(HedgeCo.Net) In a private markets environment increasingly defined by scale, selectivity, and balance-sheet discipline, Goldman Sachs has once again underscored its strategic positioning with a $2.8 billion co-investor transaction—a deal that highlights how the world’s largest financial institutions are reshaping capital deployment in 2026.

While co-investments have long been a feature of private equity and alternative investing, transactions of this size and prominence are no longer merely tactical tools. Instead, they are becoming core instruments for capital formation, risk management, and investor alignment. Goldman’s latest deal illustrates how elite asset managers are leveraging co-invest structures to meet investor demand, accelerate execution, and concentrate exposure in their highest-conviction opportunities.

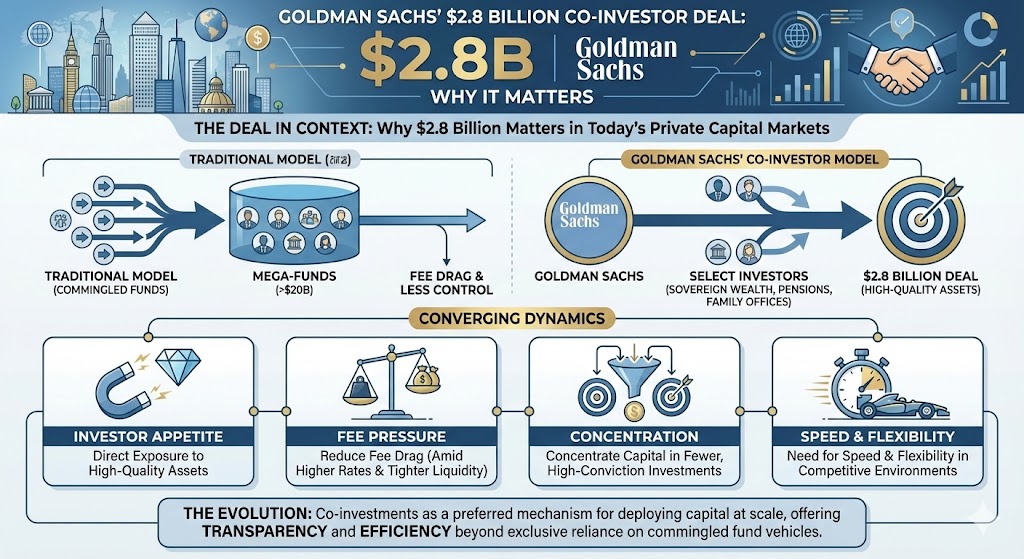

The Deal in Context: Why $2.8 Billion Matters

A $2.8 billion co-investor deal is significant not simply because of its size, but because of what it represents in today’s private capital markets. In an era where mega-funds routinely exceed $20 billion and institutional allocators demand both transparency and efficiency, co-investments have evolved into a preferred mechanism for deploying capital at scale.

For Goldman Sachs, the transaction reflects several converging dynamics:

- Investor appetite for direct exposure to high-quality assets

- Pressure to reduce fee drag amid higher interest rates and tighter liquidity

- Desire to concentrate capital in fewer, higher-conviction investments

- Need for speed and flexibility in competitive deal environments

Rather than relying exclusively on commingled fund vehicles, Goldman structured the transaction to allow select investors—often sovereign wealth funds, pensions, and large family offices—to participate directly alongside the firm.

