(HedgeCo.Net) After a turbulent late-2025, global crypto markets have staged a notable rebound this week — with Bitcoin pushing back above $97,000, broad altcoin strength, and renewed buying interest across major digital assets. This rally is striking given the uneven market backdrop and deep volatility that has characterized the first half of January.

Price Moves and Market Sentiment:

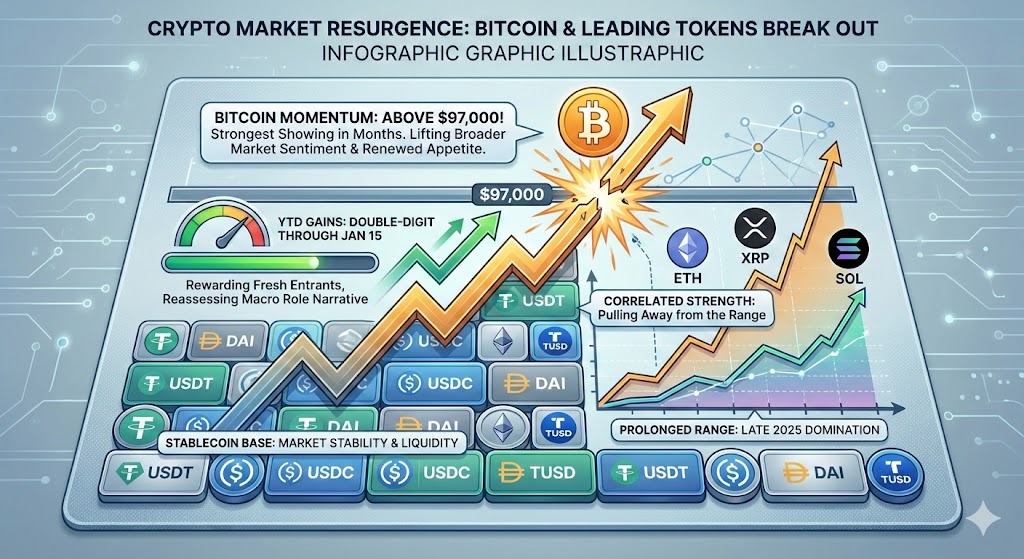

- Bitcoin regained momentum, climbing above $97,000 on Wednesday — its strongest showing in months — lifting broader market sentiment and confirming renewed appetite among both retail and institutional participants.

- According to price data through January 15, Bitcoin has delivered double-digit year-to-date gains, rewarding fresh entrants and compelling investors to reassess the narrative around its macro role.

- Ethereum, XRP, Solana and other leading tokens showed correlated strength, pulling away from the prolonged range that dominated much of late 2025.

Market professionals see three headline drivers behind this rebound:

1. Macro Risk Appetite Rebalancing

After a crypto sell-off late in 2025 that erased prior gains, broader risk assets are stabilizing, and digital assets are once again acting as high-beta vehicles for risk tolerance. Even so, some traders caution that the recovery remains fragile until macroeconomic signals align more clearly with sustained growth.

2. Regulatory Clarity in Washington (and Uncertainty)

Multiple regulatory efforts in the U.S. have shaped sentiment this month — both positive and cautionary — underscoring the market’s sensitivity to legal frameworks. On one front, long-awaited legislation to define crypto’s regulatory perimeter has been introduced in the Senate, aiming to clarify whether tokens are securities, commodities, or new asset categories — a step the industry has yearned for.

However, there’s significant friction around timing and substance:

- A Senate committee vote on the bill was postponed to late January to secure broader support, signaling both industry and legislative unease.

- These delays reflect ongoing debates around stablecoin definitions, exchange oversight, and whether intermediaries like DeFi protocols should be legally categorized as money services.

Bitcoin as Macro Narrative

Institutional positioning has also improved slightly. Large holders, including corporate and endowment allocations, have been rebalancing toward Bitcoin amid its rebound narrative, even as macro risk factors remain unsettled. The combination of policy chatter and renewed demand has helped lift confidence, though most analysts note that “not out of the woods yet” conditions still apply.

Investor Takeaway:

Bitcoin’s recent strength isn’t just a technical bounce — it reflects broader narratives about institutional allocation, late-cycle risk appetite, and the potential for improved regulatory frameworks. However, markets remain tethered to macro and policy catalysts, making short-term volatility highly probable.