(HedgeCo.Net) The hedge fund industry is experiencing what many allocators and strategists are calling a renaissance — marked by record profits at iconic managers, the largest inflows in nearly two decades, and expanding influence across sectors such as industrials and China-focused equities. While performance divergence remains, and risk practices such as elevated leverage are drawing scrutiny, the dominant narrative today is that of revitalization: hedge funds are generating returns that outpace benchmarks, attracting capital at historic levels, and stretching beyond traditional strategies in search of alpha.

1) The Record-Setting Year: Hedge Funds Rebound Strongly

As of early January 2026, multiple news reports confirm that hedge funds delivered strong performance across strategies in 2025 — a year marked by macro volatility, rising equity markets, and sector rotation. Large multi-strategy and macro managers posted double-digit gains that significantly outpaced long-only benchmarks, helped by stock market rallies and volatility’s return to markets.

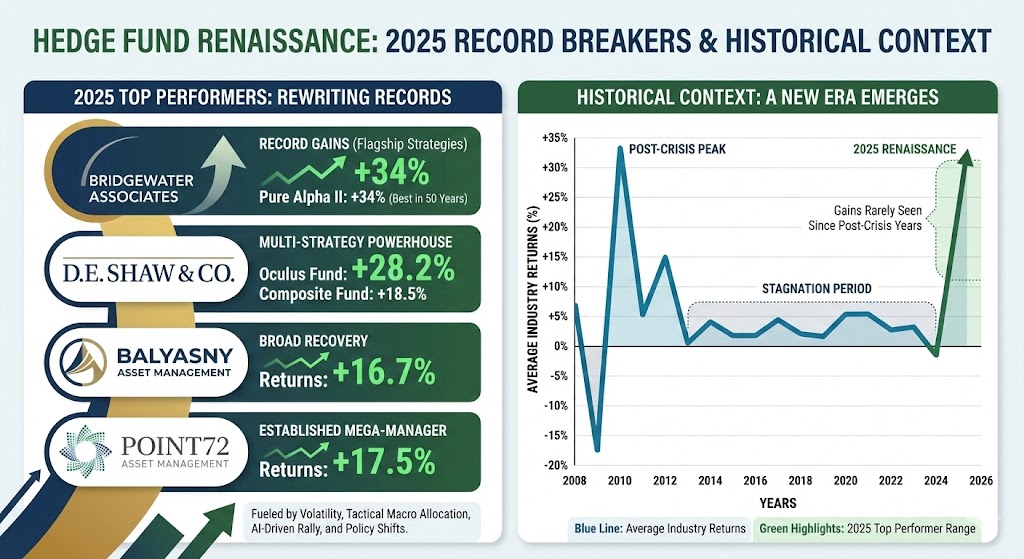

Notably, the top performing hedge funds of 2025 re-wrote industry records with gains rarely seen outside of peak post-crisis years:

- Bridgewater Associates, one of the largest macro hedge funds globally, posted record gains across its flagship strategies, fueled by volatility, tactical macro allocation, and tactical risk positioning.

- D.E. Shaw & Co. enjoyed returns of almost 28%, a standout outcome for a historically diversified multi-strategy powerhouse.

- Balyasny Asset Management and Point72 Asset Management each returned healthy gains — signaling a broad recovery among established mega-managers.

Even more striking was that these performance gains were achieved in a challenging macro backdrop — discounts on tech, persistent inflation fears, and rising geopolitical risk — underscoring managers’ tactical flexibility.

