(HedgeCo.Net) The biggest story in hedge funds today isn’t a single trade or a single firm’s quarterly number—it’s a capital shift that is rapidly becoming structural: allocators are consolidating into fewer, larger multi-strategy hedge funds, fighting for capacity, and effectively reshaping the hedge fund power map for 2026.

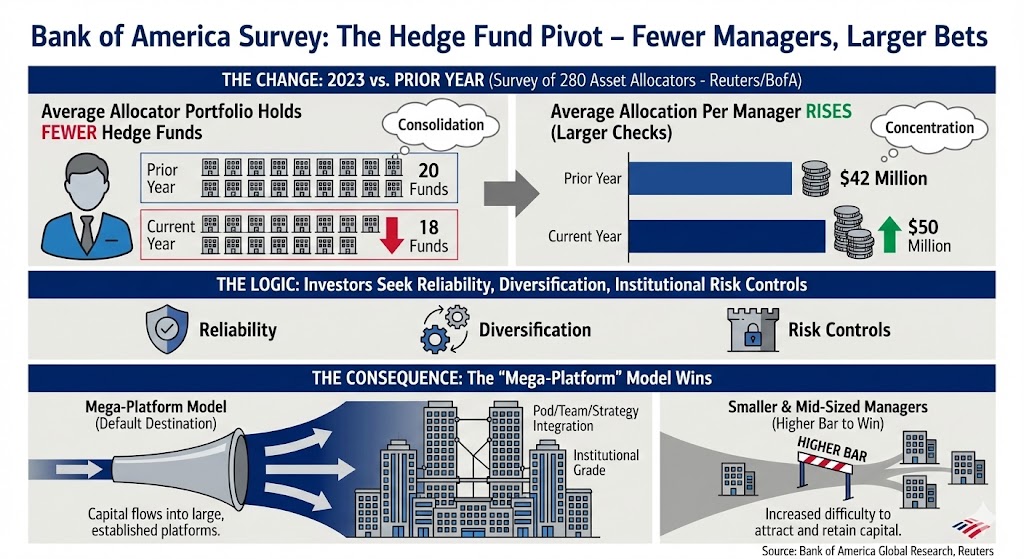

A Bank of America survey of 280 asset allocators (cited by Reuters) captures the change in one line: the average allocator portfolio now holds fewer hedge funds (18 vs. 20 the prior year), but writes larger checks into each manager (average allocation rising to $50 million from $42 million). The logic is straightforward—investors want reliability, diversification across pods/teams/strategies, and institutional-grade risk controls. The consequence is anything but simple: the “mega-platform” model is becoming the default destination for new hedge fund dollars, while smaller and mid-sized managers face a higher bar to win (and keep) capital.

Why this matters now: 2025’s performance and a $5T industry set the stage

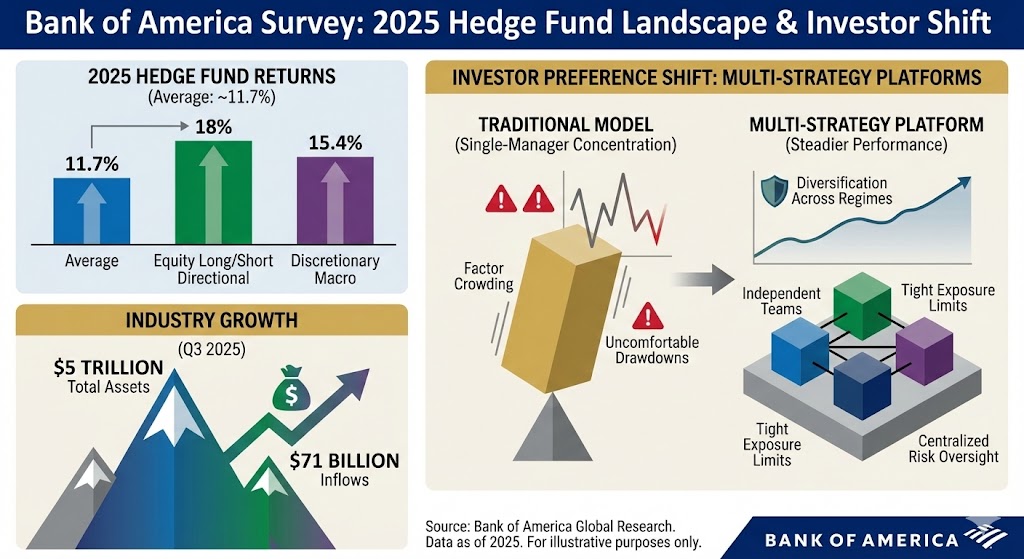

This consolidation is landing after a “better-than-feared” year for hedge funds broadly. Bank of America’s work pegs average hedge fund returns around 11.7% in 2025, with equity long/short directional strategies averaging 18% and discretionary macro around 15.4%. In the backdrop, industry assets reached about $5 trillion by Q3 2025, supported by performance and roughly $71 billion in inflows.

