(HedgeCo.Net) The global investment landscape is being quietly—but fundamentally—rewired by an unprecedented surge in artificial intelligence spending, according to top executives at Bridgewater Associates, the world’s largest hedge fund.

In a new outlook that has quickly become one of the most closely watched macro commentaries of the year, Bridgewater’s co-chief investment officers argue that artificial intelligence is no longer a narrow technology trend or sector-specific growth story. Instead, they describe AI as a capital-cycle force powerful enough to reshape asset markets, corporate behavior, and macroeconomic dynamics across the globe.

For institutional investors, the message is clear: the next phase of market leadership—and risk—will be driven less by traditional earnings cycles and more by who controls, finances, and benefits from the AI investment wave now sweeping the global economy.

From Tech Theme to Macro Engine

For much of the past decade, technology innovation has been a recurring driver of equity market returns. But Bridgewater’s CIOs draw a sharp distinction between prior tech cycles and the current AI buildout.

Unlike earlier software-driven waves, today’s AI expansion is capital-intensive, infrastructure-heavy, and deeply intertwined with real-world constraints—energy, data centers, specialized semiconductors, labor, and supply chains.

“This is not just about better apps or incremental productivity,” Bridgewater’s leadership suggests. “AI spending is becoming one of the largest coordinated capital investment efforts in modern history.”

Companies are not merely experimenting with AI. They are rewriting capital expenditure plans, reallocating budgets away from legacy systems, and committing billions of dollars to computing capacity, cloud infrastructure, and proprietary data pipelines. This surge in spending, Bridgewater argues, is now a dominant force shaping corporate balance sheets and investor returns.

The Scale of the AI Spending Boom:

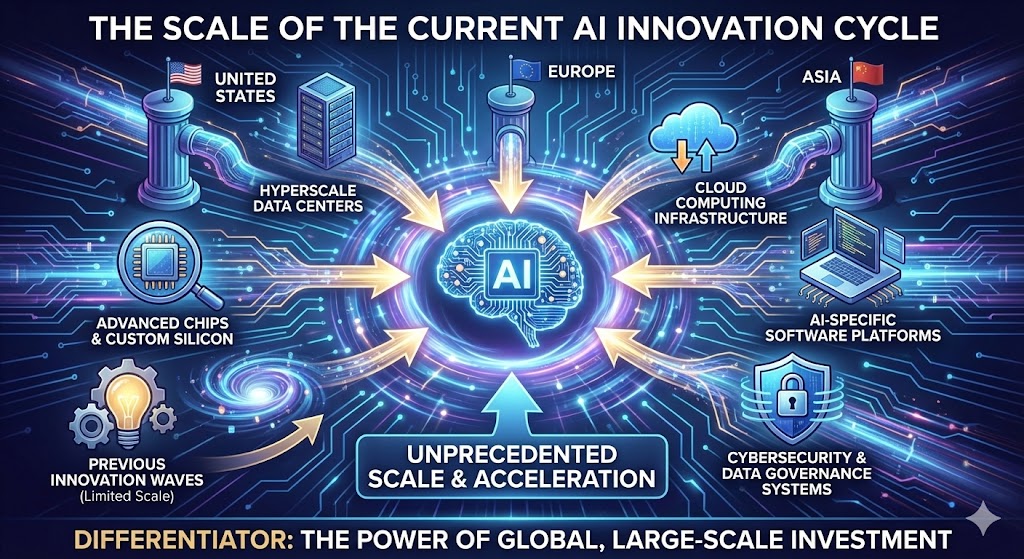

What differentiates the current AI cycle from previous innovation waves is scale.

Across the United States, Europe, and Asia, large corporations are accelerating investments in:

- Hyperscale data centers

- Advanced chips and custom silicon

- Cloud computing infrastructure

- AI-specific software platforms

- Cybersecurity and data governance systems

These investments are no longer discretionary. In many industries—from finance and healthcare to manufacturing, logistics, and energy—AI adoption is becoming a competitive necessity rather than an optional enhancement.

Bridgewater’s CIOs emphasize that this dynamic creates a powerful feedback loop. As early adopters gain efficiency and pricing advantages, competitors are forced to follow, further intensifying capital spending across sectors.

The result is a structural shift in how capital flows through the global economy.

Market Impact: Why Equities Have Stayed Resilient

One of the most notable implications of Bridgewater’s analysis is how AI spending helps explain recent market behavior.

Despite persistent concerns around inflation, geopolitical risk, and monetary tightening, equity markets—particularly in the United States—have remained remarkably resilient. Bridgewater suggests that this resilience is not accidental.

AI-driven capital expenditure is acting as a powerful growth offset, supporting revenues, employment, and investment even as other areas of the economy slow.

Technology and semiconductor stocks have been the most visible beneficiaries, but Bridgewater cautions against viewing AI as a narrow “tech trade.” Instead, the firm points to spillover effects across industrials, utilities, energy, and financial services—sectors that supply or finance the AI buildout.

In this framework, market leadership is no longer defined solely by consumer demand or cyclical recovery. It is increasingly shaped by who sits upstream in the AI investment chain.

Inflation, Energy, and the Risk of Overheating

While Bridgewater’s outlook underscores the growth-supportive nature of AI spending, it also carries a clear warning: capital intensity comes with macro consequences.

AI infrastructure requires enormous energy inputs, specialized hardware, and skilled labor—resources that are already in limited supply. Bridgewater’s CIOs note that this dynamic raises the risk of localized inflation pressures, particularly in energy markets and advanced manufacturing.

