(hedgeCo.Net) The velvet rope guarding Wall Street’s most exclusive VIP section—the sprawling, lucrative world of alternative investments—is not just being lowered; it is being trampled.

For decades, the narrative of high finance was a tale of two cities. On one side stood institutional behemoths—sovereign wealth funds, university endowments, and pension plans—enjoying access to private equity, venture capital, private credit, and real assets. These investments, shielded from the daily volatility of the stock market, provided the ballast and alpha that created dynastic wealth. On the other side stood the retail investor, confined to the public stocks and bonds menu, relying on the traditional 60/40 portfolio that, in recent years, has often failed to deliver on its promises.

But in 2025 and heading into 2026, the single biggest trend dominating financial headlines, boardroom strategies, and advisor conferences is the aggressive “democratization”—or perhaps more accurately, the “retailization”—of alternative investments.

This seismic shift is not merely a new product trend; it is a fundamental rewiring of the investment management industry. It is driven by a convergence of necessity for investors and opportunity for asset managers, creating a gold rush to unlock the estimated $60 trillion held by individual investors globally that has, until now, had near-zero exposure to private markets.

The Death of 60/40 and the Hunt for Uncorrelated Yield

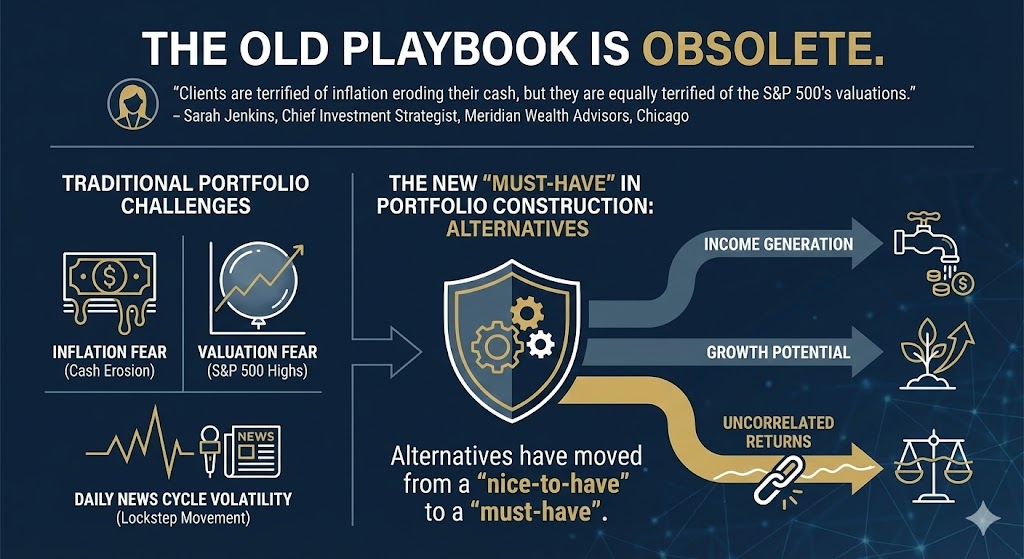

The catalyst for this trend was the brutal market environment of 2022, where stocks and bonds plunged simultaneously, shattering the illusion of safety in traditional diversification. While public markets have recovered since, the psychological scar tissue remains for both retail investors and their financial advisors.

“The old playbook is obsolete,” argues Sarah Jenkins, Chief Investment Strategist at Meridian Wealth Advisors in Chicago. “Clients are terrified of inflation eroding their cash, but they are equally terrified of the S&P 500’s valuations. They need income, they need growth, but most importantly, they need something that doesn’t move in lockstep with the daily news cycle. Alternatives have moved from a ‘nice-to-have’ to a ‘must-have’ in portfolio construction.”

In this environment, the allure of private markets—which don’t mark-to-market daily and often offer higher yields due to the “illiquidity premium”—has become irresistible to the mass affluent.