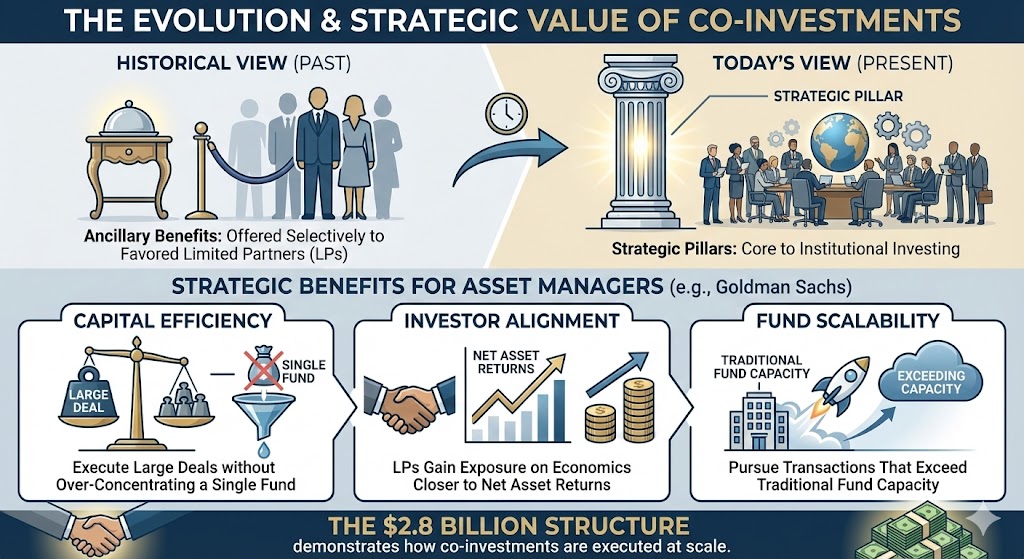

Co-Investments: From Accessory to Strategic Pillar

Historically, co-investments were viewed as ancillary benefits—often offered selectively to favored limited partners. Today, they have become strategic pillars of institutional investing.

For asset managers like Goldman Sachs, co-investments serve multiple purposes:

- Capital efficiency: Large deals can be executed without over-concentrating a single fund

- Investor alignment: LPs gain exposure on economics closer to net asset returns

- Fund scalability: Co-investments enable firms to pursue transactions that exceed traditional fund capacity

The $2.8 billion structure demonstrates how co-investments are now designed intentionally—planned early in the deal process rather than assembled at the eleventh hour.

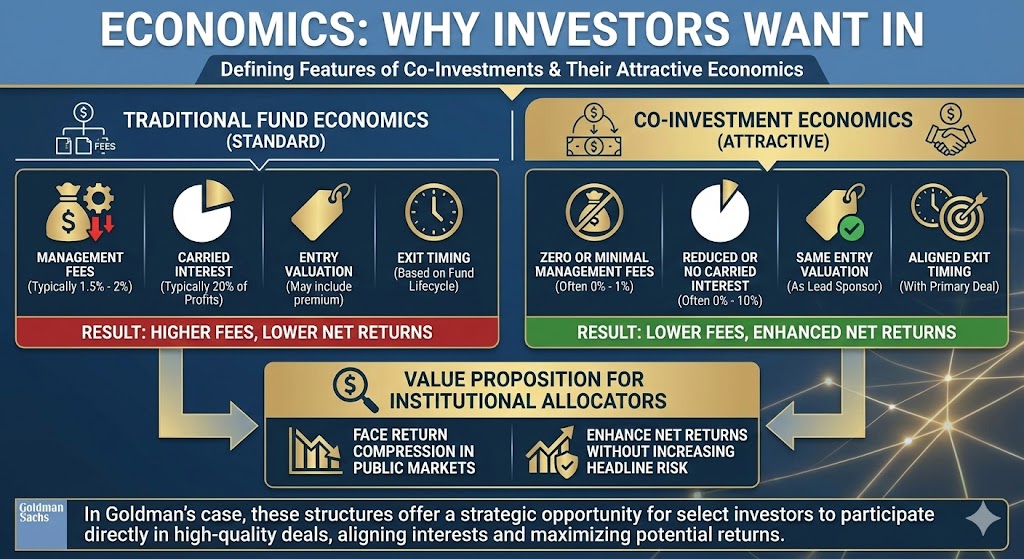

Economics: Why Investors Want In

One of the defining features of co-investments is their attractive economics relative to traditional fund commitments. While exact terms vary, large co-investor deals typically offer:

- Zero or minimal management fees

- Reduced or no carried interest

- Same entry valuation as the lead sponsor

- Exit timing aligned with the primary deal

For institutional allocators facing return compression in public markets, these structures offer a rare opportunity to enhance net returns without increasing headline risk.

In Goldman’s case, the firm’s brand, sourcing capabilities, and track record significantly lower the perceived execution risk—making the economics especially compelling for large LPs willing to write nine-figure checks.

Why Goldman Sachs Is Uniquely Positioned

Goldman Sachs occupies a distinctive position at the intersection of investment banking, asset management, and principal investing. That platform advantage allows the firm to source opportunities that few competitors can replicate.

Key differentiators include:

- Proprietary deal flow generated through advisory and financing relationships

- Deep sector specialization across technology, infrastructure, credit, and real assets

- Global capital relationships with the world’s largest allocators

- Operational resources to manage complex, large-scale transactions

In a $2.8 billion co-investor deal, credibility is currency. Investors must trust not only the asset, but also the governance, reporting, and long-term stewardship of capital. Goldman’s institutional reputation lowers friction and accelerates commitment timelines—often a decisive advantage in competitive auctions.