Electricity demand from data centers is surging. Competition for high-performance chips remains intense. Skilled engineers and AI specialists command premium compensation.

If AI investment continues to accelerate unchecked, Bridgewater warns, it could contribute to renewed inflationary pressures—even as central banks attempt to normalize policy after years of extraordinary intervention.

For investors, this introduces a more complex environment: one where growth and inflation risks coexist, and where traditional correlations between asset classes may become less reliable.

A New Capital Cycle—and New Winners

At the heart of Bridgewater’s thesis is the idea that AI represents a new capital cycle, comparable in scale to industrial electrification, the rise of the internet, or post-war infrastructure booms.

But as with all major capital cycles, the benefits will not be evenly distributed.

Bridgewater emphasizes that capital allocation discipline will be critical. Companies that invest strategically—balancing innovation with return on invested capital—stand to gain durable advantages. Those that overbuild, misallocate resources, or chase hype risk long-term underperformance.

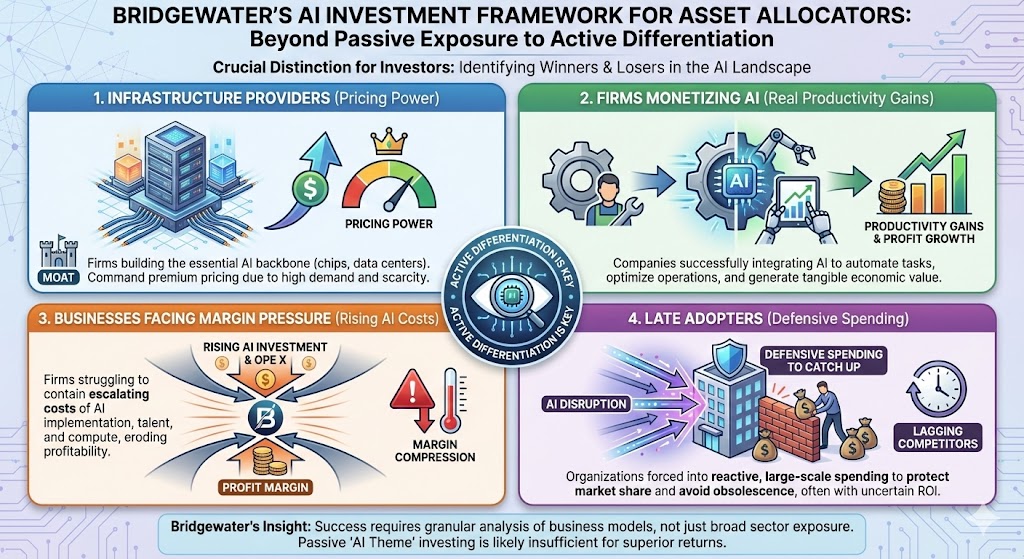

For asset allocators, this distinction is crucial. Passive exposure to “AI themes” may not be sufficient. Instead, Bridgewater suggests that investors must differentiate between:

- Infrastructure providers with pricing power

- Firms that monetize AI through real productivity gains

- Businesses that face margin pressure from rising AI costs

- Late adopters forced into defensive spending

This dynamic introduces greater dispersion within and across sectors—creating opportunities for active management, but also raising the stakes for capital misallocation.

Implications for Fixed Income and Credit Markets

While much of the AI discussion has focused on equities, Bridgewater’s analysis extends deeply into fixed income and credit markets.

AI-driven capital spending is altering corporate leverage profiles, refinancing needs, and cash-flow expectations. Companies funding large AI investments may increase borrowing, particularly in private credit markets, while others benefit from stronger balance sheets tied to AI-linked revenue streams.

This divergence, Bridgewater suggests, will place new pressure on credit analysis. Traditional metrics may fail to capture how AI investment affects long-term competitiveness and default risk.

For private credit, leveraged finance, and structured products, the AI cycle introduces both opportunity and risk—especially if economic growth slows while capital commitments remain elevated.

A Strategic Shift for Institutional Portfolios

Perhaps the most consequential takeaway from Bridgewater’s commentary is its implication for institutional portfolio construction.

If AI spending truly represents a durable macro driver, then portfolios built around traditional sector allocations may be increasingly misaligned with underlying economic forces.

Bridgewater’s CIOs imply that investors should think in terms of capital flows, supply constraints, and systemic investment themes, rather than legacy classifications.

This approach favors:

- Exposure to AI infrastructure and enabling assets

- Selective risk in companies with defensible AI economics

- Inflation-aware positioning tied to energy and commodities

- Active strategies capable of navigating dispersion

It also reinforces the importance of diversification across strategies, geographies, and asset classes as correlations evolve.

The Bigger Picture: AI as an Economic Reordering

Beyond markets, Bridgewater frames AI spending as a broader economic reordering.

Productivity gains may eventually offset costs, but in the near term, AI is driving a re-prioritization of capital at a global scale. Governments, corporations, and investors are all competing to secure a position in what is increasingly viewed as a foundational technology.

That competition—played out through budgets, supply chains, and financial markets—is what makes AI such a powerful macro force today.

As Bridgewater’s CIOs make clear, the question for investors is no longer whether AI matters. It is how deeply it reshapes the structure of markets—and who is positioned to benefit when this capital cycle matures.

Bottom Line

Bridgewater’s warning is not a call for uncritical enthusiasm, nor a prediction of imminent disruption. It is a reminder that markets are being driven by forces larger than quarterly earnings or policy headlines.

AI spending has crossed a threshold. It is now influencing growth, inflation, capital allocation, and asset pricing across the global financial system.

For professional investors, ignoring that reality may be the greatest risk of all.