The Giants Pivot: Wall Street’s New Target Audience

The demand side is only half the story. The supply side—the titans of alternative asset management—are pivotally aggressively toward the retail channel.

Firms like Blackstone, Apollo Global Management, KKR, and Carlyle have recognized that institutional capital pools, while massive, are mature. The real growth engine lies in the fragmented, vast pool of individual wealth.

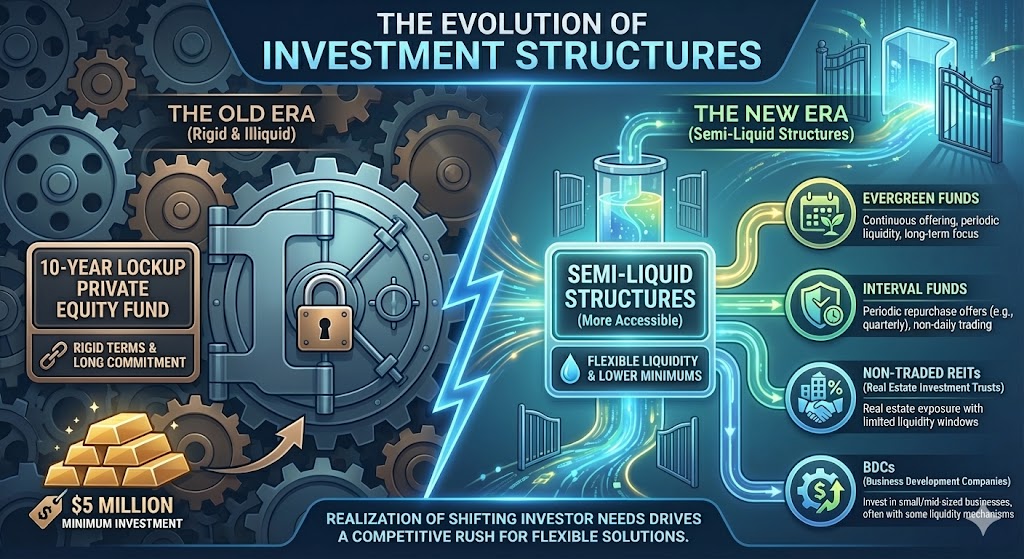

This realization has led to an arms race in product innovation. The era of the rigid, 10-year lockup private equity fund requiring a $5 million minimum investment is giving way to “semi-liquid” structures. These include evergreen funds, interval funds, and non-traded REITs (Real Estate Investment Trusts) and BDCs (Business Development Companies).

These structures offer lower minimums—sometimes as low as $25,000 or even $2,500—and provide periodic, albeit limited, liquidity windows, usually quarterly or monthly.

Blackstone’s success with BREIT (Blackstone Real Estate Income Trust) and BCRED (Blackstone Private Credit Fund) proved the model worked, demonstrating that retail money could be raised at unprecedented scale. Now, every major player is rushing to replicate that success across infrastructure, secondaries, and buyout strategies.

Apollo Global Management, in particular, has made the wealth channel a cornerstone of its 2026 strategy, focusing heavily on providing “investment grade equivalent” private credit solutions to individuals seeking yield without equity-like risk.

Private Credit: The Gateway

If democratization is the trend, Private Credit is currently its most popular product.

As traditional banks have retreated from lending due to stricter regulations, private asset managers have stepped into the void, becoming the primary lenders to middle-market companies. This asset class has exploded into a $1.7 trillion market.

For the retail investor, private credit is the perfect entry point into alternatives. It offers high-single-digit to low-double-digit yields—far exceeding public bonds or savings accounts—usually with senior secured status in the capital structure.

“Private credit is the gateway drug for retail investors entering alts,” notes David Chen, head of alternative fund research at Morningstar. “It’s easier to understand than a complex distressed debt strategy or a venture capital moonshot. It feels like a bond, pays like a high-yield stock, but without the daily price whipsaw.”