Investors aren’t just reacting to returns—they’re reacting to the return profile. Multi-strategy platforms aim to deliver steadier performance across market regimes by spreading risk across multiple independent teams, with tight exposure limits and centralized risk oversight. That pitch resonates after years when single-manager concentration and factor crowding could create uncomfortable drawdowns.

Capacity is the new currency: allocators are negotiating access like it’s a scarce asset

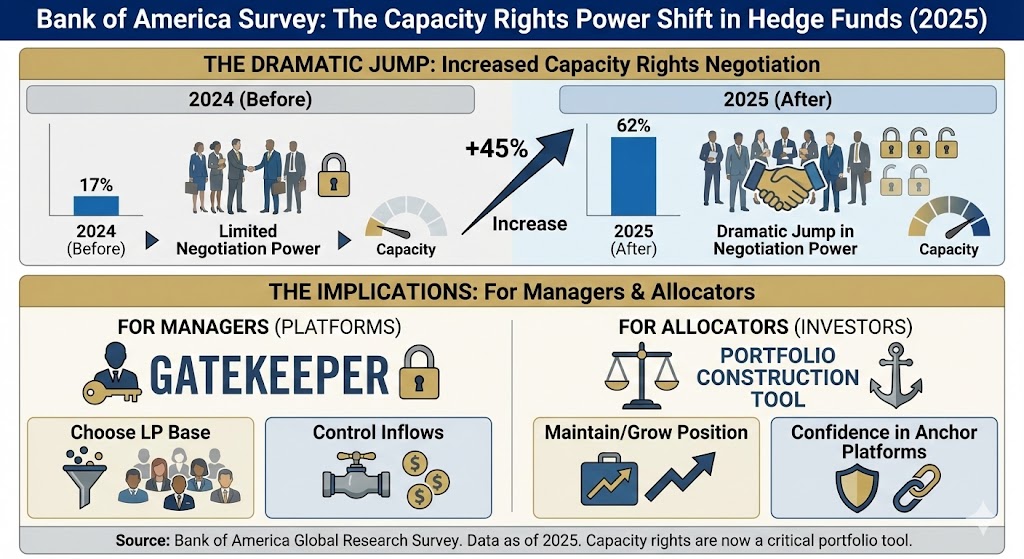

If you want a clear “tell” that big platforms have pricing power, look at capacity. According to the same Bank of America survey, 62% of hedge fund investors negotiated increased capacity rights in 2025, up from 17% in 2024. That’s a dramatic jump in a single year—and it signals that the most sought-after multi-managers can effectively choose their LP base and control inflows.

For allocators, capacity rights aren’t a nice-to-have. They are a portfolio construction tool: if you decide that a handful of “platforms” will anchor your alternatives book, you need confidence you can maintain (or grow) your position when the manager tightens the gates.

This is also why “consolidation” doesn’t mean less work for investors. It means deeper diligence, more manager-monitoring, more negotiation, and more governance—because the stakes per relationship are larger.

Wall Street is cashing in: prime brokerage becomes the hedge fund growth engine again

