(HedgeCo.Net) BlackRock is often framed as the symbol of public-markets scale—ETFs, indexing, and global beta. But what’s trending in early 2026 is the firm’s accelerating push into private markets and alternatives, highlighted by record total assets and material private markets inflows. Reuters reported that BlackRock’s private markets business drew $12.7 billion of inflows in the quarter, while the firm targets $400 billion of cumulative private markets fundraising by 2030.

At the same time, coverage of BlackRock’s results has emphasized an alternatives AUM step-up—partly tied to its acquisition of HPS Investment Partners—reflecting how urgently BlackRock wants to deepen higher-fee, stickier product lines.

What’s happening

BlackRock closed 2025 with record total AUM (reported around $14T) and strong client inflows overall, even as profits were pressured by expenses. The strategic message has been consistent: diversify away from fee compression in public beta and build a private markets franchise that can compete with traditional alt managers.

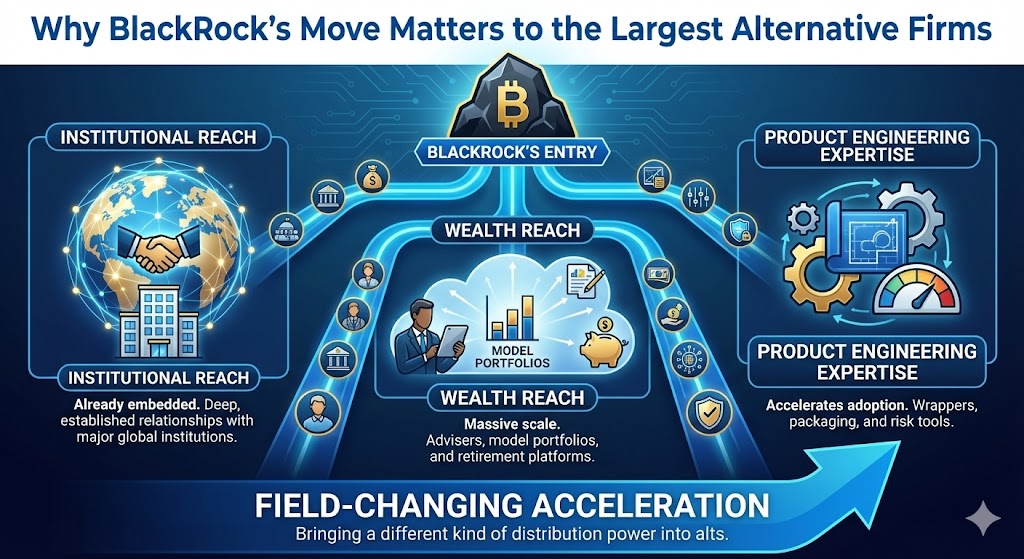

BlackRock’s move changes the field because it brings a different kind of distribution power into alts:

- Institutional reach is already embedded.

- Wealth reach (advisers, model portfolios, retirement platforms) is massive.

- Product engineering expertise (wrappers, packaging, risk tools) can accelerate adoption.

If BlackRock successfully scales private markets in semi-liquid and retirement contexts, it pressures incumbent alts firms to defend their lanes—or partner for distribution.

The “alts problem” BlackRock is solving

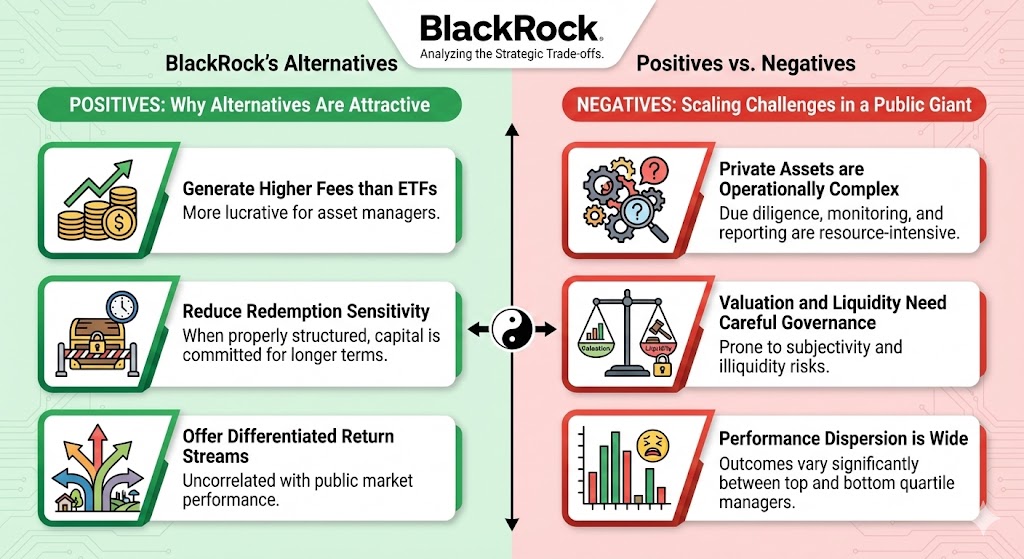

Alternatives are attractive because they:

- generate higher fees than ETFs,

- reduce redemption sensitivity when properly structured,

- and offer differentiated return streams.

But scaling alts inside a public-markets giant is hard because:

- private assets are operationally complex,

- valuation and liquidity need careful governance,

- and performance dispersion is wide.

This is why acquisitions and platform buildouts matter—BlackRock is buying depth to pair with distribution.

The private markets narrative that’s resonating now

BlackRock’s private markets outlook messaging (and peer messaging across the industry) emphasizes:

- fewer public companies,

- slower IPO cycles,

- and the rise of secondaries and private credit as core tools for liquidity and financing.

That framing is effective because it connects macro reality (public market scarcity) to product utility (private solutions). It also aligns with the biggest industry trend of 2026: private markets are no longer “alternative”—they’re becoming the financing backbone for growth, infrastructure, and transition spending.

What to watch next

- Retirement integration: If BlackRock expands private assets into retirement channels, it will accelerate the democratization curve.

- Performance proof: In alts, distribution can’t outrun returns forever—watch flagship strategies and vintage outcomes.

- Competitive response: Expect more partnerships between retirement platforms and traditional alt managers as the channel heats up.

- Operational build: servicing, reporting, and liquidity management are the quiet winners.

Bottom line: BlackRock is trying to become a top-tier alternatives firm without losing its public-markets dominance. If it succeeds, the entire competitive landscape shifts—because alts will be distributed at a scale the industry hasn’t historically seen.