2) TCI’s Historic Profit Breaks Century of Hedge Fund Records

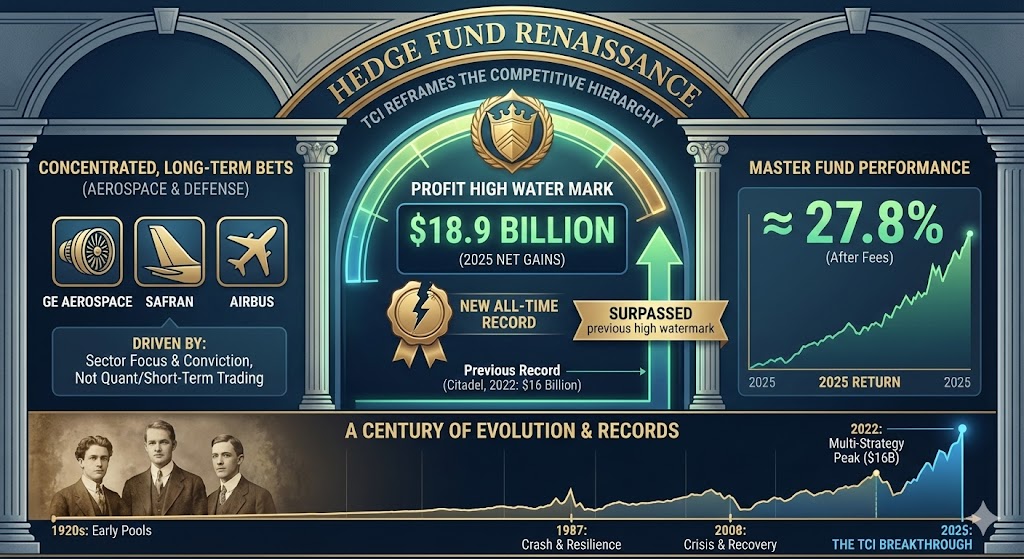

The biggest single story dominating hedge fund headlines today is the record profit generated by Sir Christopher Hohn’s TCI Fund Management in 2025 — nearly $18.9 billion in net gains for investors, the highest annual profit any hedge fund has ever posted.

TCI’s spectacular result did more than set a record — it reframed the competitive hierarchy of global hedge managers:

- It surpassed the previous high watermark of $16 billion set by Citadel in 2022.

- TCI’s master fund delivered a return around 27.8% after fees.

- The performance was driven by concentrated, long-term bets in sectors such as aerospace and defense (e.g., GE Aerospace, Safran, Airbus) — typically outside the quant and short-term trading spheres that define many multi-strategy peers.

This outcome places TCI in elite company and signals a broader trend: hedge funds that combine activist insights, sector expertise, and long-term conviction can outperform even powerful algorithmic and diversified multi-strategy firms.

3) The Inflows Surge: Hedge Funds Pull in $116 Billion:

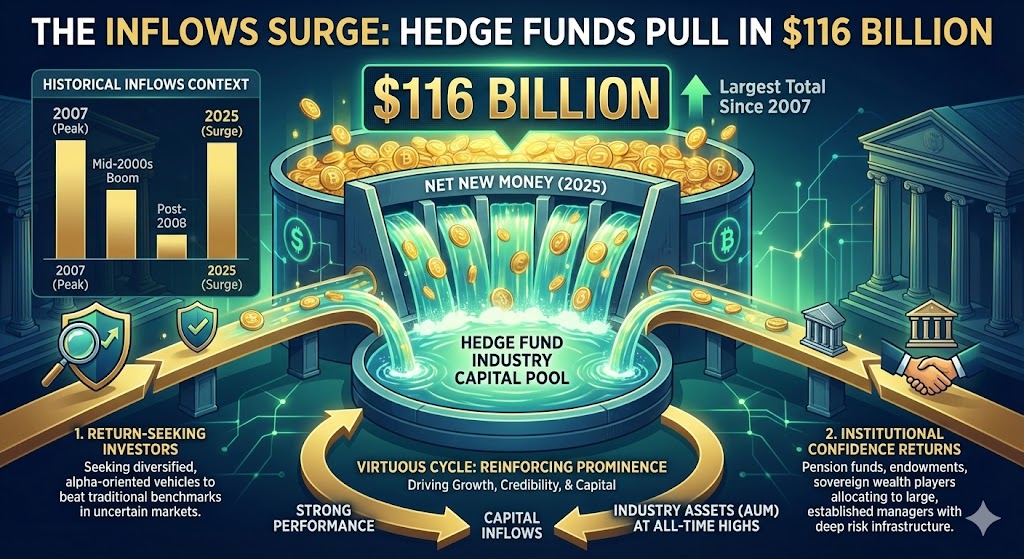

Performance gains alone do not explain hedge funds’ resurging prominence — capital flows back into hedge funds are hitting numbers not seen since the mid-2000s boom. According to recent data, hedge funds collected roughly $116 billion in net new money in 2025 — the largest total since 2007.