The Technological Bridge

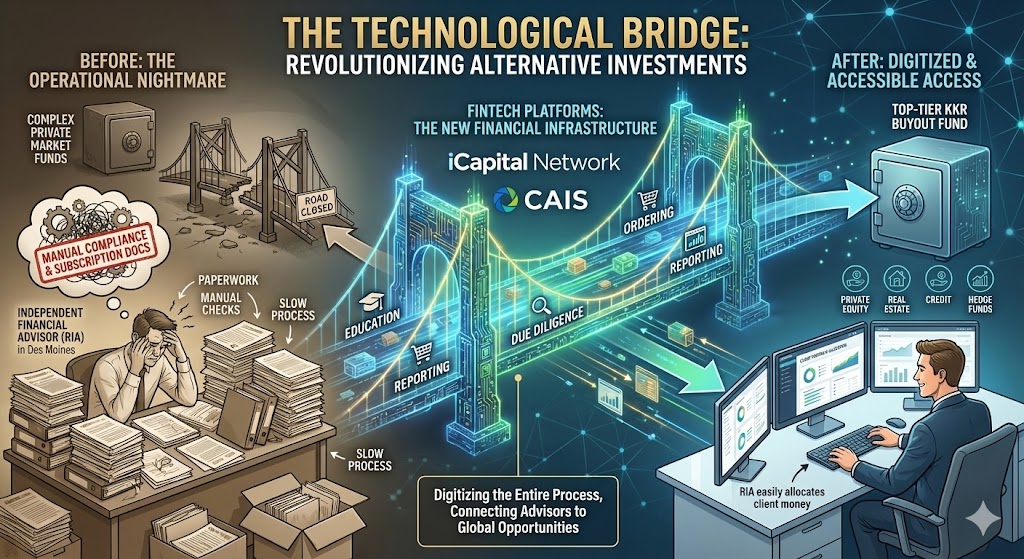

This revolution wouldn’t be possible without a new financial infrastructure. Connecting tens of thousands of independent financial advisors to complex private market funds used to be an operational nightmare of paper subscription documents and manual compliance checks.

Enter fintech platforms like iCapital Network and CAIS. These platforms have become the indispensable middlemen, digitizing the entire process. They provide the education, due diligence, ordering, and reporting infrastructure that allows a Registered Investment Advisor (RIA) in Des Moines to easily allocate a client’s money into a top-tier KKR buyout fund.

These platforms have effectively democratized access for the advisors themselves, allowing smaller firms to compete with major wirehouses in offering sophisticated portfolios.

The “Liquidity Mismatch” Nightmare

However, this trending story is not without its dark clouds. The chorus of regulators and skeptical analysts warning of the risks is growing louder.

The central concern is the “liquidity mismatch.” Retail investors are conditioned by the instant gratification of the stock market—if they want out, they can sell in seconds. Private assets, by definition, are illiquid; selling a port operator, a data center, or a private loan portfolio takes months or years.

Semi-liquid funds promise periodic redemption windows, but they also have “gates.” If too many investors try to flee at once—as happened during market jitters in late 2022 and early 2023—the funds can lower the gate, trapping investor capital.

Critics worry that unsophisticated money is flooding into complex products they don’t fully understand, lured by past performance and the prestige of big-name managers, without appreciating that their money might be stuck during a true crisis.

Furthermore, the fee structures in alternatives remain significantly higher than index funds, often involving complex layers of management fees and performance incentives that can drag on net returns for smaller investors.

A Permanent Shift in Portfolio Theory

Despite the risks, the consensus in January 2026 is that the genie is out of the bottle. The movement of retail capital into private markets is not a cyclical fad, but a structural evolution of global finance.

We are witnessing the erosion of the public-private divide. As companies stay private longer and more of the real economy is financed outside the banking system, investors who remain solely in public markets are gaining exposure to a shrinking slice of the economic pie.