(HedgeCo.Net) The private real estate market entered 2026 under a cloud of skepticism, but Blackstone is changing that narrative fast. After two years defined by rising rates, redemption pressure, and valuation resets, Blackstone’s flagship real-estate vehicles are delivering their strongest performance since 2022—signaling that the worst of the correction may be over.

At the center of the rebound is Blackstone’s Real Estate Income Trust (BREIT), which posted its best annual performance in three years. The turnaround reflects not just improving fundamentals, but a deliberate strategic pivot away from legacy office exposure and toward structurally advantaged assets such as data centers, logistics hubs, student housing, and rental housing.

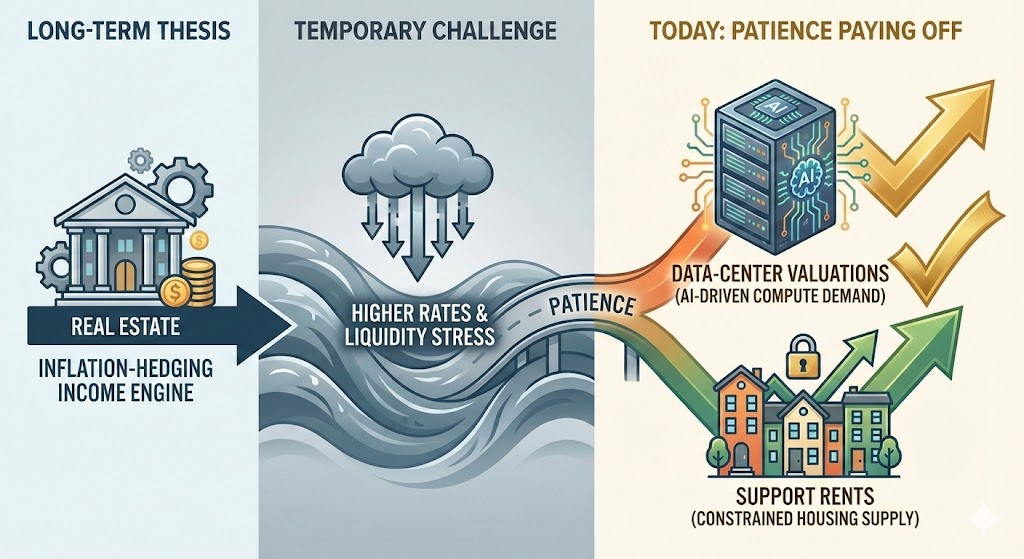

Blackstone’s long-term thesis—real estate as an inflation-hedging income engine—was temporarily challenged by higher rates and liquidity stress. But today, the firm’s patience is paying off. Demand for AI-driven compute capacity has dramatically boosted data-center valuations, while constrained housing supply continues to support rents across U.S. and European markets.

Importantly, Blackstone’s scale has become a competitive advantage rather than a liability. With tens of billions in dry powder, the firm was able to buy assets at distressed or transitional prices while smaller competitors retrenched. Now, as financing markets thaw, those acquisitions are beginning to reprice upward.

For allocators, the message is clear: private real estate is not dead—it is bifurcated. Core office assets remain challenged, but specialized real estate tied to technology, demographics, and infrastructure is emerging as a cornerstone allocation once again.