(HedgeCo.Net) In one of the most consequential private-markets transactions of early 2026, Swedish alternative-asset manager EQThas agreed to acquire UK-based Coller Capital, a pioneer in private equity secondaries, in a deal valued at $3.2 billion upfront with up to $500 million in additional contingent consideration—putting the headline value at as much as ~$3.7 billion (often rounded toward ~$3.8B in market chatter).

The acquisition is more than a marquee M&A announcement. It is a clear statement about where the next decade of private markets is headed: toward liquidity solutions, portfolio rebalancing, and wealth-channel democratization, all powered by a rapidly maturing secondaries ecosystem that increasingly functions like the “capital markets desk” of private equity.

What EQT is buying—and what it signals:

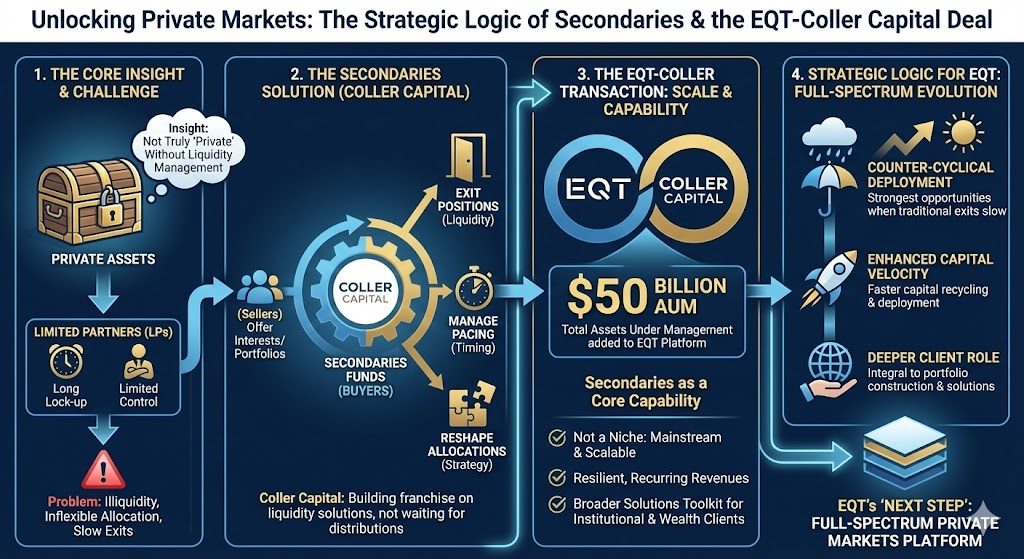

Coller Capital has built its reputation—and its franchise—on one simple insight: private assets are not truly “private” if investors can’t manage liquidity. Secondaries funds buy interests in existing private-market vehicles (and sometimes acquire portfolios directly), offering limited partners (LPs) a way to exit positions, manage pacing, and reshape allocations without waiting for traditional fund distributions.

In the announced transaction, Coller brings roughly $50 billion in total assets under management to EQT’s platform (with a meaningful portion fee-generating). That scale matters because secondaries isn’t a niche anymore—it is becoming a core capability for multi-strategy private markets firms seeking resilient, recurring revenues and a broader solutions toolkit for institutional and wealth clients.

For EQT, the logic is strategic: secondaries can deliver counter-cyclical deployment opportunities (often strongest when exits slow), enhanced capital velocity, and a deeper role in client portfolio construction. The firm framed the transaction as the “next step” in its strategic evolution into a full-spectrum private markets platform.

Deal structure: stock-funded, performance-linked, and platform-oriented

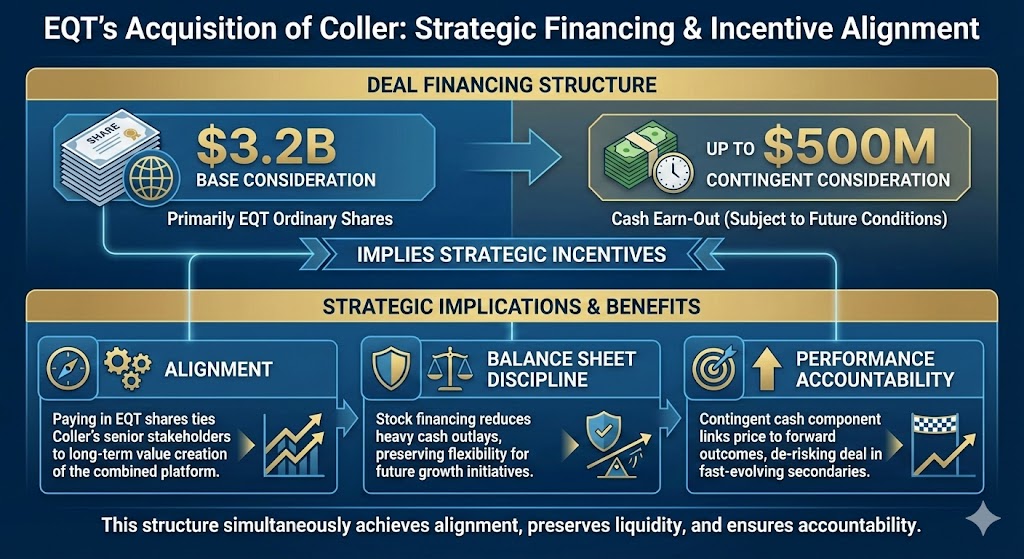

A notable feature of this acquisition is how it is financed and what that implies about incentives. Reports indicate the $3.2B base consideration is funded primarily through newly issued EQT ordinary shares, while the up to $500Mcontingent consideration is expected to be paid in cash subject to future conditions (with public reporting suggesting an earn-out style mechanism).

