.P. Morgan Asset Management frames this Outlook from a position of scale—citing an alternatives platform of over $600 billion and firmwide AUM of $4 trillion (as of Sept. 30, 2025). But the bigger point for the industry is not the headline numbers—it’s the regime shift: private markets are becoming the main arena where long-duration structural themes get financed, and 2026 is shaping up as a year when that reality becomes even more visible in portfolio construction.

If you want, I can format this into a HedgeCo.Net / HedgeCo Ventures publication style with: (1) a tighter headline + deck, (2) a “Key Takeaways” box, and (3) a (READ MORE) link placeholder for your newsletter template.