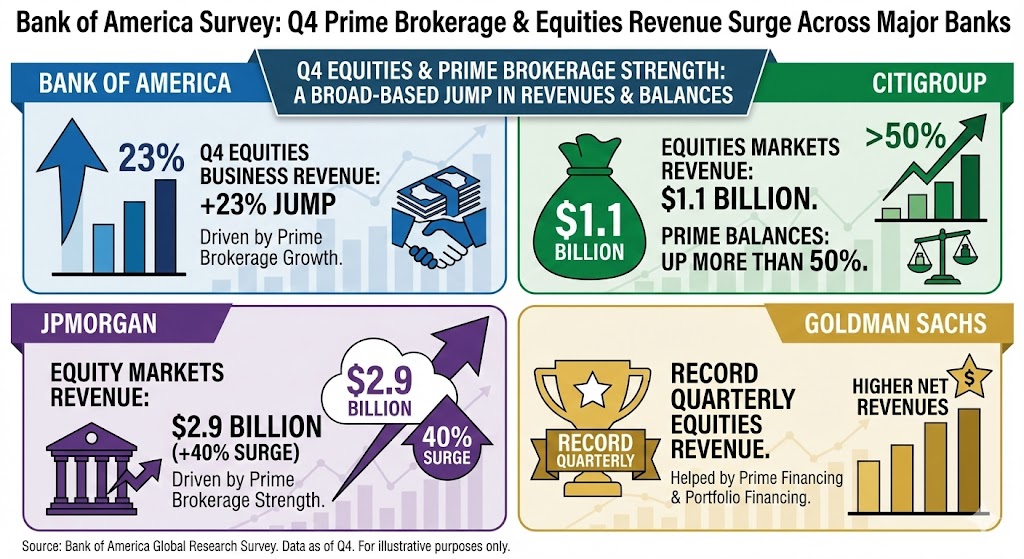

The other half of today’s story is that hedge fund consolidation is feeding directly into bank earnings—especially in prime brokerage and financing. Reuters reports that Wall Street’s biggest banks saw strong growth from prime brokerage units as they earned fees by lending to and financing the world’s largest multi-strategy hedge funds.

The numbers and commentary are telling:

- Bank of America reported a 23% jump in Q4 revenues from its equities business (which includes prime brokerage).

- Citigroup reported equities markets revenue of $1.1 billion, with prime balances up more than 50% (prime balances = assets banks manage/finance for hedge fund clients).

- JPMorgan reported a 40% surge in equity markets revenue to $2.9 billion, also driven by prime brokerage strength.

- Goldman Sachs cited record quarterly equities revenue, helped by higher net revenues in prime financing and portfolio financing.

This is not a side business anymore—it’s a competitive battleground. Since the post-Archegos reshaping of prime brokerage and the broader post-Credit Suisse scramble for wallet share, banks have been aggressively competing to win (and retain) the biggest hedge fund relationships. The consolidation trend makes that fight even more intense: if allocators are putting more dollars into fewer mega-managers, then banks want to be the financing partner to those mega-managers.

Leverage is rising—and that’s both opportunity and risk

Financing growth is not just about servicing flows; it’s about leverage and activity. Reuters notes that macro hedge funds have been using near-record leverage levels and that prime brokerage data from major banks shows leverage used by traditional long/short hedge funds is close to an all-time high and still rising.

That’s not automatically alarming—leverage can be prudent when applied inside strict risk systems and with liquid instruments. But it does raise two important questions for 2026:

- Who controls the risk? Multi-strategy platforms emphasize centralized risk management; that’s part of why allocators like them.

- What happens in a sharper volatility shock? Banks and funds will both stress test the same scenario: a sudden cross-asset dislocation that widens financing haircuts, triggers de-grossing, and forces crowded trades to unwind.

The positioning backdrop: tech crowding remains a defining feature

Even as allocators rotate into “all-weather” multi-strats, the industry’s most crowded exposures still matter—because crowding is where correlations can spike.

A Hazeltree report summarized by Reuters found hedge funds maintained heavily crowded long positions in large-cap U.S. tech names such as Alphabet, Microsoft, and Meta in 2025—reflecting sustained confidence in firms viewed as key AI beneficiaries. On the short side, the report flagged persistent shorts like IBM and Strategy (MicroStrategy), and noted Synopsys becoming an increasingly crowded short amid concerns including execution risk tied to its planned Ansys deal and weaker revenue results.

This matters for the “big hedge funds” story because multi-strategy platforms may be diversified across teams, but they are not immune to market-wide crowding. If multiple pods independently like the same AI-adjacent winners (or the same shorts), the platform’s true diversification can compress right when it’s needed most.

What the “largest hedge funds” do next: a 2026 playbook emerges

Putting the pieces together, today’s headline trend points to a 2026 environment defined by scale, access, and infrastructure:

- Mega multi-strats strengthen their moat: capacity discipline, diversified return streams, and institutional processes that satisfy increasingly demanding allocators.

- Banks tilt further toward financing-led relationships: prime brokerage, derivatives, and portfolio financing become central profit drivers tied to hedge fund activity and leverage.

- Allocators formalize “core hedge fund” rosters: fewer relationships, bigger allocations, more negotiation for capacity rights, and more pressure on managers to deliver consistency.

- Crowding risk becomes a top-down constraint: the more capital converges into similar “AI winners” and high-conviction themes, the more essential liquidity planning and crowding analytics become.

The bottom line

The biggest hedge fund story today is a shift in who gets incremental capital—and the answer is: the largest multi-strategy platforms, increasingly treated by allocators as “core holdings” rather than tactical allocations. With capacity rights becoming a bargaining chip and prime brokerage once again a major earnings engine for Wall Street, 2026 is shaping up as a year where the hedge fund industry’s center of gravity moves even further toward a handful of scaled, institutionalized, multi-strategy giants.