(HedgeCo.Net) The hedge fund industry’s largest players are navigating a pivotal moment — where performance, diversification, structural innovation and investor demands converge. With over $5 trillion in global assets and hedge funds generating some of the strongest annual returns since the financial crisis, the biggest firms are adapting how they invest, organize and compete to sustain leadership in 2026. From refined macro positioning and enhanced multistrategy frameworks to organizational reinvention and expanding product suites, giants such as Bridgewater Associates, D.E. Shaw, Millennium Management and Citadel are redefining what it means to run a large hedge fund in the modern era.

Volatility-Driven Returns and Strategic Rebalancing

Following a year of strong performance across the sector — where hedge funds outpaced many traditional asset classes — managers are fine-tuning their portfolios for a more micro-focused, differentiated playbook in 2026.

Bridgewater’s macro engines delivered record gains, underscoring the relevance of macro insights when markets face policy tightening, geopolitical risk and global rate adjustments. In contrast, multi-strategy managers like D.E. Shaw and ExodusPoint rode tactical rotations across equities and fixed income, capturing alpha without overexposure to any single sector.

These results highlight a broader insight: performance driven by diversification and tactical rebalancing often beats concentrated placement during market dislocations — a lesson increasingly embraced by allocators and hedge fund leadership alike.

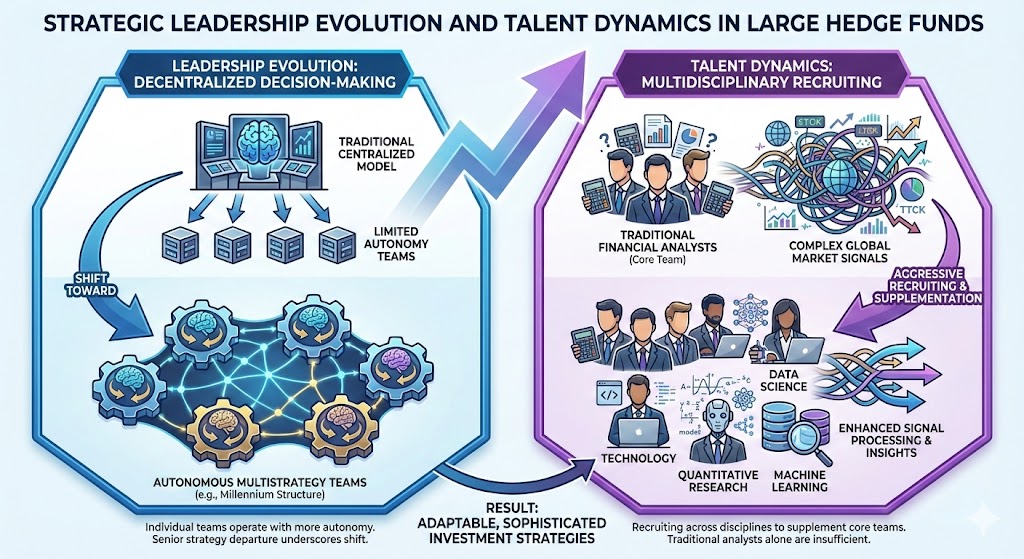

Strategic Leadership Evolution and Talent Dynamics

One notable theme emerging among the largest hedge funds is how leadership and talent strategy are evolving. Millennium Management’s recent senior strategy departure underscores the shift toward decentralized decision-making, where individual teams operate with more autonomy within a multistrategy structure.

At the same time, hedge funds are aggressively recruiting across disciplines — including technology, quantitative research, machine learning and data science — to supplement core investment teams. This trend reflects recognition that traditional financial analysts alone are no longer sufficient to process the complex signals driving global markets.

Product Innovation and New Investment Frontiers

Large hedge funds are expanding their investment horizons:

- Private credit strategies: Hedge funds that once traded largely liquid markets are launching private lending vehicles to capture yield in less cyclically correlated markets, without jeopardizing core hedge fund liquidity structures.

- Managed accounts and bespoke risk solutions: Customized solutions for institutional and high-net-worth clients are growing in popularity, offering clients tailored risk exposures, fee efficiencies and alignment with specific risk mandates.

