(HedgeCo.Net) After more than a year in which U.S. equity markets appeared narrowly dependent on a handful of mega-cap names, a subtle but important shift is underway. As earnings season accelerates, investors are watching a critical test: whether blockbuster results from the largest companies can lift the broader market rather than overshadow it. This week’s slate of mega-cap earnings may provide the clearest signal yet that the rally is evolving from concentration to participation.

The stakes are high. Mega-cap stocks—particularly in technology, communications, and consumer platforms—have driven a disproportionate share of index performance since 2023. Their balance sheets, pricing power, and exposure to structural growth themes like artificial intelligence have made them safe havens in an uncertain macro environment. But concentration also bred skepticism: could markets advance sustainably if gains remained locked within a narrow leadership cohort?

Now, the answer may be changing.

From Concentration to Confirmation

The defining question of this earnings season is no longer whether mega-cap firms can beat expectations. That has become almost routine. Instead, markets are asking something more nuanced: can mega-cap strength validate, rather than crowd out, the broader equity recovery?

Recent market behavior suggests that may already be happening. Small- and mid-cap stocks have begun to outperform on a relative basis. Cyclical sectors—industrials, financials, and select consumer segments—are attracting renewed capital. Market breadth indicators have quietly improved, with a greater percentage of stocks trading above key moving averages.

Mega-cap earnings this week could act as the accelerant. Strong results would reinforce confidence in corporate profitability, capital expenditure trends, and demand durability—conditions that benefit not just the largest firms, but their suppliers, competitors, and adjacent industries.

In other words, mega-caps may no longer be the only growth story. They may be the proof point.

Why Mega-Caps Still Matter—Even as Leadership Broadens

Despite the narrative around diversification, mega-cap companies remain foundational to market psychology. They account for a substantial share of index earnings, cash flow generation, and capital investment. Their outlooks shape expectations for technology spending, labor markets, and global demand.

This week’s earnings reports arrive at a delicate moment. Inflation has moderated but not disappeared. Central banks remain cautious. Investors are balancing optimism about growth against lingering concerns about rates and geopolitics. In that environment, mega-caps function as anchors.

If these firms demonstrate sustained revenue growth, margin discipline, and forward-looking investment—particularly in AI infrastructure, cloud services, and enterprise software—it sends a signal that corporate America remains resilient. That signal tends to ripple outward, improving risk appetite across asset classes.

Crucially, markets are not demanding perfection. What investors want is confirmation: that earnings momentum is durable, that capital spending is rational rather than speculative, and that guidance reflects confidence without excess.

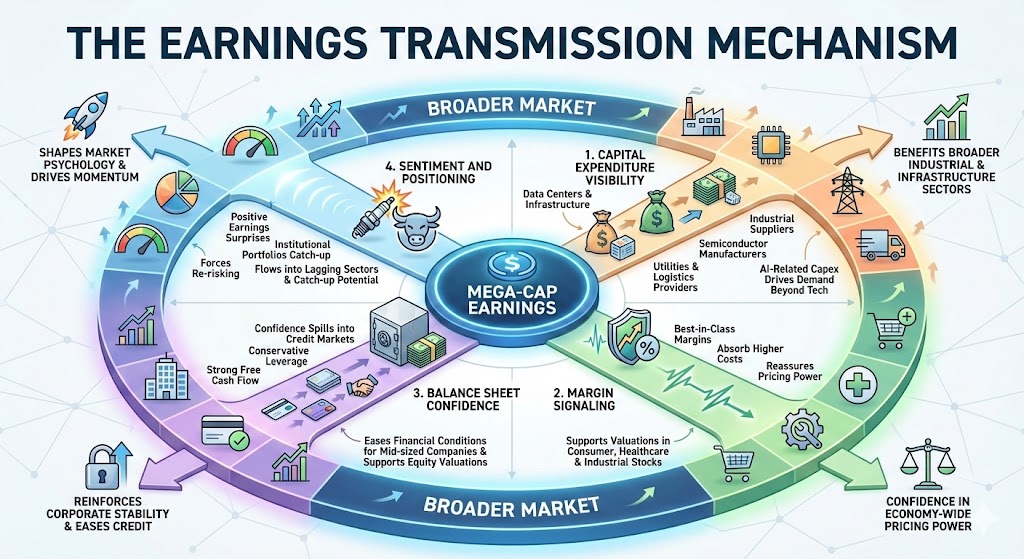

Mega-cap earnings influence the broader market through several channels:

1. Capital Expenditure Visibility

Large technology and platform companies sit at the center of complex ecosystems. When they increase spending—on data centers, logistics, hardware, or software—it benefits industrial suppliers, semiconductor manufacturers, utilities, and infrastructure providers. AI-related capex is particularly powerful, as it drives demand well beyond the tech sector.

