(HedgeCo.Net) Blackstone’s largest hedge fund platform delivered a nearly 12% return in 2025, beating the HFRX Global Hedge Fund Index (about 7.1%) and reinforcing a narrative that’s quietly been building across the hedge fund landscape: multi-asset, multi-engine hedge platforms are regaining their “all-weather” credibility—not by making one heroic macro call, but by stacking consistent contributions across equities, systematic trading, credit, and macro positioning.

The number matters for more than bragging rights. Blackstone’s hedge platform sits inside Blackstone Multi-Asset Investing (about $93 billion), a business Blackstone has been reshaping to compete in a world where allocators want durable, repeatable returns and better downside behavior—especially after a stretch where traditional 60/40 portfolios (and even some “alts” sleeves) didn’t diversify the way investors expected.

A 12% year that looks “hedge fund healthy”

The most telling detail is how the performance was achieved. According to reporting, gains were driven by a mix of equities, algorithmic trading, credit strategies, and macro investing—a classic “multiple shots on goal” model that tends to hold up better across shifting regimes than single-style funds.

That breadth is exactly what institutional investors tend to pay for—particularly those allocating to large platforms to solve a specific portfolio problem: deliver steadier compounding with controlled drawdowns, and do it with a process that doesn’t rely on one market story staying true.

Blackstone’s platform also reportedly posted a 3.9% net gain in Q4 (after fees), versus about 1.4% for the same hedge fund index in that period. That’s meaningful because fourth quarters often expose whether returns are coming from persistent, repeatable engines—or from crowded exposures that unwind when liquidity thins. The outperformance suggests the platform’s diversification and risk controls did what they’re designed to do.

The consistency signal: 33 straight positive months

One of the most headline-grabbing metrics: the platform has now logged 33 consecutive months of positive net gains.

That doesn’t mean it never took risk or never had volatile periods—but it does imply something allocators care deeply about: path of returns. In an era where investors increasingly measure risk not just by standard deviation but by behavior under stress (and the psychological reality of staying invested), a long streak of positive months becomes a powerful fundraising and retention story.

The strategic backdrop: a rebuilt hedge fund business inside a mega-manager:

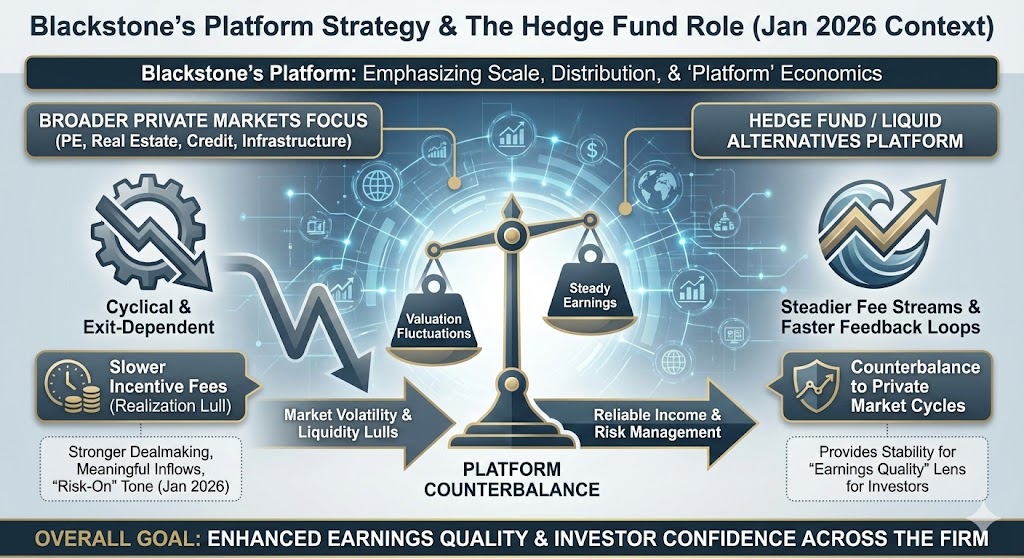

This performance is landing at a moment when Blackstone is emphasizing scale, distribution, and “platform” economics across the firm. In late January 2026 reporting around Blackstone’s results and business momentum highlighted stronger dealmaking activity, meaningful inflows, and a broader “risk-on” tone returning to parts of private markets.

