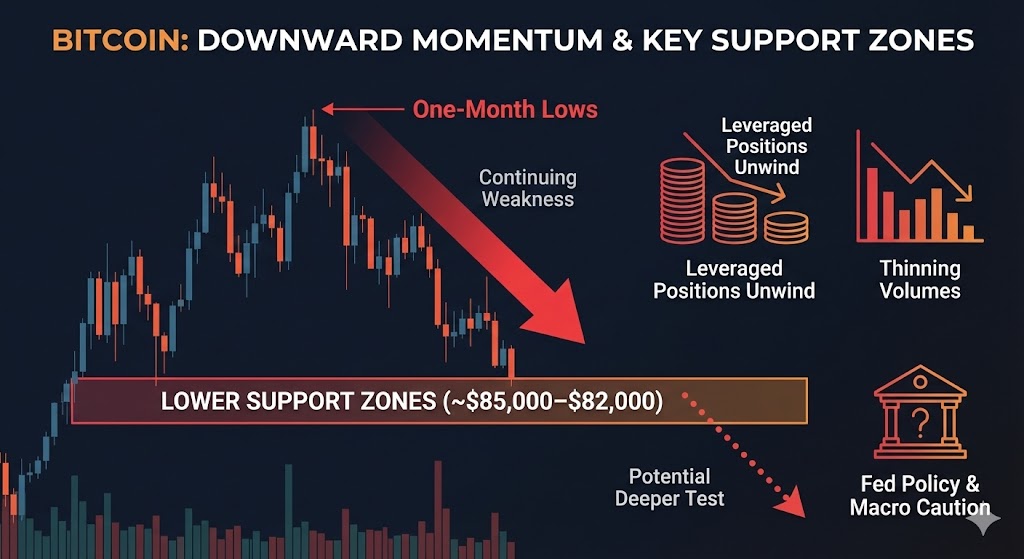

(HedgeCo.Net) Bitcoin’s price recently dropped toward one-month lows, continuing weakness from last week as traders positioned for the Federal Reserve’s upcoming policy decision and broader macro caution. BTC trading has extended recent losses, reflecting subdued sentiment as leveraged positions unwind and volumes thin.

Analysts are now looking at lower technical support zones (~$85,000–$82,000) if downward momentum continues, signaling a potential deeper test of Bitcoin’s multi-week consolidation range. Some models see a path to these downside targets if the bounce fails to gain follow-through.

What this means: short-term price action is bearish-tilted amid macro headwinds and liquidity drawdowns, even as broader crypto markets await catalysts.

