(HedgeCo.Net) KKR’s successful raise of $2.5 billion for its second Asia-focused private credit vehicle is more than a headline—it’s a datapoint that Asia private markets are entering a new phase of institutionalization. The firm’s Asia Credit Opportunities Fund II attracted $1.8B, with an additional $700M in separately managed accounts targeting similar performing credit strategies. That structure matters: it reflects how sophisticated allocators increasingly want “fund + SMA” architectures to fine-tune exposures, liquidity expectations, and portfolio-level risk constraints.

Why this is happening now

Three forces are converging:

1) Yield scarcity isn’t gone—it’s just moved.

Even when public rates are elevated, allocators still struggle to source durable income that is underwritten, covenant-aware, and structurally protected. Asia performing private credit sits in a sweet spot: many borrowers are underbanked relative to the U.S. and Europe, while corporate balance sheets in select markets can be attractive when paired with local origination and robust credit work.

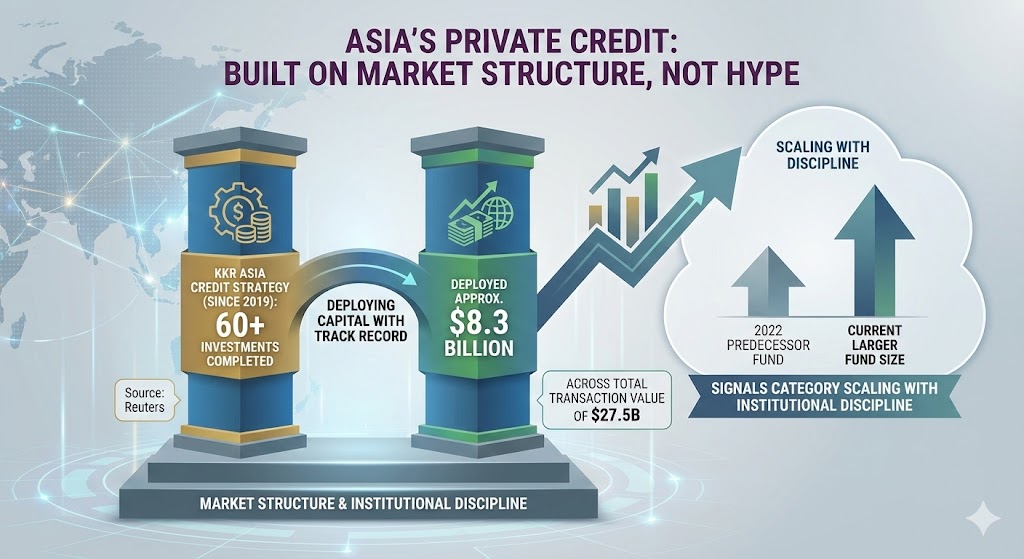

2) Asia’s private credit “moment” is being built on market structure, not hype.

Reuters notes KKR has completed 60+ investments in the region through its Asia Credit strategy since 2019, deploying about $8.3B across total transaction value of $27.5B. That track record—combined with the larger fund size versus its 2022 predecessor—signals the category is scaling with institutional discipline.

3) Investors want diversification beyond U.S. middle-market direct lending.

U.S. direct lending is crowded, and spreads can compress quickly when fundraising runs hot. Asia provides a different cycle, different lender landscape, and different deal mix (including sponsor-backed, corporate, and structured solutions). Allocators increasingly see this as a way to diversify credit beta and manager alpha.

What this means for managers and allocators

For managers: this is the blueprint—performing credit, pan-regional origination, and SMA capability to capture large tickets from pensions, sovereigns, insurers, and OCIO platforms. The winners will be those with local underwriting talent and the ability to manage workout complexity across legal regimes.

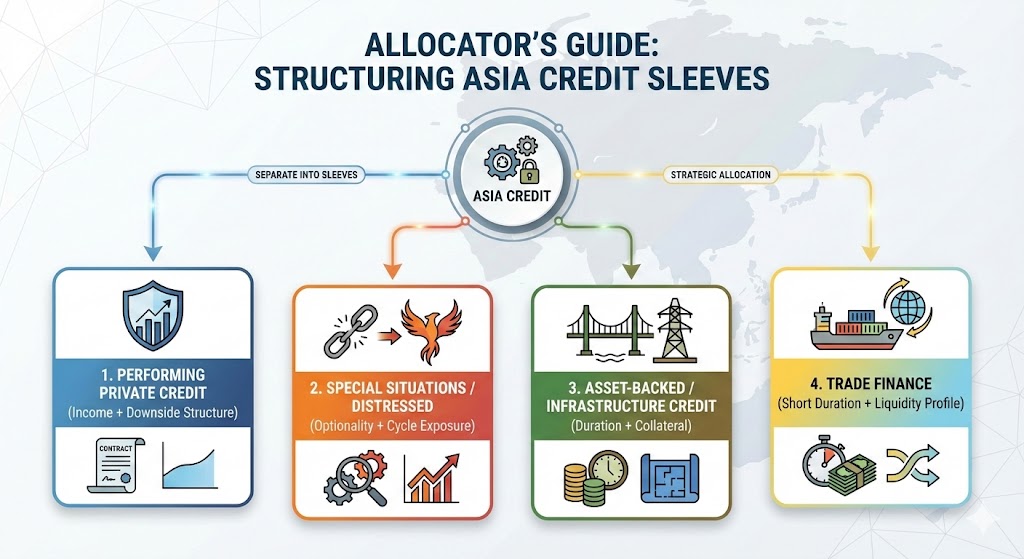

For allocators: the key is separating “Asia credit” into the right sleeves:

- Performing private credit (income + downside structure)

- Special situations / distressed (optionality + cycle exposure)

- Asset-backed / infrastructure credit (duration + collateral)

- Trade finance (short duration + liquidity profile)

The fund headline is only half the story—the real question is: where in your portfolio does Asia private credit sit relative to U.S./EU direct lending, EM debt, and private infrastructure credit?

Risks investors should price in

- FX and repatriation complexity (even if deals are hedged at the portfolio level)

- Legal enforceability variance across markets

- Refinancing windows if public markets tighten

- Manager selection dispersion (the best platforms are not interchangeable)