Even though that broader coverage focuses heavily on private equity, real estate, credit, and infrastructure, it matters here because it frames the hedge fund platform’s role inside Blackstone:

This performance is landing at a moment when Blackstone is emphasizing scale, distribution, and “platform” economics across the firm. In late January 2026 reporting around Blackstone’s results and business momentum highlighted stronger dealmaking activity, meaningful inflows, and a broader “risk-on” tone returning to parts of private markets.

Even though that broader coverage focuses heavily on private equity, real estate, credit, and infrastructure, it matters here because it frames the hedge fund platform’s role inside Blackstone:

- Private markets are cyclical and exit-dependent; when realizations slow, incentive fees get pushed out.

- Hedge fund / liquid alternatives can provide steadier fee streams, faster feedback loops, and a counterbalance when private markets are in a valuation or liquidity lull.

- For large, publicly traded alternative managers, that steadiness can matter to investors evaluating the business through an “earnings quality” lens.

The leadership + structure story inside the platform

Reuters noted that the hedge platform sits within BXMA and referenced the unit’s evolution under Joe Dowling, including a restructuring that shifted focus away from being purely a traditional hedge fund allocator and toward a broader multi-asset model with strengthened risk management.

It also cited David Ben-Ur as managing the platform, reporting up through Dowling.

Why mention names at all? Because in hedge funds, organizational design is strategy. When a platform’s “center of gravity” shifts—from a collection of pods or strategies competing for capital, to a unified multi-asset risk budget with coordinated governance—you often see changes in:

- how quickly risk is cut,

- how exposures are netted across teams,

- how leverage is managed,

- and how systematic signals are blended with discretionary views.

A 12% year doesn’t prove those changes worked—but the combination of outperformance vs. benchmark and consistency across months is at least consistent with improved platform-level risk controls.

What this says about the hedge fund cycle right now

A big takeaway for 2026: the hedge fund “pitch” is becoming compelling again, especially for large allocators who want something between cash-like safety and equity-like upside.

Three forces are driving that:

- Volatility is back as a feature, not a bug.

Rate uncertainty, geopolitics, and concentrated equity leadership create repeated dislocations—exactly the environments where multi-strategy and macro-capable platforms can monetize dispersion. - Systematic + discretionary hybrids are winning mindshare.

Reuters pointed to algorithmic trading as a contributor to returns. Across the industry, allocators increasingly want managers that can run systematic engines and apply discretionary judgment when correlations snap. - Allocators are judging “alts” by delivery, not labels.

The last few years taught investors that “alternative” doesn’t automatically mean “diversifying.” The funds that are winning are those that can show repeatability, liquidity discipline, and controlled tail risk.

The competitive context: why 12% matters for Blackstone specifically

Blackstone is best known for private markets dominance. So when its largest hedge platform posts a clean, benchmark-beating year, it does two things:

- Strengthens the case that Blackstone is not just a private-markets shop, but a full-spectrum alternatives manufacturer.

- Gives the firm a liquid-performance narrative at a time when many private-market strategies are still working through slower exits and more complex valuation debates.

And because Blackstone’s overall business narrative in late January coverage emphasized improved activity, fundraising momentum, and confidence about the cycle turning—having a flagship hedge platform “doing its job” supports the broader message that Blackstone can generate performance and fees across multiple environments.

What to watch next in 2026

If you’re tracking this platform (or the broader mega-manager hedge trend), the most important signals in 2026 aren’t just headline returns—they’re composition and resilience:

- Is performance still broad-based (equities + systematic + credit + macro), or does it narrow to one engine?

- How does it behave in a sharp risk-off quarter? The platform’s value proposition is downside control and recoverability.

- Net flows and capacity discipline: consistent platforms often face a temptation to scale too fast; the best ones protect the machine.

- Correlation to equities: the industry’s credibility with institutions increasingly depends on delivering returns that are not simply equity beta in disguise.