This structure accomplishes several things at once:

- Alignment: Paying largely in EQT shares ties Coller’s senior stakeholders to the long-term value creation of the combined platform.

- Balance sheet discipline: Stock financing reduces the need for heavy cash outlays and preserves flexibility for future growth initiatives.

- Performance accountability: The contingent component suggests that part of the price is linked to forward outcomes—often a marker of dealmaking in fast-evolving segments like secondaries.

Just as important: both firms have emphasized continuity and investment independence, a typical promise in asset-management M&A where “platform + autonomy” is the standard formula for retaining investment talent and maintaining client confidence.

Why secondaries are booming: liquidity has become a product

The strongest tailwind behind this deal is structural: private markets have scaled so dramatically that liquidity management is no longer optional.

Three forces are pushing LPs toward secondaries at record pace:

- Exit markets have been inconsistent. When IPO windows close and strategic M&A slows, distributions fall—and LPs feel the squeeze.

- Denominator effects and rebalancing needs persist. When public markets move sharply, private allocations can become mis-sized relative to policy targets, forcing action.

- Portfolio “pacing” has become sophisticated. Institutions increasingly treat secondaries as a routine portfolio tool, not a last resort.

Secondaries, in other words, has evolved from a distressed corner of the market into a solutions engine—one that delivers price discovery, customized liquidity, and risk transfer. Coller’s position as a long-standing franchise in this segment makes it an unusually strategic asset to acquire at a time when private-market clients want fewer managers, more capabilities, and integrated solutions.

The bigger play: wealth channel expansion and evergreen products

Perhaps the most important subtext is distribution. Large alternative managers are racing to build products that can fit into private banks, wealth platforms, and insurance balance sheets. Secondaries is attractive here because it can potentially offer:

- more diversified underlying exposure (vintage diversification),

- potentially shorter duration characteristics than primary commitments,

- and a narrative that resonates with wealth clients: access + liquidity management.

Public reporting around the deal points to ambitions to expand offerings for private wealth under a combined brand. This aligns with a broader industry shift: the next wave of AUM growth for mega-managers is expected to come from expanding beyond institutions into semi-liquid and evergreen structures—where the “liquidity toolkit” is a competitive advantage, not a marketing line.

What changes for LPs and the private equity ecosystem

For institutional LPs, the immediate change is market structure. Consolidation of secondaries specialists into large platforms can mean:

- more balance-sheet stability and operational scale supporting complex transactions,

- broader access to financing solutions (NAV loans, structured liquidity, preferred equity),

- and potentially tighter integration between primary investing, co-investment, and secondaries.

But it also raises practical questions LPs will watch closely:

- Conflicts and governance: How will the combined platform manage information boundaries between primary and secondary activities?

- Pricing discipline: Will large platforms maintain underwriting conservatism when competing aggressively for volume?

- Client servicing: Will secondaries remain a bespoke craft, or become a manufacturing business?

For GPs, the transaction underscores that secondaries is increasingly intertwined with fundraising strategy. Continuation vehicles, GP-led restructurings, and bespoke liquidity options are now standard features of private equity lifecycle management. A scaled secondaries platform inside a multi-strategy manager can become a powerful “capital partner” across those situations—potentially strengthening EQT’s positioning across fund types and market cycles.

Competitive implications: the race to be a full-stack private markets firm

This deal fits a clear competitive pattern: the largest managers want to become full-stack private markets franchises—with primaries, secondaries, private credit, infrastructure, real assets, and wealth-facing solutions under one roof.

EQT’s move echoes the broader thesis that private markets are converging into a solutions-driven ecosystem where capital is not just raised—it is continuously reallocated, refinanced, and repackaged. In that world, secondaries becomes the connective tissue between long-duration assets and the real-world need for liquidity, risk management, and portfolio optimization.

And for Coller, joining a scaled global platform could accelerate distribution, broaden product development, and increase reach—while giving EQT instant credibility in a strategy where track record, relationships, and underwriting culture are everything.

Risks to watch: integration, cycle timing, and the cost of scale

No asset-management acquisition is risk-free—especially in strategies where performance dispersion can be significant. Key risks include:

- Cycle sensitivity: Secondaries can benefit from dislocation, but underwriting errors in fast-rising markets can be costly.

- Cultural integration: Maintaining Coller’s specialist DNA inside a larger organization is crucial.

- Regulatory and client scrutiny: As secondaries grows, transparency, valuation rigor, and governance become more heavily examined—particularly in GP-led deals.

Still, the strategic direction is hard to miss: private markets are professionalizing into an ecosystem where liquidity is engineered—not hoped for.

Bottom line

EQT’s acquisition of Coller Capital—at $3.2B upfront and up to ~$3.7B total value—is a landmark bet on the “secondaries supercycle” and a broader shift in alternative investments: from product manufacturing to portfolio solutions.

If the 2010s were defined by private markets scale and the 2020s by private credit’s ascent, the next phase may be defined by liquidity architecture—and secondaries sits at the center of that architecture. With this transaction, EQT is positioning itself not only as an owner of assets, but as an increasingly important market-maker in private capital.