(HedgeCo.Net) Mike Novogratz has spent the better part of the last decade trying to make one argument stick: crypto is not simply a speculative casino—it is an emerging financial system that will eventually be integrated into mainstream markets, whether traditional finance likes it or not. Now, Galaxy is putting a fresh, very hedge-fund-shaped stake in the ground.

According to reporting on January 21, 2026, Galaxy is preparing to launch a $100 million hedge fund in Q1 2026, built to trade through crypto’s volatility rather than apologize for it. The planned portfolio construction is telling: up to ~30% in crypto tokens, with the remainder in financial-services stocks that are being reshaped by digital assets, regulation, and AI-driven market structure.

It’s a strategy that reads like a “bridge product” for a market in transition—designed to capture the upside of crypto’s growth while giving institutional allocators something they recognize: equities, hedging tools, and a framework meant to profit in both rising and falling markets.

The headline: a crypto hedge fund that’s not “only crypto”

At first glance, a $100 million crypto hedge fund might not sound radical in an industry that has seen multi-billion-dollar vehicles and ETF-scale flows in prior cycles. But Galaxy’s plan matters for two reasons.

First, the fund is launching after a sharp drawdown in the digital-asset complex, not at the euphoric peak. The Financial Times noted bitcoin had fallen materially from its prior peak and was trading around the $90,000 level in the wake of the sell-off. The point is not the precise price; it’s the timing. Launching into turbulence is an implicit claim that the next phase of crypto investing will be defined less by directional beta and more by relative value, long/short expression, and sector rotation.

Second, the fund’s structure signals that Galaxy believes the real opportunity set is now “crypto + finance,” not “crypto versus finance.” That is a crucial reframing. If tokens are the new settlement rails, then banks, brokers, payments companies, exchanges, custodians, and even legacy asset managers become investable expressions of the same theme—often with different risk profiles, volatility regimes, and regulatory sensitivities.

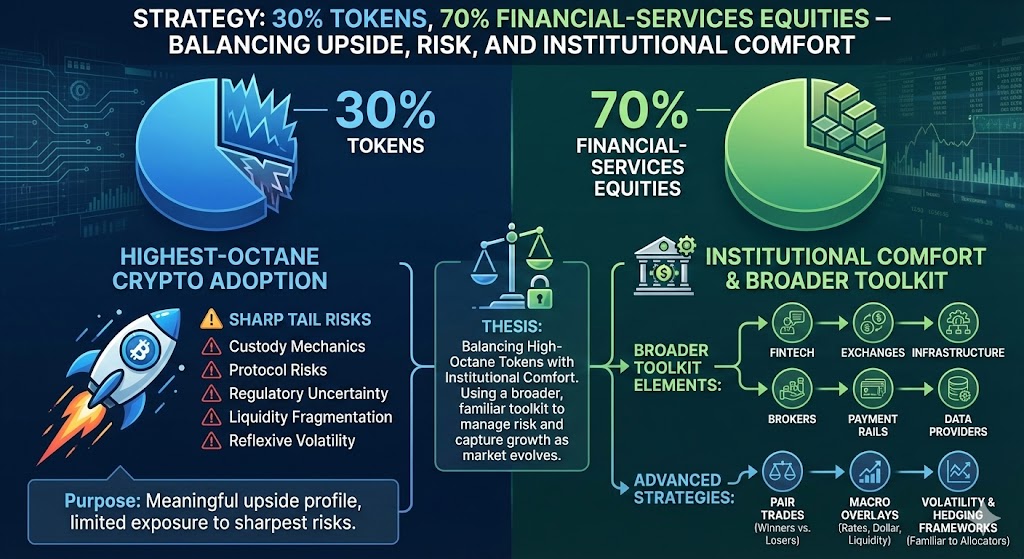

The strategy: 30% tokens, 70% financial-services equities—why that mix?

Galaxy’s reported target allocation—30% tokens / 70% financial-services stocks—isn’t just a diversification gimmick. It reflects a thesis about where “institutional comfort” is accumulating.

Tokens remain the highest-octane way to express crypto adoption, but they also carry the sharpest tail risks: custody mechanics, protocol risks, regulatory classification uncertainty, exchange liquidity fragmentation, and reflexive volatility. By limiting token exposure to a minority sleeve, the fund can keep a meaningful upside profile while making room for a much broader toolkit:

- Equities (fintech, exchanges, infrastructure, brokers, payment rails, data providers)

- Pair trades (winners vs. losers as regulation and market structure evolve)

- Macro overlays (rates, dollar strength, liquidity, risk-on/risk-off regimes)

- Volatility and hedging frameworks more familiar to traditional hedge fund allocators

This is consistent with what Galaxy has reportedly emphasized: the goal is to identify both the winners and losers as financial services get disrupted by crypto, AI, and shifting regulation.

In other words: Galaxy is trying to run a crypto hedge fund that looks less like a directional “token fund” and more like a cross-asset thematic long/short strategy—one that can plausibly sit inside an institutional alternatives bucket without triggering a governance crisis every time bitcoin sells off.

Who’s running it, and what Galaxy is really selling to investors

In the reporting, the fund’s leadership is tied to Joe Armao, who framed the opportunity around core networks like bitcoin, ethereum, and solana, while also pointing to the macro backdrop—particularly rate expectations—as a potential tailwind.

That combination—crypto networks + macro rates—sounds obvious, but it’s actually the center of gravity for how institutional allocators increasingly think about digital assets:

- Crypto is not just tech.

- Crypto is not just venture.

- Crypto is increasingly macro-sensitive—liquidity, real rates, the dollar, and risk appetite matter.

