(HedgeCo.Net) Quant hedge funds sell a simple promise: rules over emotion, diversification over concentrated bets, and a repeatable process that can compound across cycles. Yet when quant funds hit a rough patch, the drawdowns can feel abrupt—and eerily synchronized—because many systematic strategies are ultimately responding to the same market microstructure, the same factor regimes, and the same crowding dynamics.

That is exactly what has been resurfacing in early 2026. Prime-brokerage and market commentary point to a difficult start for systematic long–short equity managers, with losses concentrated in U.S. equities and linked to crowded positioning and violent reversals in the stocks that dominate quant signals.

The bigger story isn’t that “quants had a bad week.” It’s why quant drawdowns can be the worst when they happen: because they are often less about being “wrong on fundamentals” and more about the rapid unwinding of shared exposures—momentum, quality, low volatility, short baskets, liquidity—and the mechanical de-risking that follows.

What “quant hedge funds” really means in 2026

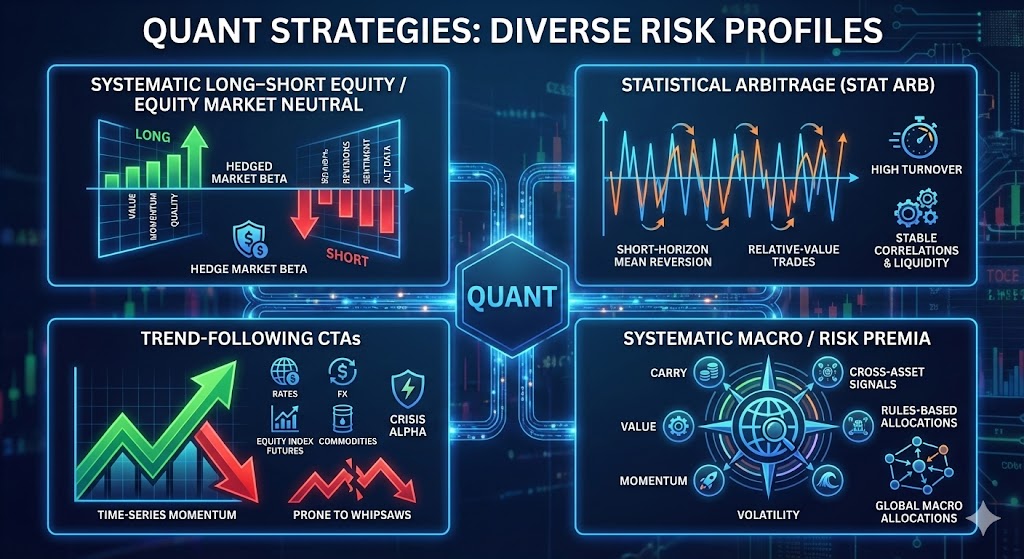

“Quant” is an umbrella label that covers multiple strategy families with very different risk profiles:

- Systematic long–short equity / equity market neutral: Models trade cross-sectional signals (value, momentum, quality, revisions, sentiment, alternative data) and attempt to hedge market beta.

- Statistical arbitrage (stat arb): Short-horizon mean reversion and relative-value trades; typically high turnover and dependent on stable correlations and liquidity.

- Trend-following CTAs: Time-series momentum across futures (rates, FX, equity index futures, commodities). Often marketed as crisis alpha, but prone to whipsaws in fast reversals.

- Systematic macro / risk premia: Rules-based allocations across carry, value, momentum, defensive, volatility, and cross-asset signals.

Different quant “species” can struggle for different reasons. But when markets become dominated by sharp factor rotations, short squeezes, and liquidity air pockets, multiple quant buckets can draw down together—creating the perception of “quant carnage” even if the pain is concentrated in one sleeve (most commonly: systematic equity).

Why the drawdowns are showing up now

1) Crowding turns “alpha” into a shared macro trade

Quant models are designed to exploit persistent patterns. The problem is that when many sophisticated players converge on the same patterns—momentum leadership, quality screens, factor tilts, similar short baskets—those patterns become positioning. And positioning can unwind faster than fundamentals can justify.

Recent reporting highlights crowded U.S. equity bets as a key driver of early-2026 systematic long–short weakness, with the sector experiencing its worst short-term drawdown since October (as framed by prime brokerage data and market coverage).