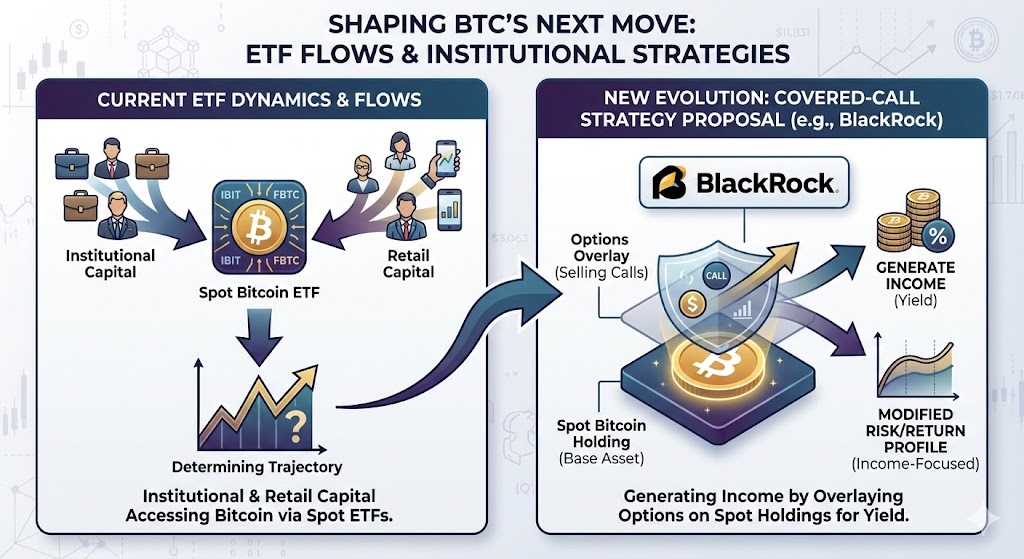

2. ETF flows and institutional positioning are shaping BTC’s next move

A key story today is how ETF dynamics could determine Bitcoin’s trajectory. A major asset manager (BlackRock) has filed a new Bitcoin ETF with a covered-call strategy proposal, aiming to generate income by overlaying options on top of a spot Bitcoin holding. This is a meaningful evolution in how institutional and retail capital might access Bitcoin with a risk/return profile that incorporates yield.

Why it matters: Traditional investors have been pushing for more sophisticated ETF structures. A covered-call Bitcoin ETF could attract allocators seeking income with digital assets, potentially improving inflows if approved by regulators.

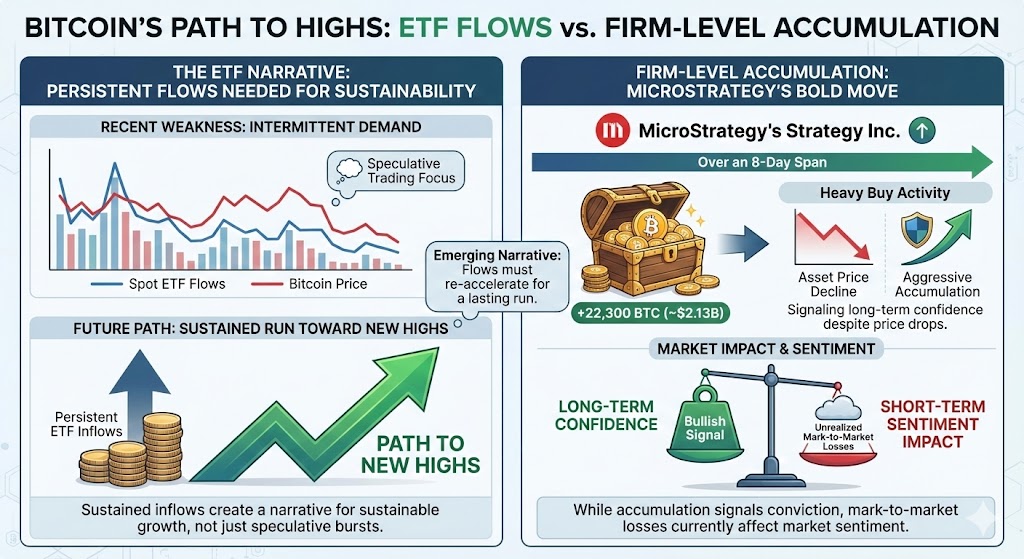

3. Macro volatility and strategic flows shaping sentiment

Recent analysis shows that Bitcoin’s path back to highs will depend heavily on whether spot ETF flows re-accelerateafter a period of intermittent demand. A narrative emerging in market commentary today argues that persistent ETF inflows — not just speculative trading — are needed to sustain a run toward new highs.

At the same time, firm-level flows are noteworthy: MicroStrategy’s Strategy Inc. has continued its aggressive Bitcoin accumulation strategy, acquiring roughly 22,300 BTC (~$2.13B) over an eight-day span, even while the asset’s price has declined. This heavy buy activity is signaling long-term confidence, but also comes with unrealized mark-to-market losses that are affecting sentiment.

Investor takeaway: Long accumulation by corporate holders can underpin base support, but markets are still weighing where short- and medium-term catalysts will come from.

4. Market structure and price benchmarks today

Across exchanges and price aggregators, BTC is trading near ~$88,000 with mild intraday gains — a slight bounce but still well below recent highs and showing choppy consolidation behavior.

This range performance reflects broader crypto market dynamics:

- Low volatility environments often precede breakout or breakdown moves.

- Institutional participants are cautious ahead of Fed policy decisions.

- Liquidity is concentrated around key support/resistance bands.

Bottom line: Bitcoin is range-bound and sensitive to macro news, with recent trading suggesting hesitation on fresh bullish conviction.