Galaxy’s pitch, implicitly, is that it can speak both languages: the token-native ecosystem and the institutional macro playbook.

The business context: Galaxy’s platform has matured, and the timing is deliberate

Galaxy is not launching this fund as a one-off experiment. It’s coming out of a platform that, by the FT’s reporting, manages about $17 billion in digital assets and has shown material earnings power (the FT cited $505 million of profit in Q3 2025).

Zoom out and you can see why Galaxy might believe this is the right moment:

- Institutional participation is broader—but uneven. Some allocators can buy ETFs; others want active strategies. Many still want “crypto exposure” without the optics of being 100% tokens.

- Regulatory pathways are clarifying in pockets, even if the global patchwork remains messy. The winners will be the platforms that can navigate compliance and product structure.

- Tokenization is creeping from concept to implementation. Galaxy itself has been increasingly active across tokenization, partnerships, and market-structure initiatives (as evidenced by its own announcements and “Our Stories” cadence).

A hedge fund vehicle that mixes tokens and financial equities is, effectively, a way to monetize that platform maturity—turning Galaxy’s research, trading, and distribution into a product that fits the “institutional middle.”

Why this matters beyond Galaxy: hedge funds are “re-rating” crypto as tradable market structure

The most important takeaway is not the fund size—it’s what the structure implies about the next iteration of crypto as a hedge fund opportunity:

- Crypto is becoming a relative-value playground. As market structure improves, spreads, basis, vol regimes, and cross-venue dislocations become more tradable in a hedge-fund sense.

- Equities are a second derivative on crypto adoption. Many of the biggest moves (up and down) in “crypto-adjacent” stocks are fundamentally about regulation, monetization models, and competitive moats—classic hedge fund territory.

- Long/short is back in fashion. After years where “beta did all the work” (especially in peak bull phases), allocators are increasingly willing to pay for managers who can navigate drawdowns and extract idiosyncratic alpha.

Galaxy’s planned design—tokens plus financial-services stocks—positions it to play all three.

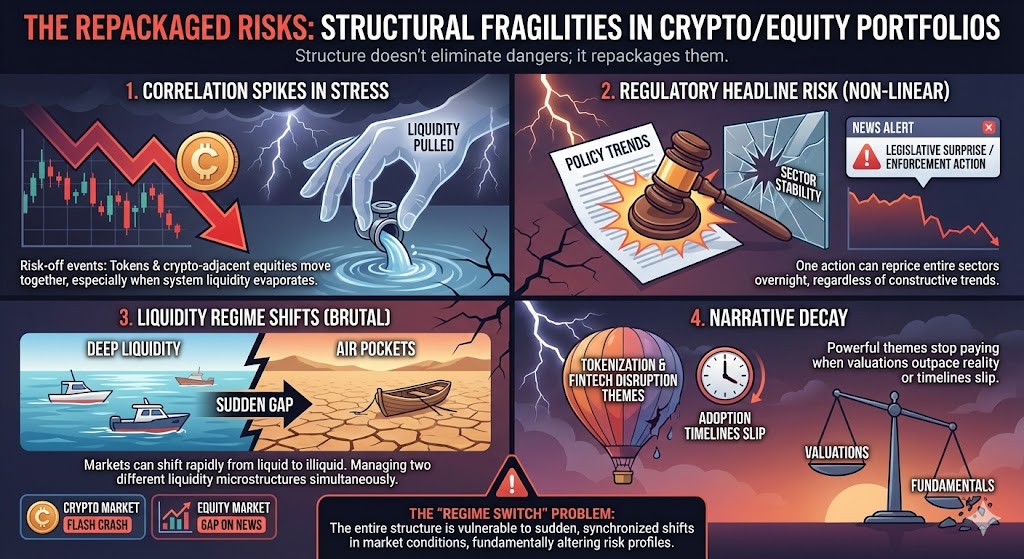

The key risks: correlation, liquidity shocks, and the “regime switch” problem

Of course, the structure doesn’t eliminate crypto’s biggest dangers; it repackages them.

- Correlation spikes in stress. In risk-off events, tokens and crypto-adjacent equities can move together, and often do—particularly when liquidity is pulled from the system.

- Regulatory headline risk remains non-linear. Even if policy trends appear constructive, one enforcement action or legislative surprise can reprice entire sectors overnight.

- Liquidity regime shifts are brutal. Crypto markets can go from deep liquidity to air pockets quickly. Equities can gap on earnings or regulatory news. A cross-asset book must manage two different liquidity microstructures simultaneously.

- Narrative decay. “Tokenization” and “fintech disruption” can be powerful themes, but themes can stop paying if valuations get ahead of fundamentals or if adoption timelines slip.

The fund’s success will hinge on whether Galaxy can consistently do what it’s implying: separate durable structural winners from “tourist capital” hype, and hedge effectively when the regime turns.

The bottom line: a product built for 2026’s reality, not 2021’s fantasy

Galaxy’s planned hedge fund looks like a bet that the market has entered a more adult phase—less about whether crypto exists, and more about how it integrates into financial services, and who captures the economics.

A 30/70 tokens-to-equities mix is essentially a statement that crypto’s growth story is now inseparable from the institutions, platforms, and regulatory scaffolding around it. If Galaxy executes, it could become a template for the next wave of “institutional crypto hedge funds”—vehicles designed not to worship volatility, but to harvest it.

And if it doesn’t? The launch will still tell the market something important: in 2026, crypto is no longer trying to replace hedge funds. Crypto is increasingly becoming something hedge funds can trade—systematically, skeptically, and at scale.