Crowding doesn’t require explicit coordination. It emerges because:

- The investable universe is shared.

- The most liquid names are easiest to scale.

- Risk models herd portfolios toward “efficient” implementations.

- Similar signals tend to select similar longs and shorts.

When the unwind comes, it arrives as slippage, widening spreads, and “correlations going to one” inside books that were built on the idea of diversification.

2) “Garbage stock” rallies and short squeezes punish the same shorts

Another ingredient that reliably hurts quant long–short equity is a sharp rally in heavily shorted, lower-quality names—often the exact cohort that systematic models are short. A recent Financial Times column noted a resurgence in “garbage stocks” early in 2026 and tied the move to short squeezes and hedge-fund pain, with quant strategies highlighted as being pressured by crowded trades and momentum reversals.

This matters because a large portion of systematic equity risk is not “market direction” but long–short spread behavior: do the stocks you’re long outperform the stocks you’re short? In a squeeze, the short book can gap against you in days, and the model may not be able to exit without paying up—especially if many peers are exiting at once.

3) Factor correlations break at the worst possible time

One of the underappreciated features of quant drawdowns is that they can be driven by unusual factor correlation regimes. A model may assume that its signals diversify each other; in stress, those signals can become the same trade.

MSCI’s research on the “summer 2025 quant fund wobble” emphasized how unusual factor behavior and crowding contributed to long–short equity quant underperformance, using factor-model lenses to explain what happened beneath the surface.

In practice, this shows up as:

- Momentum and quality behaving like a single “long tech / short junk” macro trade.

- Liquidity becoming a risk factor (you can’t get out when you need to).

- Short interest acting like embedded convexity (small moves can trigger squeezes).

4) Deleveraging is mechanical—and it feeds on itself

Quant firms tend to have explicit risk budgets. When volatility rises or losses breach internal limits, gross and net exposure is cut. This creates a feedback loop:

- Losses increase realized volatility.

- Risk models reduce position sizes.

- Selling pressure pushes prices further.

- Liquidity worsens; correlations rise.

- More funds hit limits; more selling follows.

This is why quant drawdowns often feel “sudden.” They’re not always the result of a single bad prediction. They’re frequently the result of a crowded ecosystem all stepping back at the same time.

The “worst drawdowns” narrative: equity quants vs. trend CTAs

It’s important not to flatten all systematic strategies into one storyline. In fact, 2025 offered a reminder that some quant platforms can deliver excellent returns even in volatile environments.

A Reuters report, for example, described strong 2025 performance at AQR, including double-digit gains across several flagship strategies. That doesn’t negate today’s drawdowns elsewhere; it illustrates the dispersion within quant.

At the same time, trend-following CTAs—another major “quant” bucket—have faced their own challenges in recent periods, particularly when markets chop sideways and reverse sharply. Industry commentary and research have highlighted 2025 as a difficult environment for trend, with whipsaw dynamics undermining the classic payoff profile.

Put differently:

- Systematic equity tends to blow up on factor rotations, short squeezes, and crowding-driven deleveraging.

- Trend tends to bleed in V-shaped reversals and range-bound regimes.

Both can have “worst drawdowns,” but for different structural reasons.