This expansion showcases how hedge funds are innovating beyond traditional mandates while reinforcing core strengths in risk forecasting and agile execution.

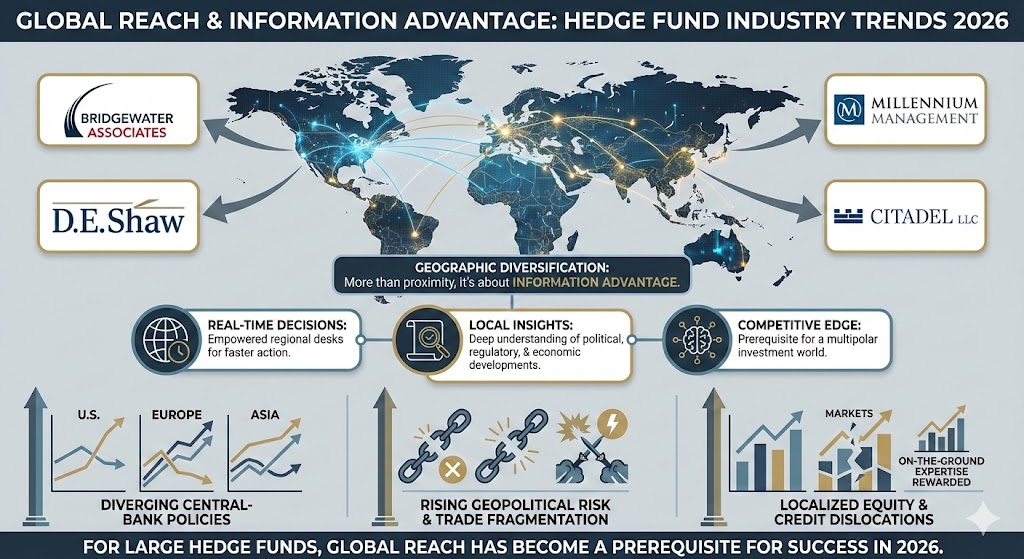

Global Reach and Geographic Diversification

Another defining trend among the world’s largest hedge funds in early 2026 is geographic diversification. Firms such as Bridgewater Associates, D.E. Shaw, Millennium Management, and Citadel LLC continue to expand research, trading, and risk teams across Europe, Asia, and the Middle East.

This global footprint is no longer just about proximity to markets—it is about information advantage. Regional desks are increasingly empowered to make real-time decisions informed by local political, regulatory, and economic developments. In 2026, this approach is proving especially valuable amid:

- Diverging central-bank policies across the U.S., Europe, and Asia

- Rising geopolitical risk and trade fragmentation

- Localized equity and credit dislocations that reward on-the-ground expertise

For large hedge funds, global reach has become a prerequisite for competing in an increasingly multipolar investment world.

Risk Management as a Core Differentiator

As hedge funds scale, risk management has become as critical as alpha generation. The largest platforms are investing heavily in real-time risk systems, stress-testing frameworks, and cross-strategy exposure controls. Rather than relying on post-trade analytics, firms are embedding risk oversight directly into portfolio construction.

Key developments shaping 2026 include:

- Intra-day risk monitoring that allows managers to dynamically resize positions during volatility spikes

- Cross-asset correlation modeling, particularly important as equity, rates, and FX markets increasingly move in tandem

- Firm-wide drawdown controls, ensuring that no single desk or strategy can materially impair capital

This emphasis reflects a hard-earned lesson from past cycles: scale amplifies both gains and mistakes. The hedge funds that continue to attract institutional capital are those demonstrating not just strong returns, but repeatable, risk-aware performance.

Technology, Data, and the Arms Race for Insight

Technology investment is accelerating across the hedge fund industry, but the largest firms are pushing furthest. Advanced data ingestion, machine-learning tools, and proprietary analytics are now standard across top platforms.

In 2026, hedge funds are increasingly focused on:

- Alternative data (supply-chain data, satellite imagery, web traffic, transaction data)

- AI-assisted research, where models augment human analysts rather than replace them

- Faster execution and lower latency, particularly for systematic and relative-value strategies

Crucially, the biggest hedge funds are not simply buying off-the-shelf solutions. They are building in-house platformsthat integrate data, research, trading, and risk into unified systems—creating structural advantages that smaller competitors struggle to replicate.

