(HedgeCo.Net) The global cryptocurrency market enters the second week of January 2026 with mixed price dynamics, rising macro sensitivity, and emerging regulatory friction — painting a picture of cautious optimism layered with fresh structural undercurrents. Today’s market landscape reveals influential forces at work: traders reacting to macro data expectations, ongoing institutional inflows via regulated vehicles, and policy developments reshaping user experience in key geographies.

Bitcoin and Major Tokens in Focus

Bitcoin — the bellwether of crypto risk appetite — has rebounded toward the $92,000 level, signaling renewed interest among traders ahead of critical macro data releases, particularly U.S. inflation statistics that market participants view as potentially shaping Federal Reserve policy and liquidity conditions this year.

Despite this upside move, the broader market underscores muted risk sentiment. Recent sessions have seen BTC and other top assets hovering in narrow ranges, reflecting a cautious positioning among institutions and discretionary investors alike.

Ethereum’s price action tells a similar tale of consolidation in the mid-$3,000 range — with technical analysts highlighting resistance zones near $3,300–$3,350. Meanwhile, smaller altcoins display diverging performance across sectors: while some localized memecoins and newer protocols gain traction, overall bitcoin dominance remains a key market gauge.

Total Market Cap and Trading Activity

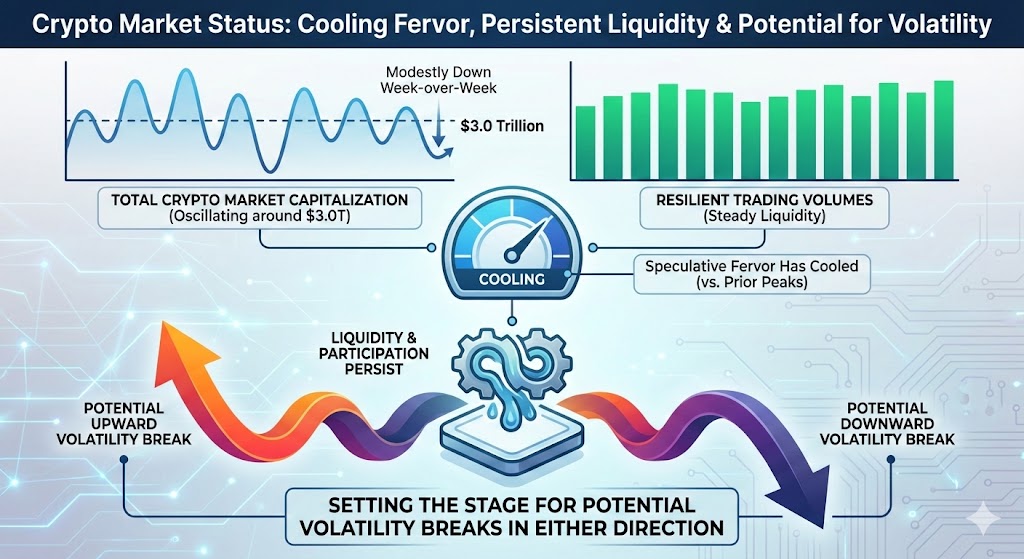

Data from major exchange aggregators shows total crypto market capitalization oscillating around $3.0 trillion, modestly down week-over-week but with resilient trading volumes. This trend highlights that while speculative fervor has cooled since prior cycle peaks, liquidity and participation persist — setting the stage for potential volatility breaks in either direction.

Market Sentiment: Cautious but Not Bearish

Industry sentiment leans toward “measured optimism.” Traders note that the crypto complex’s sensitivity to macro data — especially inflation and interest rate outlooks — remains elevated. This alignment with traditional risk assets marks a subtle evolution from earlier phases when crypto acted more independently of macro conditions.

For many investors, crypto is increasingly seen not merely as a high-growth bet but as a risk-adjusted component of diversified portfolios, especially with Bitcoin’s gradual positioning as a macro hedge.

Yet, downside risks are visible. A recent market pullback saw total crypto capitalization dip below key thresholds, with privacy-focused altcoins and certain smart-contract tokens lagging. Zcash, for example, faced notable selling pressure as traders weighed regulatory implications versus speculative upside.

Hot Coins & Trending Tokens

On crypto analytics platforms tracking real-time interest, several names are trending among retail and speculative traders, including Monero, Dolomite, and Lighter, based on recent search and interaction volumes. These tokens stand out for strong on-chain activity or speculative buzz, even as broader markets remain range-bound.

For market timing and strategy, indicators such as total value locked (TVL) in DeFi protocols, Bitcoin dominance metrics, and short-term volume differentials are being closely watched by active traders.

Institutional Traction: Crypto ETFs & Big Bank Moves

In a significant shift for investor access and perception, Morgan Stanley has filed with the U.S. Securities and Exchange Commission to launch two new crypto ETFs — including a Bitcoin trust and a Solana-linked fund. If approved, these would make Morgan Stanley the first major U.S. bank wealth manager to offer direct exposure via regulated ETFs.

Institutional appetite for regulated vehicles has grown even amid broader price volatility. Recent flows into crypto ETFs and similar derivative instruments highlight that institutional capital is not only dipping its toes but test-driving broader allocations, driven in part by client demand for secure, liquid exposure over direct custody. This dynamic is reshaping how digital assets are integrated into traditional portfolio frameworks.

Regulation & Compliance: A Double-Edged Sword

Regulatory developments are among the most impactful trends shaping today’s crypto industry — with India implementing stricter AML/KYC protocols requiring users to submit live selfies and geo-location data when onboarded by exchanges.

These enhanced identity verification measures aim to curb illicit activity and fortify compliance, yet they also raise questions regarding user privacy and access friction. Both exchanges and investors now must adapt their systems and behaviors to meet evolving standards.

Simultaneously, in the U.S., crypto policy momentum continues around market-structure legislation, with upcoming hearings focused on stablecoin oversight and regulatory clarity for DeFi operations.

Summing Up the Market Pulse

Today’s crypto narrative is one of structural evolution amid tactical consolidation:

- Bitcoin and Ethereum anchor a market still digesting macro influences and trading range dynamics.

- Institutional products and ETFs are expanding, promising easier access for wealth clients and larger pools of capital.

- Regulatory tightening across major markets (e.g., India) reflects crypto’s integration into global financial compliance regimes.

- Trending tokens and speculative interest continue to ebb and flow, driven by on-chain metrics and social momentum.

In the near term, traders and investors alike will be watching macro data releases, ETF approval processes, and regulatory milestones — the combination of which may define 2026’s market trajectory as either continued consolidation or the next breakout phase.