(HedgeCo.Net) David Einhorn’s Greenlight Capital is moving to close its hedge fund to new investments effective July 1, 2026, a capacity decision that arrives at a moment when allocator interest in hedge funds is rising again—but conviction about public-market valuations is becoming more fragile. The closure, disclosed in Greenlight’s fourth-quarter investor letter dated January 20, 2026, requires prospective investors to signal intent by May 1.

On the surface, the move reads like a familiar hedge fund playbook: close when assets are “right-sized,” protect performance, and reinforce scarcity value. But in Greenlight’s case, the decision carries a second message—one aimed at market structure itself. The firm reiterated a strongly bearish view on U.S. equities, writing that it believes the U.S. market is “the most expensive we’ve seen since we began managing money and arguably in the history of the United States.”

For allocators and industry observers, this is not just an operational update. It is a strategic signal about how one of hedge funds’ best-known long/short equity franchises is thinking about 2026: capacity discipline, a heavier emphasis on macro expression, and an unusually stark assessment of equity risk premia at a time when many investors are still positioned for a benign “soft landing” narrative.

The Mechanics of the Closure—and Why Timing Matters

According to Institutional Investor, Greenlight will close to new capital on July 1, and prospective investors must notify the firm of their intentions by May 1. Greenlight also noted that the closure could be “indefinite” and framed the decision as tied to fund size—“again at a size that supports the business.”

The decision is particularly notable because Greenlight had reopened to investors in May 2020, making this a re-tightening of the capital aperture rather than a first-time close. That matters: reopening after a long stretch of being closed can be read as a willingness to scale; reclosing suggests the firm now believes the marginal dollar of AUM could dilute opportunity capture—especially in the kinds of idiosyncratic positions and event-driven setups that have historically defined its return profile.

For allocators, the “why now” question often matters as much as the “what.” Hedge fund closures commonly cluster when managers see either (1) a surge of interest and inbound demand, (2) a set of high-conviction opportunities they want to protect from crowding, or (3) a market environment where liquidity and volatility could punish oversized books. In Greenlight’s communication, there are hints of all three—particularly the third, via its explicit warning on valuations.

A Fund That Looked More “Macro” Than “Long/Short” in 2025

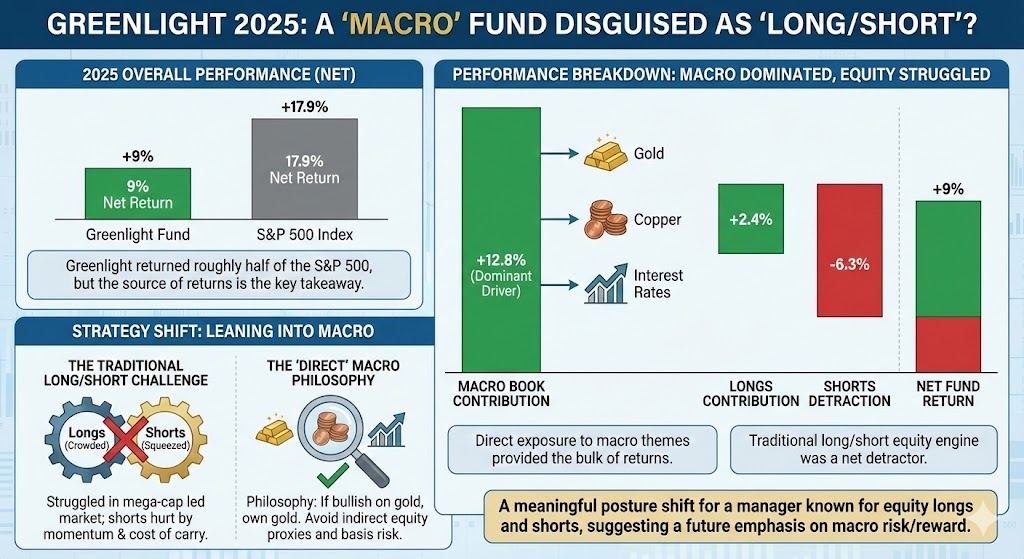

Perhaps the most revealing part of Greenlight’s latest messaging is how it characterizes its own performance drivers. In 2025, Greenlight’s fund returned 9%, roughly half of the S&P 500’s 17.9%—but the firm emphasized that the year’s returns came overwhelmingly from its macro book rather than its traditional long/short equity engine.

