(HedgeCo.Net) Ray Dalio has spent decades building a reputation as one of the most influential macro investors of the modern era—first by turning Bridgewater Associates into a category-defining institution, and later by becoming a public-facing interpreter of the world’s biggest economic forces. Now, with Dalio’s formal separation from Bridgewater complete, the story investors are watching is not just about a founder exiting a firm—it’s about what happens when a market thinker who helped shape global macro discourse shifts fully into “platform mode”: publishing, advising, investing privately, and speaking with fewer institutional constraints and more philosophical range.

In recent days, Dalio has again become a headline catalyst—this time for warnings that global political and financial tensions could escalate into what he describes as “capital wars,” a framework he has used to explain how money flows, currency credibility, and geopolitical competition can collide. The message resonates because it lands at an uneasy moment for allocators: the world is balancing large government deficits, stubborn structural inflation risks, fractured trade relationships, and the growing possibility that national security priorities reshape capital markets.

But Dalio’s influence is also a function of timing. His full departure from Bridgewater has removed the last ambiguity over whether he is still “inside the machine.” In 2025, Bridgewater repurchased Dalio-related shares, and Dalio stepped down from the board—bringing an end to a multi-year transition that began with his move away from day-to-day leadership.

The end of an era at Bridgewater—and a new ownership model

Bridgewater is not just another hedge fund brand. For years it has been synonymous with large-scale macro, systematic thinking, and a research-driven culture that tried to industrialize decision-making. Dalio’s exit matters because Bridgewater’s identity was long intertwined with the idea of its founder as both architect and philosopher-in-chief.

According to Reuters, Bridgewater repurchased all Dalio-related shares and he stepped off the board as part of the final transition, with leadership emphasizing that the firm can thrive without him. Reuters also reported that Bridgewater has become employee-controlled, with co-CIO Bob Prince described as the largest individual partner after the transition.

That matters to allocators, because it reframes Bridgewater’s long-term continuity: less “founder-led” and more “institution-led.” It also comes as Bridgewater has sought to modernize its product set, including new strategies and vehicles. Reuters has described initiatives such as an AI-driven macro fund and an ETF launched with State Street Global Advisors, highlighting Bridgewater’s push to evolve beyond the traditional mega-fund playbook.

Bridgewater itself has also pointed to structural changes aimed at agility—such as capping firm assets and expanding equity ownership among employees—framing them as part of a deliberate effort to stay nimble and diversified.

Why Dalio still moves the conversation: frameworks, not predictions

Dalio’s public appeal has never been about making a single bold call. It’s about building frameworks—repeatable mental models that help investors contextualize what they’re seeing. That’s why his warnings often travel farther than the typical strategist note. They’re portable: you can apply them to bonds, currencies, commodities, equity factor rotations, and geopolitical risk.

At the 2026 World Economic Forum in Davos, Business Insider reported Dalio warning that aggressive policy choices and rising nationalism could contribute to “capital wars,” as trust dynamics around debt, capital flows, and monetary credibility come under pressure. Forbes similarly unpacked the concept in reporting that framed Dalio’s point as a warning about how countries can increasingly weaponize finance—not just trade.

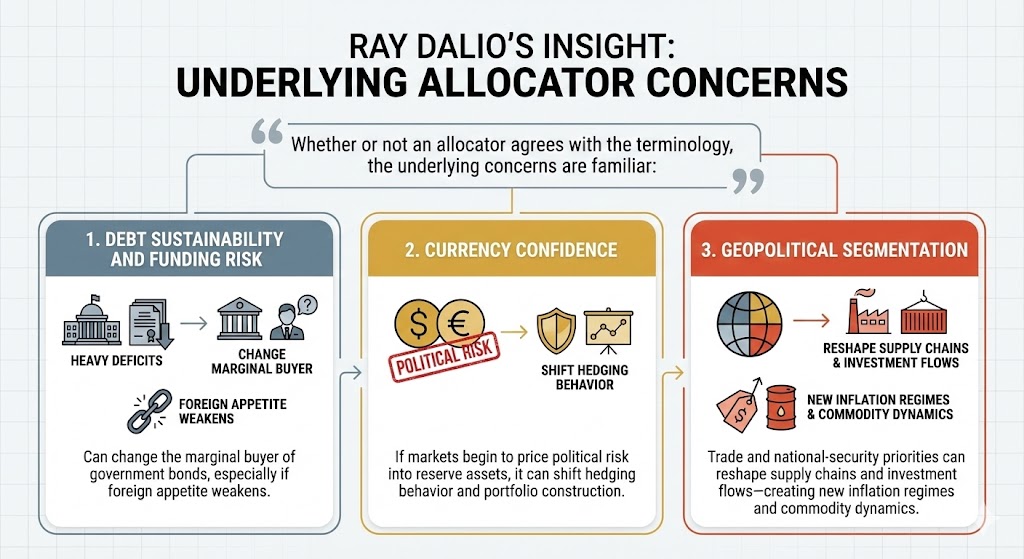

- Debt sustainability and funding risk: Heavy deficits can change the marginal buyer of government bonds, especially if foreign appetite weakens.

- Currency confidence: If markets begin to price political risk into reserve assets, it can shift hedging behavior and portfolio construction.

- Geopolitical segmentation: Trade and national-security priorities can reshape supply chains and investment flows—creating new inflation regimes and commodity dynamics.

Dalio’s framing effectively tells investors: stop thinking in quarters; start thinking in systems.

“Principles” as the operating system—and the controversy that came with it

Dalio’s influence can’t be separated from the cultural experiment he built at Bridgewater. “Principles,” his widely read management and life philosophy, popularized the firm’s emphasis on idea meritocracy and “radical transparency.”