Two dynamics are driving the flow story:

- Return-seeking investors view hedge funds as diversified, alpha-oriented vehicles capable of beating traditional benchmarks in uncertain markets.

- Institutional confidence has returned, with pension funds, endowments, and sovereign wealth players allocating to large, established managers with deep risk infrastructure and multi-strategy capabilities.

These flows, combined with strong performance, are pushing industry assets under management to all-time highs, reinforcing a virtuous cycle of performance, credibility, and capital allocation.

4) Broader Market Impact: Hedge Funds as Market Movers

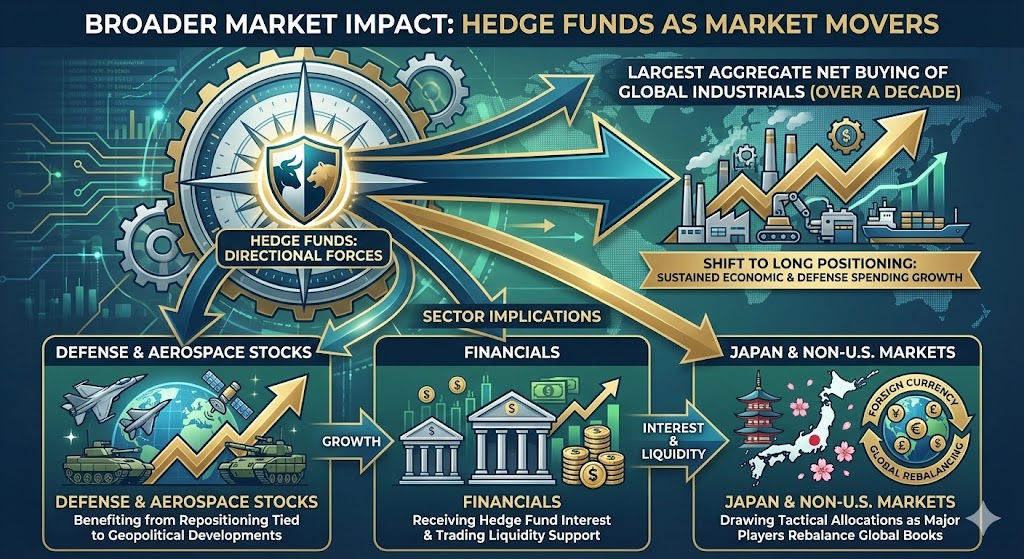

Beyond individual performances and fund flows, hedge funds are asserting market influence — not just as risk takers but as directional forces in sectors and securities. A recent report shows that hedge funds were responsible for the largest aggregate net buying of global industrial stocks in over a decade, tilting markets toward long positioning rather than short covering and reflecting expectations for sustained economic and defense spending growth.

Sector implications include:

- Defense and aerospace stocks benefiting from repositioning tied to geopolitical developments.

- Financials receiving both hedge fund interest and trading liquidity support.

- Japan and non-U.S. markets drawing tactical allocations as major players rebalance global books.

This evolution reinforces hedge funds’ strategic role — not merely as alpha engines but as macro allocators shaping sector flows and investor expectations.

5) Performance Contrast Across Strategies

Despite the bullish narrative, performance was not uniform across strategies or managers. Tech-focused and trend-following quants faced headwinds in parts of 2025, underscoring that not all hedge fund playbooks benefit equally from volatility or macro rotations — particularly for those over-exposed to concentrated tech positions.

The divergence between systematic / quant strategies and discretionary / macro / activist approaches speaks to the evolving landscape in which each subset must justify its strategic edge in an era of rising rates, geopolitical tensions, and rising macro awareness.

6) Outlook: Hedge Funds in 2026 and Beyond

Given recent trends — record profits, inflows, sector allocations on the rise, and shifting performance leadership — the hedge fund industry appears poised for expanded relevance in 2026, though challenges remain:

- Allocators will increasingly differentiate between strategy performance drivers and risk exposures.

- Managers may need to emphasize risk management and leverage oversight given broader market volatility and rising hedge fund leverage levels.

- Traditional benchmark-agnostic hedge functions must continue innovating in macro, credit, and alternative data analytics to sustain edge.

Overall, the “hedge fund renaissance” narrative is underpinned by data: record gains, renewed capital commitments, and an expanded role as market participants — marking one of the most consequential periods for hedge funds since the financial crisis.