In Greenlight’s own breakdown:

- The macro book contributed 12.8% to the net return.

- Longs contributed 2.4%, while shorts detracted by 6.3%.

That decomposition is more than attribution; it is a strategy tell. Many long/short funds have struggled in environments where mega-cap leadership compresses dispersion, where short books get squeezed by momentum, and where the cost of carry on shorts becomes more punishing when markets levitate. Greenlight’s letter effectively acknowledges that dynamic while also arguing it has a repeatable approach for expressing macro insights “directly,” without taking unnecessary basis risk through proxies.

The firm described its philosophy bluntly: if it is bullish on gold, copper, or interest rates, it should own gold, copper, or interest rates—rather than equities that are indirectly linked to those themes. This is a meaningful posture shift for a manager widely associated with equity longs and high-profile shorts. It suggests Greenlight is comfortable leaning harder into macro instruments when it sees clearer risk/reward—and that the firm believes 2026 may reward that style of expression.

The Valuation Call: “Most Expensive…Arguably in History”

Greenlight’s closure announcement is inseparable from its broader thesis: that U.S. equities are priced for perfection. The firm’s warning—“most expensive…arguably in the history of the United States”—is the kind of language hedge funds reserve for moments when they see asymmetric downside risk.

Whether one agrees with the superlative or not, the message aligns with a common allocator concern heading into 2026: that consensus positioning has become too dependent on a narrow set of growth and AI-linked winners, while rates, deficits, geopolitics, and election-cycle policy uncertainty remain underappreciated in price. In that context, Greenlight’s closing move reads as a dual decision: protect the portfolio from excess scale and protect investors from chasing returns into what the manager views as a late-cycle valuation regime.

Positioning Snapshot: Moderate Net, Elevated Gross

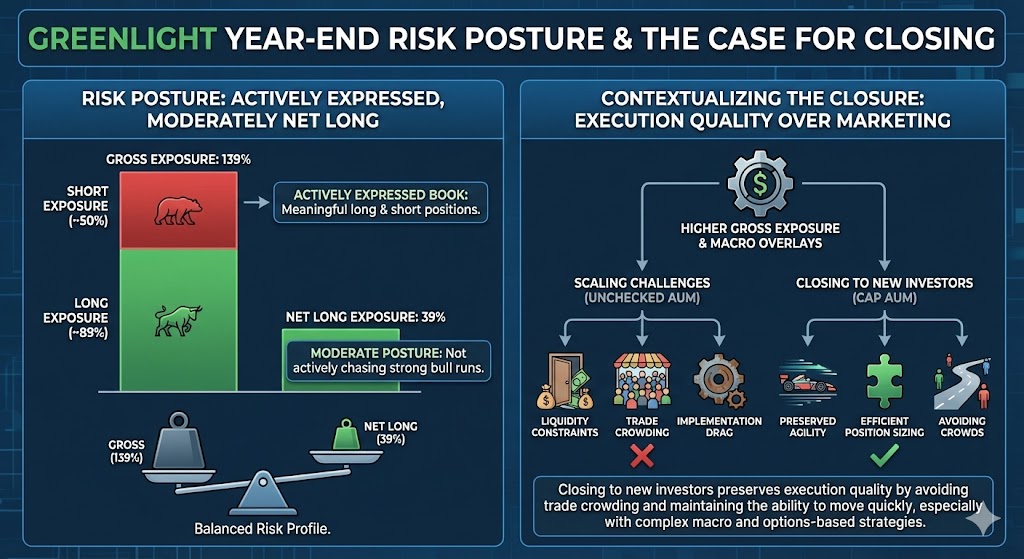

Greenlight’s letter also offers a window into its risk posture. At year-end, the fund reported gross exposure of 139%and net long exposure of 39%. Those numbers imply a book that is actively expressed—with meaningful long and short positions—but not aggressively net long in the way many equity-heavy funds can become during strong bull runs.

