(HedgeCo.Net) BlackRock TCP Capital Corp. (TCPC) experienced a dramatic 14% stock slide following disclosure of a 19% drop in fourth-quarter net asset value (NAV), underscoring mounting stress in parts of the private credit universe.

Private credit — long heralded as a resilient alternative to traditional bank lending — is now confronting the real-world implications of slower economic cycles, rising default risk, and sector-specific vulnerabilities. TCPC’s investor filing and subsequent price reaction highlight both firm-specific and systemic signals that warrant industry attention.

What Happened with TCPC?

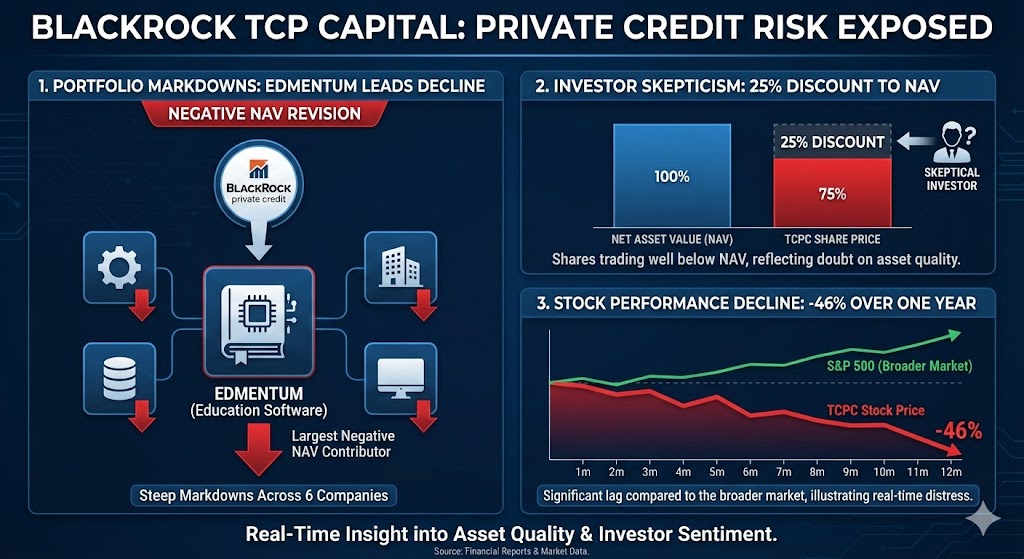

BlackRock’s private credit vehicle reported steep markdowns across six portfolio companies, with Edmentum — an education software firm — cited as the largest contributor to the negative NAV revision.

- TCPC shares are now trading at a 25% discount to NAV, illustrating investor skepticism over the fund’s asset quality and expected future performance.

- Over the past year, TCPC’s stock has declined roughly 46%, significantly lagging the broader market.

This dramatic move offers real-time insight into how credit stress is unfolding, particularly for funds focused on middle-market debt instruments.

Private Credit in Context

Private credit has exploded in popularity over recent years as banks retreated from middle-market lending. Firms such as Ares Management, Blue Owl Capital, and Blackstone have significantly expanded their private debt offerings. However, rising investor redemptions and credit stress have tempered what was once near-universal enthusiasm.

While many high-profile BDCs and non-traded private credit vehicles have honored redemption requests — a sign of structural resiliency — flows out of private credit show that sentiment has soured amid lower returns and increasing default warnings.

Broader Implications

BlackRock’s setback with TCPC arrives at a moment when credit markets are wrestling with slowing economic growth and tightening spreads. Industry watchers note that while isolated defaults don’t define an entire asset class, stress in well-known funds like TCPC tends to amplify risk perception among investors broadly.

Institutional allocators, advisors, and financial analysts are now considering:

- Whether credit discipline and underwriting standards have eroded amid earlier growth phases.

- How much capital resiliency private credit managers have if defaults rise with economic volatility.

- The impact on yield expectations, pricing power, and future fundraising.

For BlackRock — the world’s largest asset manager with a broader $14 trillion AUM footprint — the TCPC news is a reminder that even empire-level firms must navigate the complex interplay between credit quality, investor expectations, and alternative investment product structures.