Product Expansion Without Dilution

A notable shift in 2026 is how large hedge funds are expanding their product offerings without diluting flagship strategies. Rather than forcing all innovation into existing funds, firms are launching adjacent vehicles with clearly defined mandates.

These include:

- Private credit and structured lending funds, run separately from core hedge fund vehicles

- Systematic and quant sleeves designed for lower volatility and scalability

- Customized managed accounts for sovereign wealth funds and pensions seeking transparency and control

This modular approach allows hedge funds to meet evolving investor needs while preserving the integrity and liquidity of their core strategies—an important balance as allocators become more discerning.

Investor Behavior: Hedge Funds Regain “Core” Status

Institutional investors entered 2026 with a renewed appreciation for hedge funds as core portfolio allocations, not just tactical diversifiers. After years of skepticism driven by fees and mixed performance, strong industry-wide results in 2024–2025 have shifted sentiment.

Allocators cite several reasons for renewed confidence:

- Hedge funds’ ability to perform during volatile, range-bound markets

- Lower correlation to traditional equity and bond portfolios

- Improved transparency, governance, and alignment

As a result, many pensions and endowments are modestly increasing hedge fund allocations—particularly to large, multi-strategy platforms with demonstrated risk discipline.

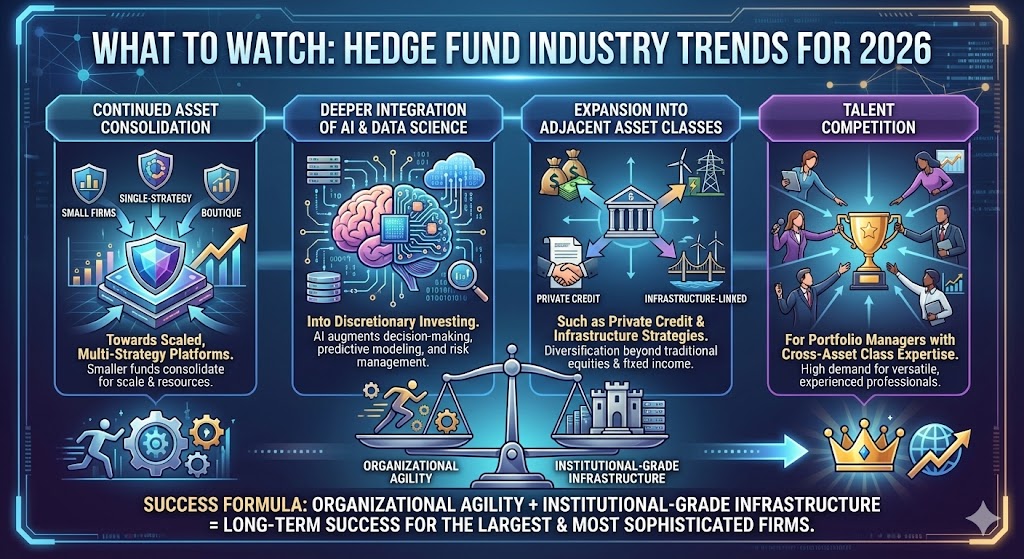

What to Watch Through the Rest of 2026

Looking ahead, several themes will shape the trajectory of the largest hedge funds:

- Continued consolidation of assets toward scaled, multi-strategy platforms

- Deeper integration of AI and data science into discretionary investing

- Expansion into adjacent asset classes such as private credit and infrastructure-linked strategies

- Talent competition, particularly for portfolio managers who can operate across asset classes

The hedge funds best positioned for long-term success will be those that combine organizational agility with institutional-grade infrastructure—a balance that only the largest and most sophisticated firms can consistently achieve.

Conclusion

In early 2026, the largest hedge funds are not standing still. They are evolving—refining their strategies, investing in technology, expanding globally, and redefining how scale can be an advantage rather than a constraint. Strong recent performance has reinforced investor confidence, but it is the structural changes underway today that will determine which firms continue to lead the industry over the next decade.