A Reflection of the “High-Conviction Era”

The broader private markets landscape in 2026 is increasingly defined by what many investors describe as the “high-conviction era.” Rather than spreading capital thinly across dozens of portfolio companies, leading firms are concentrating capital in fewer deals with clearer strategic narratives.

Goldman’s co-investor transaction aligns squarely with this trend:

- Larger single-asset exposure

- More active ownership

- Deeper operational involvement

- Clearer exit pathways

This shift is partly structural and partly cyclical. Higher interest rates have raised the cost of capital, forcing managers to be more selective. At the same time, investors are demanding fewer but better ideas, supported by data, operational plans, and downside protection.

Risk Allocation and Governance

Despite their appeal, co-investments introduce distinct governance considerations. Investors typically accept:

- Limited control rights

- Reliance on sponsor decision-making

- Reduced diversification

- Longer holding periods

In exchange, they gain exposure to assets that may never be accessible through traditional fund channels.

Goldman’s ability to structure governance frameworks that balance sponsor control with investor protections—board representation, information rights, and aligned exit incentives—has been central to its success in executing deals of this magnitude.

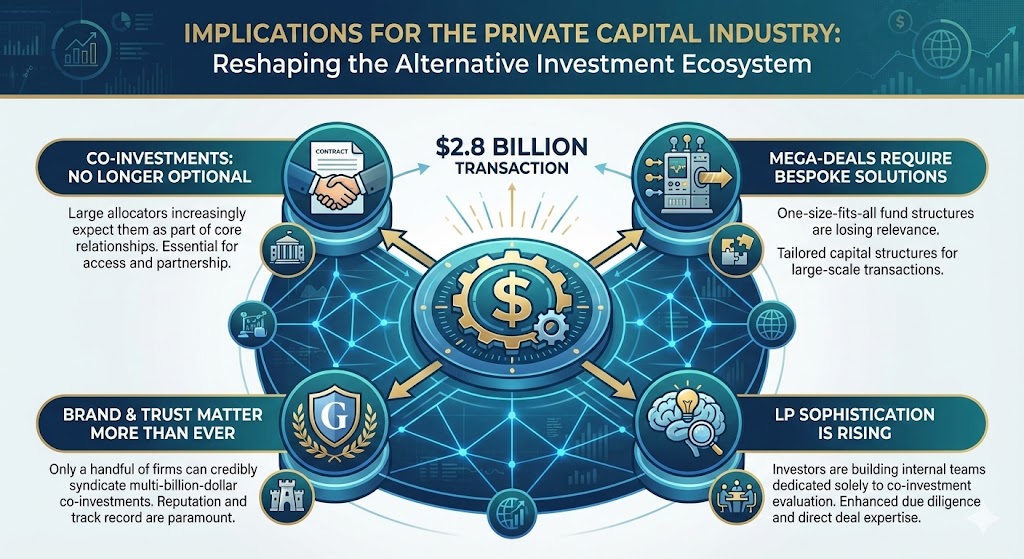

The $2.8 billion transaction has implications well beyond Goldman Sachs. It signals broader shifts that are reshaping the alternative investment ecosystem:

- Co-investments are no longer optional

Large allocators increasingly expect them as part of core relationships. - Mega-deals require bespoke capital solutions

One-size-fits-all fund structures are losing relevance. - Brand and trust matter more than ever

Only a handful of firms can credibly syndicate multi-billion-dollar co-investments. - LP sophistication is rising

Investors are building internal teams dedicated solely to co-investment evaluation.

The Competitive Landscape Heats Up

Goldman is not alone in expanding its co-investment footprint. Across Wall Street and private markets, leading firms are racing to deepen LP relationships by offering differentiated access.

However, the bar is rising. Investors now expect:

- Early visibility into deal pipelines

- Clear articulation of why co-capital is needed

- Demonstrated sponsor commitment alongside LP capital

Goldman’s deal reflects this new equilibrium—where co-investments are not favors, but strategic partnerships.

Looking Ahead: What This Signals for 2026 and Beyond

As private markets continue to mature, deals like Goldman Sachs’ $2.8 billion co-investor transaction are likely to become more common—but more selective. Not every deal will qualify, and not every investor will gain access.

For Goldman, the transaction reinforces its evolution from traditional asset manager to capital solutions provider—one capable of tailoring structures to meet the precise needs of both assets and investors.

For the broader industry, the message is clear:

The future of private capital will be defined not just by how much money firms raise, but how intelligently they deploy it.

In that future, co-investments are no longer sidecars. They are engines—and Goldman Sachs is firmly in the driver’s seat.