(HedgeCo.Net) Wall Street’s major banks reported stronger-than-expected revenue growth in prime brokerage this week, driven by record activity among hedge funds and soaring balances across equities and derivatives trading desks. According to Reuters reporting today, Bank of America, Citigroup, and JPMorgan all saw double-digit increases in prime brokerage performance for 2025, underscoring the vital role alternative asset managers now play in fueling institutional profit engines.

Prime Brokerage Engines Burning Hot

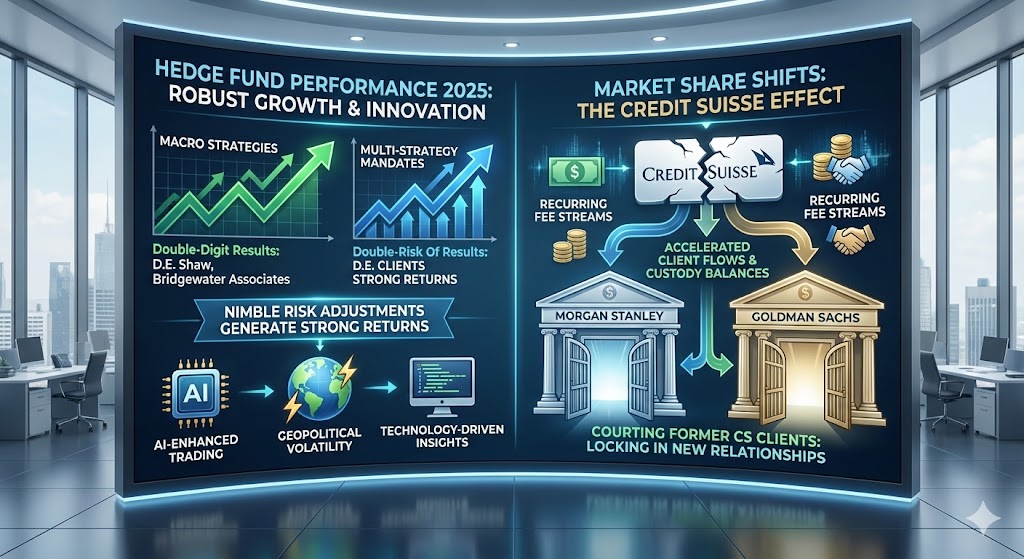

The surge in prime brokerage revenue comes amid a robust year for hedge fund performance, particularly in macro and multi-strategy mandates where firms leveraged technology-driven insights and nimble risk adjustments to generate strong returns. By some measures, hedge funds such as D.E. Shaw and Bridgewater Associates produced double-digit results in 2025, buoyed by AI-enhanced trading systems and volatile market conditions triggered by geopolitical tensions and macroeconomic shifts.

The collapse and wind-down of Credit Suisse’s brokerage business over the past year has accelerated market share shifts, funneling client flows and custody balances to U.S. banks. This dynamic has allowed Morgan Stanley and Goldman Sachs to aggressively court former Credit Suisse hedge fund clients, locking in new relationships and generating recurring fee streams.

What This Means for Alternative Managers

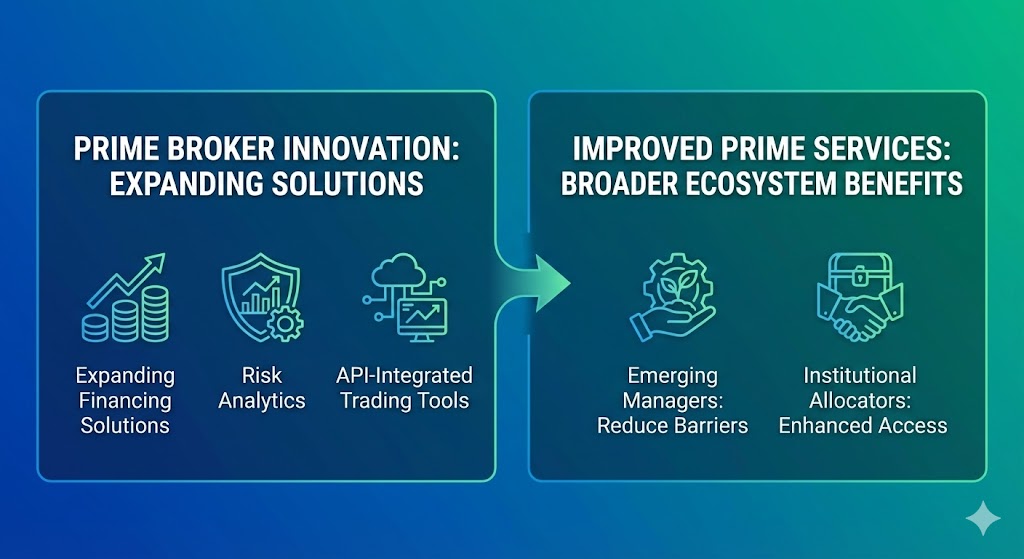

For hedge funds and multi-strategy managers, the uptick in prime brokerage performance reflects greater access to leverage, financing, and trading platforms that support more sophisticated strategies. As leverage levels remain near historic highs, fund managers are intensifying their use of quantitative signals, systematic execution models, and cross-asset arbitrage plays to enhance risk-adjusted returns.

It also suggests that prime brokers themselves will continue to innovate — expanding financing solutions, risk analytics, and API-integrated trading tools tailored to hedge funds of all sizes. For the broader alternatives ecosystem, improved prime services may reduce barriers for emerging managers and institutional allocators alike.

Market Outlook

Analysts now project that prime brokerage units will grow at a steady pace through 2026 as hedge funds diversify exposures into new arenas such as private credit secondaries and structured credit solutions, reinforcing the linkage between liquid strategies and private market access. We expect further announcements from other Wall Street firms in the coming weeks.