(HedgeCo.Net). For more than a decade, the hedge fund industry has lived in a paradox: indispensable to institutional portfolios, yet perpetually questioned in public markets. Fees were debated, “alpha drought” narratives came and went, and investors periodically swung between love and skepticism. Now, Hedge Fund Research (HFR) has put a hard number on the industry’s latest turning point: global hedge fund capital has surged past the historic $5 trillion mark for the first time, ending 2025 at a record $5.15 trillion.

This is not just a round-number headline. It is a signal that the hedge fund business model—particularly at scale—has reasserted itself as a core allocation choice for institutions navigating a market environment defined by regime shifts: inflation that never fully returned to its pre-2020 complacency, higher-for-longer rate uncertainty, geopolitical volatility, and an investment landscape increasingly shaped by AI-driven capital spending and rapid thematic rotations.

The Numbers Behind the $5.15 Trillion Milestone

HFR’s year-end data frames the milestone as the culmination of nine consecutive quarters of capital growth, with a powerful finish in the fourth quarter. In 4Q25, industry capital rose $178.9 billion, driven by $134.1 billion in performance-based gains and $44.8 billion in net inflows.

Zooming out, the annual picture is even more striking. For full-year 2025, total industry capital increased by a record $642.8 billion, comprised of $527.0 billion in performance gains and $115.8 billion in net inflows—which HFR notes is the strongest calendar year of inflows since 2007.

Two conclusions follow immediately:

- Performance did the heavy lifting, but investors reinforced the move with substantial new money.

- The inflow figure is not “incremental.” It is cyclical-level capital formation—suggesting allocators are not merely rebalancing; they are meaningfully increasing target weights.

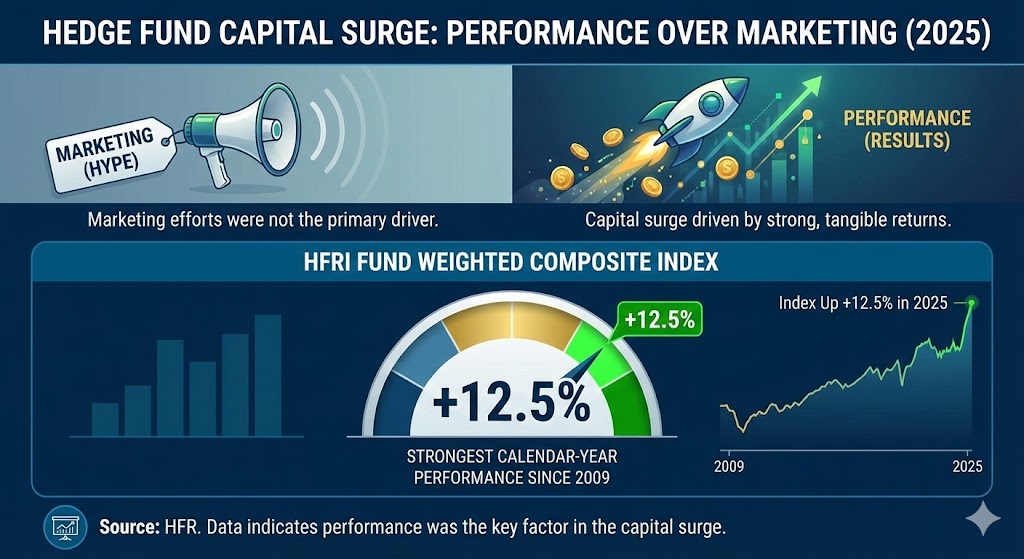

Performance: The Best Year Since 2009

The capital surge was not built on marketing alone. According to HFR, hedge funds delivered their strongest calendar-year performance since 2009, with the HFRI Fund Weighted Composite Index up +12.5% in 2025.

Beneath the headline index, the strategy dispersion reveals where managers found traction:

- Equity Hedge (Total): +17.1% in 2025

- Event-Driven (Total): +10.9%

And at the sub-strategy level, the year rewarded sector-specific positioning:

- HFRI EH: Healthcare: +33.9%

- HFRI EH: Energy/Basic Materials: +21.4%

That combination—strong broad performance with clear pockets of leadership—matters. It implies the industry did not simply ride one macro wave; it captured returns across multiple drivers, from corporate activity to sector rotations to thematic micro-cycles.