To fans, that culture represented an attempt to remove ego from decisions and create a truth-seeking machine. To critics, it could feel intense or overly procedural. Either way, it became part of the Bridgewater mythos: a hedge fund that tried to operate like a research lab, where debate was not just encouraged but engineered.

The lasting takeaway for the investment industry is that Dalio helped normalize a style of organizational design that many alternatives firms later borrowed—data-heavy performance measurement, extreme feedback loops, and a belief that culture is a competitive advantage, not HR wallpaper.

And even as Bridgewater evolves, “Principles” has remained a standalone asset—an influence engine that extends beyond any one firm, reaching founders, executives, and allocators who now speak in Dalio-like language about systems, incentives, and decision hygiene.

What Dalio is now: founder emeritus, family-office investor, public macro narrator

With the Bridgewater chapter formally closed, Dalio’s day-to-day identity is less tied to one institution. That doesn’t mean he’s “retired” in the way the word is typically used on Wall Street. It means his portfolio of influence has diversified.

He remains closely associated with macro education through books, interviews, and public commentary—often focused on debt cycles, internal political conflict, and the long arc of empires. And he is also active in philanthropy through Dalio Philanthropies, including major ocean initiatives such as OceanX and OceanX Education—programs designed to support exploration, research, and ocean storytelling.

This matters to markets for a subtle reason: public intellectual capital can become market capital. When Dalio emphasizes a theme—debt credibility, geopolitical fracture, a changing world order—he is not just opining. He is contributing to the narrative infrastructure that shapes how allocators justify positioning.

Bridgewater’s performance resurgence—and the optics of the founder’s exit

There’s also a timing irony: Dalio’s full separation from Bridgewater has coincided with a period when Bridgewater has been regaining headline performance traction. Reuters reported that Bridgewater’s flagship Pure Alpha surged sharply in 2025, a notable rebound narrative for a fund that has been heavily scrutinized over the past decade as macro conditions shifted.

That creates a cleaner storyline for the firm: performance momentum and modernization efforts under the current leadership, without the constant market question of “Is Dalio still pulling strings?”

It also creates a cleaner storyline for Dalio: he can speak and publish without every comment being interpreted as a signal of what Bridgewater is doing in size.

The Dalio signal in 2026: what allocators should actually do

The mistake many investors make with Dalio is to treat him like a forecaster. That’s not where his value is highest. His value is in mapping the terrain. If Dalio is right that “capital wars” are an emerging feature of the regime, the practical implications show up in portfolio engineering:

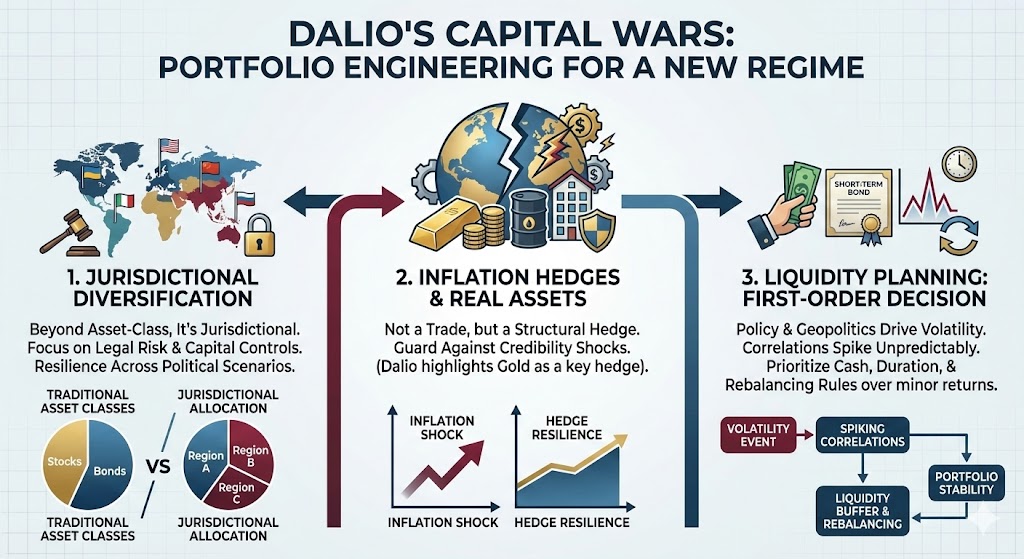

- Diversification isn’t just asset-class; it’s jurisdictional. Investors may care more about where legal risk sits, where capital controls could emerge, and what instruments are most resilient across political scenarios.

- Inflation hedges and real assets re-enter the conversation. Not as a trade, but as a structural hedge against credibility shocks. (Dalio has often pointed to gold as a hedge in public remarks, including in recent coverage.)

- Liquidity planning becomes a first-order decision. If volatility is driven by policy and geopolitics, correlations can spike unpredictably—making cash, duration design, and rebalancing rules more important than the last 50 basis points of return optimization.

In other words: Dalio’s “signal” is less about what to buy today, and more about what risks you’re underpricing if your process assumes yesterday’s stability.

The legacy: turning macro into a product—and philosophy into distribution

Ray Dalio’s legacy is unusual because it has two layers.

The first is financial: Bridgewater built a macro machine that institutionalized research and scale, and became one of the most important names in hedge funds. The second is cultural: he translated that machine into a set of ideas that traveled—about decision-making, systems, transparency, and cycles.

Now, in his post-Bridgewater chapter, Dalio’s role looks increasingly like a hybrid of investor, author, and strategic narrator—someone whose frameworks become part of the market’s shared language.

For the alternative investment industry, the lesson is straightforward: founders may leave firms, but narratives don’t retire. And when the global system is noisy—when debt, politics, and geopolitics push into the same frame—markets tend to look for interpreters who think in cycles.

Dalio has built his career on exactly that.