For allocators, exposure metrics like these help contextualize the closure. A fund that is structurally designed to run higher gross—especially if it is doing more macro overlays and options-based exposures—can face liquidity and implementation constraints that scale poorly past a certain AUM threshold. Closing to new investors can be less about marketing and more about execution quality: avoiding trade crowding, preserving the ability to move quickly, and keeping position sizing efficient.

Gold, Copper, and the Macro Narrative Underneath the Close

If 2025’s headline was “macro carried the year,” the subtext is what macro themes Greenlight believes are most durable. The letter described gold as a key driver—rising sharply in 2025—and argued that central bank reserve diversification and reduced reliance on the dollar for reserves/trade settlement are supportive forces.

Greenlight also highlighted copper as a “notable winner,” tying the thesis directly to AI-driven electrification and infrastructure demand, while emphasizing constrained supply dynamics. In other words, the same theme dominating broad market narratives—AI capex—shows up inside Greenlight’s macro expression, but in a different form: not just equity exposure to AI beneficiaries, but commodity and rates positioning tied to the physical buildout.

This matters because it frames Greenlight’s outlook as less about making a single binary bet against equities and more about constructing a portfolio for a world where real assets, supply chains, and policy-driven capital allocation may be as important as software multiples.

What the Closure Means for Allocators

For institutional investors and wealth platforms, a closure to new capital often triggers a predictable set of questions:

Is this performance-driven demand—or capacity protection?

Greenlight explicitly framed it as a size/capacity decision (“a size that supports the business”) and indicated it could be indefinite.

Does the closure suggest a high-conviction opportunity set?

Possibly. Closures often coincide with managers wanting to preserve flexibility, especially if they anticipate volatility or dislocations that require nimble execution.

Is this a “scarcity value” moment for existing investors?

It can be. Fund closures tend to increase the perceived franchise value of seats inside the strategy, particularly if performance improves in a choppier tape.

What does it imply about 2026 market risk?

Greenlight’s language suggests the firm sees elevated downside risk in U.S. equities at today’s valuations—strong enough that it wants to limit additional inflows that could pressure execution while the opportunity set becomes more fragile.

The Bigger Picture: A Hedge Fund Industry That’s Reasserting Discipline

Greenlight’s decision is also part of a broader hedge fund pattern: as allocations rise again, many established managers are re-emphasizing capacity discipline. In previous cycles, asset growth sometimes outpaced opportunity depth, leading to diluted returns and disappointment. Closures—especially from legacy names—are often an effort to avoid repeating that mistake.

In Greenlight’s case, the closure comes with a very specific worldview: a conviction that U.S. equities are richly valued, and a demonstrated willingness to lean into macro instruments—gold, copper, rates—when those vehicles offer cleaner expression than equities.

Bottom Line

Greenlight Capital’s closure to new investors is not merely a housekeeping update. It is a strategic statement: the firm believes its scale is back at a level worth protecting, and it believes public markets—especially U.S. equities—are priced at an extreme. For allocators, it is a reminder that the most durable hedge fund franchises tend to do two things at once: preserve the ability to execute and communicate a clear view of regime risk.

If 2025 was the year hedge funds rebuilt momentum, Greenlight’s move suggests that some of the industry’s most seasoned managers want to enter 2026 with tighter capacity, sharper tools, and portfolios designed for a world where volatility—and valuation reality checks—may return fast.