2. Margin Signaling

Mega-caps tend to operate with best-in-class margins. When they demonstrate an ability to absorb higher input costs or labor expenses, it reassures investors that pricing power still exists across the economy. That supports valuations in consumer, healthcare, and industrial stocks that face similar pressures.

3. Balance Sheet Confidence

Strong free cash flow and conservative leverage reinforce confidence in corporate balance sheets more broadly. That confidence often spills into credit markets, easing financial conditions for mid-sized companies and supporting equity valuations outside the mega-cap universe.

4. Sentiment and Positioning

Perhaps most importantly, mega-cap earnings shape sentiment. Many institutional portfolios remain underweight equities after years of volatility. Positive earnings surprises can force re-risking—not just into the largest names, but into lagging sectors offering catch-up potential.

A Different Kind of Market Rally

The early phases of the post-pandemic rally were characterized by speed and concentration. A small group of companies delivered extraordinary growth, while much of the market lagged. That environment rewarded passive exposure and punished diversification.

The current phase looks different.

Recent gains have been slower, broader, and more selective. Investors are increasingly focused on earnings quality rather than momentum. Balance sheets matter. Cash flow matters. Valuation discipline is returning.

Mega-cap earnings this week could reinforce that transition. If results are strong but not euphoric—solid growth, stable margins, measured guidance—they may encourage investors to look beyond the obvious winners and toward underappreciated opportunities.

This is particularly relevant for active managers, who have struggled to differentiate performance in a narrow market. A broadening rally reintroduces dispersion, creating opportunities in stock selection, sector rotation, and thematic investing.

Implications for Sector Leadership

A broadening market does not imply the end of mega-cap leadership. Rather, it suggests complementary leadership.

Technology remains central, especially where it intersects with AI, automation, and productivity enhancement. But other sectors stand to benefit:

- Industrials: Beneficiaries of infrastructure spending, reshoring, and capex tied to AI and energy transition.

- Financials: Improved earnings visibility, stabilizing net interest margins, and increased capital markets activity.

- Energy and Utilities: Power demand linked to data centers and electrification trends.

- Healthcare: Defensive growth with improving innovation pipelines and pricing stability.

Mega-cap earnings that highlight sustained investment and demand can lift expectations across these sectors, even if their growth profiles differ.

The Role of Valuation

Valuation remains a central concern. Mega-caps trade at premiums justified by scale, growth, and profitability. But those premiums become problematic if growth expectations slip or if capital intensity rises faster than returns.

This earnings season may clarify whether valuation concerns are overblown. If companies demonstrate that AI-related investments are translating into monetizable demand—rather than open-ended spending—investors may grow more comfortable with both mega-cap valuations and the broader equity multiple.

At the same time, a broadening market provides a release valve. Investors can rotate into attractively valued mid-cap and cyclical names without abandoning mega-cap exposure entirely.

What Could Go Wrong?

The optimistic scenario is not guaranteed. Several risks remain:

- Disappointing Guidance: Even strong backward-looking results could be overshadowed by cautious outlooks.

- Capex Anxiety: If AI spending appears excessive or poorly explained, investors may question return on investment.

- Macro Surprises: Inflation reacceleration or rate volatility could dampen risk appetite quickly.

- Earnings Concentration Persists: If gains remain confined to a handful of firms, skepticism about market health could resurface.

Markets are sensitive not just to numbers, but to narrative coherence. Earnings must tell a consistent story across sectors to sustain a broad rally.

Why This Matters for Allocators and Hedge Funds

For hedge funds and institutional allocators, this earnings week carries strategic implications.

A broadening market favors active risk-taking over index replication. It supports strategies focused on relative value, sector rotation, and idiosyncratic alpha. Multi-strategy funds, in particular, benefit from environments where correlations decline and dispersion increases.

From an asset allocation perspective, improving breadth reduces tail risk. Markets that rely on a few stocks are inherently fragile. Markets supported by many sectors are more resilient.

Mega-cap earnings that lift the broader market would mark an important inflection point—suggesting that the equity rally is not just surviving, but maturing.

The Bigger Picture

In many ways, this moment reflects a normalization of market dynamics. After years defined by crisis response, extraordinary monetary policy, and technological acceleration, investors are recalibrating expectations.

Earnings matter again. Valuations matter again. Fundamentals matter again.

Mega-cap companies remain central to that story, but they are no longer alone. Their earnings this week may serve as the bridge between a concentrated past and a more balanced future—one in which growth is shared, risk is distributed, and opportunity extends beyond the usual suspects.

If that happens, this earnings season will be remembered not just for its numbers, but for what it signaled: a stock market that is finally broadening out—and doing so from a position of strength.