(HedgeCo.Net) A rare thing happened in U.S. crypto policy last week: the country’s largest publicly traded crypto exchange didn’t just lobby around the edges—it publicly withdrew support for a marquee market-structure proposal, triggering an immediate political reset. Coinbase CEO Brian Armstrong’s opposition to the draft “Digital Asset Market Clarity” legislation (often referred to in coverage as a “crypto market structure” or “clarity” bill) helped lead to a delayed Senate Banking Committee process, underscoring how fragile the current legislative coalition remains.

Why this matters

Crypto’s next phase in the U.S. is increasingly defined by a single question: who regulates what—and under what definitions. A functional market structure framework would influence everything from token listings and exchange registration requirements to stablecoin product design, DeFi integration, and tokenized securities. A flawed framework, by contrast, can hard-code constraints that turn into multi-year competitive disadvantages.

Coinbase’s stance—“bad legislation is worse than none”—isn’t just rhetorical. The company is effectively signaling that, at this stage of industry maturity, regulatory outcomes can move the business model more than quarter-to-quarter trading volumes.

What happened (and why the timing matters)

According to Reuters, Armstrong said Coinbase could not support the bill “in its current form,” and the Senate Banking Committee subsequently postponed planned action as bipartisan talks continued. The immediate market reaction was negative—Coinbase shares fell in the aftermath, even as some observers argued the clash could produce a stronger end-state if it forces revisions now rather than locking in constraints later.

The timing is notable: Armstrong made additional comments today (Jan. 20) from the World Economic Forum in Davos, reinforcing that Coinbase still sees a path forward on legislation—just not the current draft. That nuance is the strategic tell: this isn’t a rejection of regulation; it’s a rejection of this version of regulation.

The core fault lines: tokenization, DeFi, and “who gets the pen”

Public reporting indicates Coinbase’s objections focus on provisions that could (a) create barriers for tokenized equities, (b) constrain DeFi and certain customer reward mechanics, and (c) reshape the CFTC’s role in ways the company views as counterproductive.

Even without the full legislative text in front of investors, the meta-issue is clear: market-structure bills are not single-variable. They’re interlocking definitions and jurisdictional handoffs. One seemingly narrow definition—what constitutes a security vs. commodity in spot markets—can cascade into exchange registration requirements, listing standards, custody rules, disclosures, and secondary trading permissions.

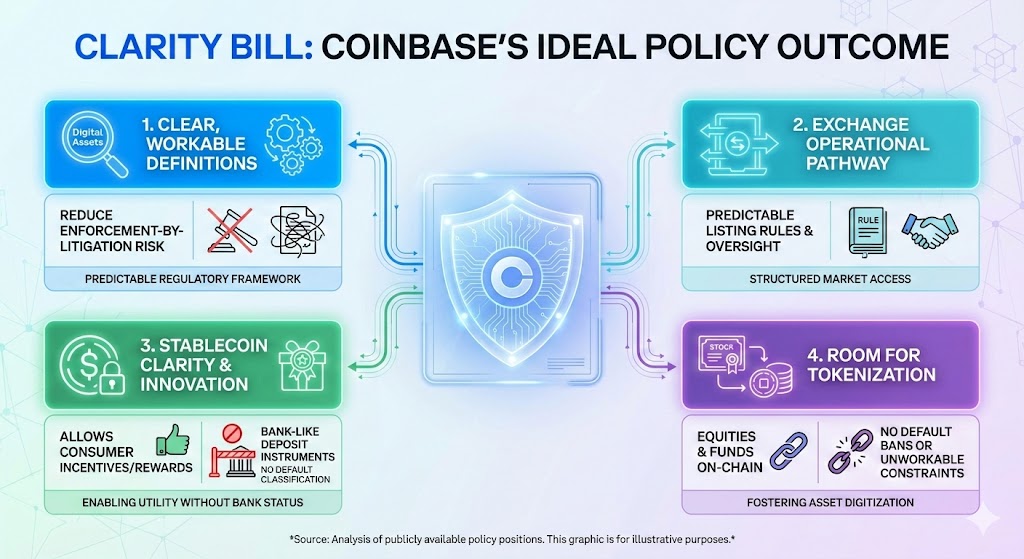

- Clear, workable definitions for digital assets that reduce enforcement-by-litigation risk

- A pathway for exchanges to operate with predictable listing rules and oversight

- Stablecoin clarity that allows consumer incentives/rewards without inadvertently classifying products as bank-like deposit instruments

- Room for tokenization (equities and funds) without default bans or unworkable constraints

Those objectives align with a broader institutionalization narrative: if U.S. rules become coherent, the U.S. can become the most attractive venue for compliant tokenization and regulated distribution. If not, innovation migrates—capital and talent follow.

The second-order impact: compliance budgets, product roadmaps, and M&A

For the largest crypto firms, the near-term outcome isn’t only “will the bill pass?” It’s “how do we plan product and compliance for the next 12–24 months?” When policy becomes a moving target:

- Compliance teams build modular frameworks instead of linear ones

- Product teams slow-roll launches that could be invalidated by new definitions

- Firms prefer partnerships and acquisitions that provide regulatory cover (licensed entities, custody, broker-dealer relationships)

That dynamic tends to favor scale—another reason this is “big-firm” news. Smaller competitors can’t absorb repeated pivots.

What to watch next

- Revised draft language and whether it resolves the definitional disputes

- Committee scheduling: if “postponed” turns into “parked,” the industry extends uncertainty into mid-2026

- Stablecoin provisions: rewards, interest-like mechanics, and reserve/custody standards will be decisive for consumer platforms

- Tokenized securities language: whether tokenization is treated as a feature or a threat

Bottom line: Coinbase’s public break with the draft bill is a reminder that crypto’s U.S. endgame is now a legislative engineering problem, not just a lobbying one. The largest firms are effectively negotiating the rulebook they’ll be living under for a decade.