What allocators often misunderstand about quant risk

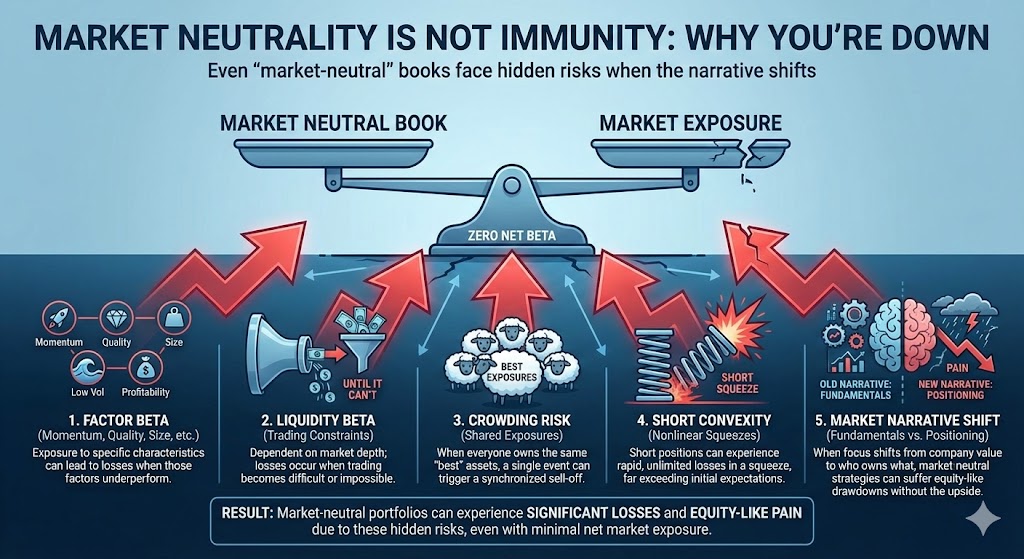

Market neutrality is not immunity. A market-neutral book can still have:

- Factor beta (momentum, quality, size, low vol, profitability).

- Liquidity beta (it owns what it can trade—until it can’t).

- Crowding risk (everyone owns the same “best” exposures).

- Short convexity (short squeezes can be nonlinear).

When the market narrative shifts from “fundamentals matter” to “positioning matters,” market-neutral portfolios can experience equity-like pain—without taking much net market exposure.

“Shouldn’t models adapt instantly?”

Models can update signals quickly. They cannot instantly escape impact costs. In stress regimes, the limiting factor isn’t forecasting—it’s execution. If your peers are all trying to unwind similar books, the exit door becomes narrow.

“Aren’t quants diversified across thousands of names?”

Breadth helps—but only if those names represent truly independent bets. In a factor storm, thousands of positions can still collapse into a handful of common drivers.

How risk is evolving inside the quant complex

The quant industry has spent the past decade industrializing research and scaling infrastructure—machine learning pipelines, alternative data ingestion, faster execution, and tighter risk controls. Those are real advantages. But they also have side effects:

- Faster signal decay: Crowded insights get arbitraged away more quickly.

- More similar architectures: Common toolkits can lead to similar solutions.

- Greater dependence on market microstructure: If liquidity conditions change, the whole ecosystem feels it.

In a “normal” market, this looks like stable Sharpe and consistent compounding. In a regime shift, it can look like synchronized drawdowns.

What to watch next: indicators that drawdowns could persist—or stabilize

If you’re monitoring quant stress (as an allocator, risk manager, or market observer), four signposts matter:

- Short-squeeze intensity and breadth

If the most shorted cohort continues to rip higher, quant short books can remain under pressure. The FT’s early-2026 observations around highly shorted and unprofitable names surging is the kind of tape that keeps this risk elevated. - Momentum reversals

Quant pain often peaks when trend leadership flips rapidly—particularly in mega-cap vs. junk, defensives vs. cyclicals, and “quality” vs. “trash.” - Prime-brokerage deleveraging signals

When PBs flag broad de-grossing in systematic books, the unwind can become self-reinforcing (and can spill into other strategies). - Liquidity conditions

Watch funding markets, bid–ask spreads, and intraday depth. If liquidity improves, quant execution improves, and drawdowns can mean-revert.

Practical allocator takeaways: how to underwrite quant through drawdowns

Quant drawdowns are not inherently disqualifying—many systematic strategies have historically recovered after crowding events. But allocators should demand better underwriting than “it’s diversified” or “it’s a black box with good backtests.”

What “good” looks like in due diligence:

- Exposure transparency: Not the secret sauce, but factor, sector, and crowding diagnostics.

- Capacity discipline: How does the strategy behave as AUM scales? What’s the internal capacity estimate?

- Stress testing: Not just 2008-style macro stress, but microstructure stress (short squeezes, liquidity gaps, factor crashes).

- Execution and slippage controls: Evidence the manager can trade in stressed conditions without blowing through expected transaction costs.

- Clear kill-switch governance: Predefined risk limits and decision-making processes for extraordinary regimes.

And perhaps most importantly: portfolio fit. If you already have heavy momentum and quality exposure elsewhere, adding a quant equity sleeve can duplicate risk rather than diversify it.

The bottom line

“Quant hedge funds see worst drawdowns” is less a headline about models failing and more a signal that markets have entered a regime where positioning and factor flows can dominate fundamentals—at least temporarily. Early 2026’s pressure on systematic long–short equity strategies, linked to crowded U.S. equity bets and sharp reversals, fits the classic pattern of quant stress.