Where the Assets Are Concentrated: Strategy Buckets and Scale Wins

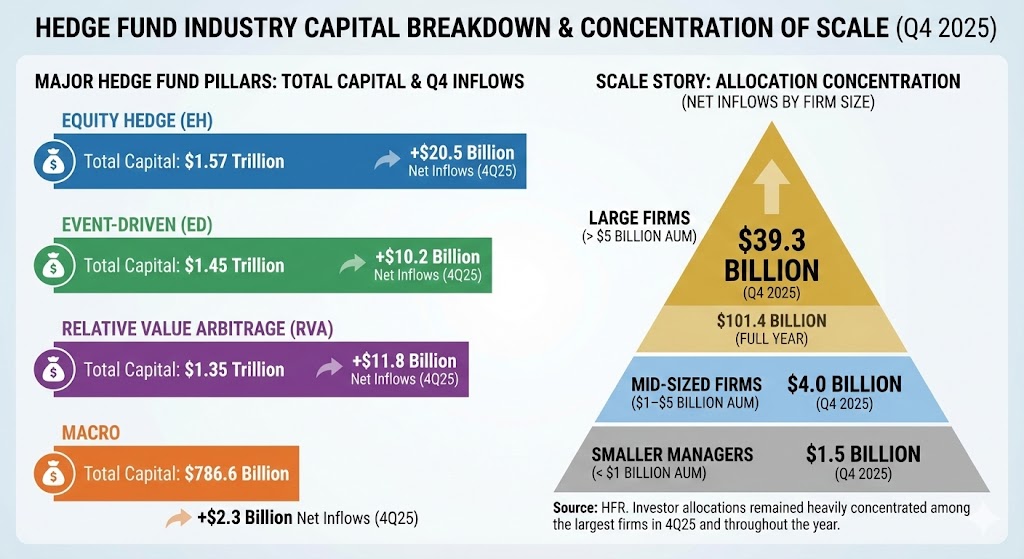

HFR’s breakdown of capital by strategy shows just how large the major hedge fund “pillars” have become:

- Equity Hedge (EH): $1.57 trillion total capital at year-end, with $20.5 billion net inflows in 4Q25

- Event-Driven (ED): $1.45 trillion, with $10.2 billion net inflows in 4Q25

- Relative Value Arbitrage (RVA): $1.35 trillion, with $11.8 billion net inflows in 4Q25

- Macro: $786.6 billion, with $2.3 billion net inflows in 4Q25

But the bigger story is not only strategy—it is scale.

HFR reports that investor allocations remained concentrated among the largest firms. In 4Q25, managers with over $5 billion AUM captured $39.3 billion in net inflows, compared with $4.0 billion for mid-sized firms ($1–$5B) and $1.5 billion for smaller managers (under $1B). For the full year, large firms absorbed $101.4 billion in inflows, dwarfing the totals for mid-sized and smaller peers.

This is a defining feature of the modern hedge fund market: allocators are not simply buying “hedge funds.” They are buying institutional-grade platforms—infrastructure, risk systems, liquidity management, talent depth, and diversified books that can evolve quickly as the opportunity set shifts.

Why Now: Volatility, AI Capital Cycles, and a World That Refuses to Normalize

HFR’s commentary on the quarter reads like a description of today’s market tape: managers navigated a volatile fourth quarter where risk sentiment oscillated between “risk-on” and “risk-off” across thematic micro-cycles.

Kenneth J. Heinz, President of HFR, attributes the industry’s capital growth to a combination of forces including strategic M&A, geopolitical uncertainty, uncertainty around lower interest rates/inflation/Fed leadership, and unprecedented investments in AI infrastructure.

In other words, hedge funds benefited from an environment where flexibility is a feature—not a luxury. When markets rapidly rotate between growth and defensives, when dispersion returns at the sector level, and when policy and geopolitics become tradeable variables, hedged structures can look more attractive than static long-only exposures.

Hedge Funds vs. Private Equity: Liquidity Becomes a Competitive Advantage

Another important backdrop is the relative appeal of hedge funds versus illiquid private markets. In late 2025, the Financial Times highlighted that hedge funds attracted renewed enthusiasm as some investors grew more cautious about private equity—where slower deal activity and liquidity constraints have complicated exits and portfolio management.

This does not mean private equity is “over.” But it does underscore something allocators have re-learned repeatedly: during uncertain macro periods, liquidity has a premium, and vehicles that can dynamically reposition can attract larger marginal inflows.

How We Got Here: From “Almost $5 Trillion” to “Above $5 Trillion”

The $5T milestone was not a surprise spike; it was a trend. In October 2025, Reuters reported that industry capital had climbed to almost $5 trillion by the third quarter, reflecting sustained inflows and a growing number of funds. HFR’s January 2026 data shows that the industry then pushed decisively past the milestone into year-end, closing at $5.15 trillion.

That sequence matters because it indicates momentum: asset growth was already in motion before the year-end close, and the fourth quarter effectively “sealed” the record.

What This Means for 2026: The Institutionalization of Uncertainty

HFR’s own outlook is blunt: “the only certainty is uncertainty,” and hedge fund positioning is likely to remain tactical and opportunistic as managers execute across strategies. That framing may sound like commentary boilerplate, but in 2026 it is increasingly operational reality.

Three implications stand out:

- Mega-platform dominance is likely to intensify. If the largest firms keep capturing the bulk of net inflows, the gap in resources, data, and talent will widen—potentially reshaping competition and fee dynamics.

- Sector and theme dispersion may remain a hedge fund tailwind. The 2025 leadership from healthcare and energy/basic materials inside Equity Hedge suggests that fundamental, research-driven differentiation is being rewarded again.

- The hedge fund value proposition is shifting from “pure alpha” to portfolio engineering. Institutions are not only chasing returns—they are paying for liquidity, convexity, and the ability to navigate regime change without being forced sellers.

Bottom Line

Crossing $5 trillion is not merely a celebratory statistic for the hedge fund industry. It is evidence that investors—pensions, institutions, family offices, sovereign wealth, and wealthy individuals—are responding to today’s market structure by leaning into strategies built for complexity.

Hedge funds are not “back” in the nostalgic sense. They are evolving into something more structural: an allocation category positioned for a world where volatility is episodic, narratives shift quickly, and capital cycles—especially those tied to AI infrastructure and geopolitics—create opportunity sets that reward speed, hedging, and sophistication.

If 2025 was the year the industry reclaimed confidence, 2026 may be the year it tests whether this growth is cyclical—or durable.