(HedgeCo.Net) In markets dominated by macro uncertainty and geopolitical tension, the biggest story trending today among U.S. hedge funds is the massive repositioning in response to President Donald Trump’s renewed tariff threats. What began as a broader policy signal has swiftly evolved into front-of-mind strategy for macro, discretionary, and event-driven hedge funds alike — as firms recalibrate exposures, seize dislocated opportunities, and hedge risk in anticipation of escalating trade frictions between the U.S. and major European economies.

This article explores why tariffs have become such a dominant catalyst for hedge fund action, how leading managers are positioning, and what this means for markets, portfolios, and investor confidence going into 2026.

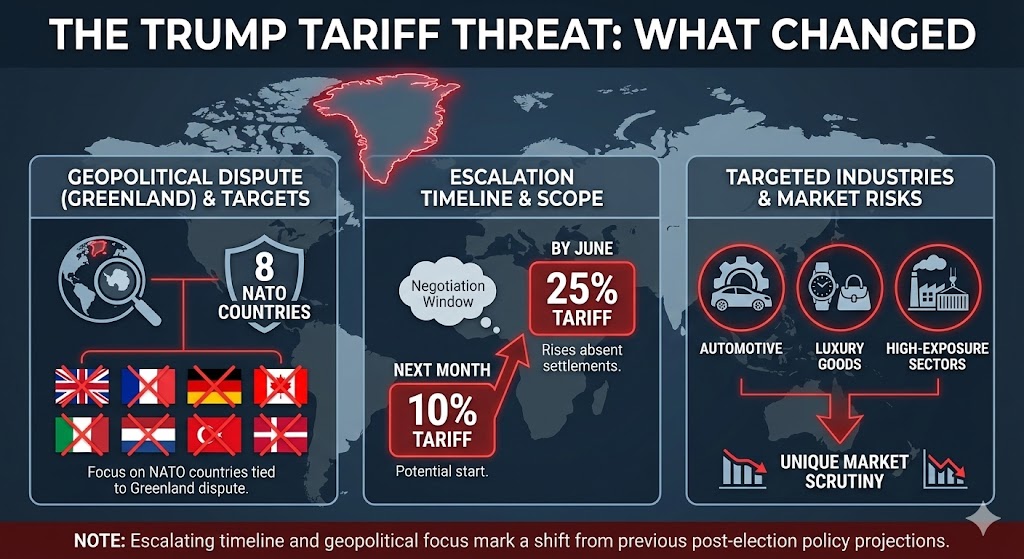

President Trump’s recent declarations signal a potential escalation in U.S. trade policy — with proposed tariffs on goods from up to eight NATO countries over geopolitical disputes tied to Greenland. While tariffs are not new to the post-election policy landscape, the scope, scale, and geopolitical undertones of this escalation have drawn unique market scrutiny. Under current proposals:

- A 10 % tariff could take effect as early as next month

- Tariffs could rise to 25 % by June absent negotiated settlements

- Targeted industries include automotive, luxury goods, and other sectors with high trade exposure

This potential shift has already pushed European indices lower, with traditional benchmarks such as the DAX, CAC, and FTSE seeing notable declines over recent sessions — reflecting rising risk premia tied to trade disruption.

For hedge funds, the message is clear: macroeconomic risk has become non-linear and politically amplified. Firms are recalibrating not just positions in equities and credit, but also currency, derivatives, and cross-market hedges.

Hedge Fund Positioning: Tactical Shorting and Sector Exposure

Several major hedge funds have taken proactive positions to capture dislocation and hedge downside risk:

Short Positions in Vulnerable Sectors

Hedge funds including Marshall Wace, DE Shaw, and Helikon Investments are reported to hold significant short exposures in stocks most likely to be hit by tariffs. These include:

- Luxury goods companies reliant on European-U.S. demand

- Automobile manufacturers with integrated transatlantic supply chains, including UK-linked manufacturers with significant export exposure

For example, Burberry has attracted substantial short interest from Marshall Wace, while DE Shaw and Helikon hold short positions in auto producers highly tied to U.S. markets.

These moves reflect a classic event-driven trade: anticipate profit compression and demand pressure in sectors sensitive to import levies.

Beyond short equities, hedge funds are layering in macro hedges:

Increased Gold and Silver Exposure

Precious metals have surged to all-time highs as safe-haven assets, signaling a flight to safety from traders fearing broader market disruption. Gold and silver are being used as real asset hedges against:

- equity volatility

- inflationary pressures

- emerging currency dislocations

This is especially notable as yield dynamics and political risk premiums influence asset pricing.

Currency Strategy Adjustments

Other hedge funds have reduced bullish euro bets, flipping to more defensive currency stances ahead of tariff actions — a clear signal that foreign exchange strategies are becoming integral to macro risk management.

Institutional Voices: Criticism and Caution

Not all hedge fund voices are solely opportunistic — some are cautionary.

Ken Griffin, CEO of Citadel, publicly criticized the policy environment at the 2026 World Economic Forum, calling Trump’s tariff strategy a “pretty unfortunate position for the U.S.” Griffin argued that sustained tariff uncertainty complicates corporate planning, undermines historical trade partnerships, and dissuades long-term investment — particularly in sectors like manufacturing and technology where supply chains are deeply globalized.

This public critique from a leading macro hedge fund manager underscores a deeper structural concern: tariffs introduce policy risk premiums that can distort valuation models and increase protective hedging costs across asset classes.

Why Hedge Funds Are Taking Tariff Risk Seriously

1. Tariffs Change Risk/Reward Profiles Quickly

Unlike most macro data releases — which are anticipated and priced gradually — tariff announcements can instantly alter expected returns, margins, and currency flows. Hedge funds thrive on pricing regime shifts, and tariffs represent one of the starkest regime disruptions possible.

2. Global Supply Chains Amplify Impacts

In an interconnected global economy, tariffs on one region can ripple across supply chains:

- Pricing changes passed to consumer goods

- Cost increases for intermediate inputs

- Foreign retaliation impacts export-oriented sectors

Hedge funds are positioning to capture—or protect against—these knock-on effects rather than merely bet directionally on U.S. equities. Policies that once were largely macroeconomic have become politico-economic catalystsfor trading strategies.

3. Correlation and De-Risking in Traditional Markets

Equity correlations have increased during macro stress periods, meaning that tariffs—though specific in intention—can cause broad market de-risking and flight to safety, even outside targeted industries.

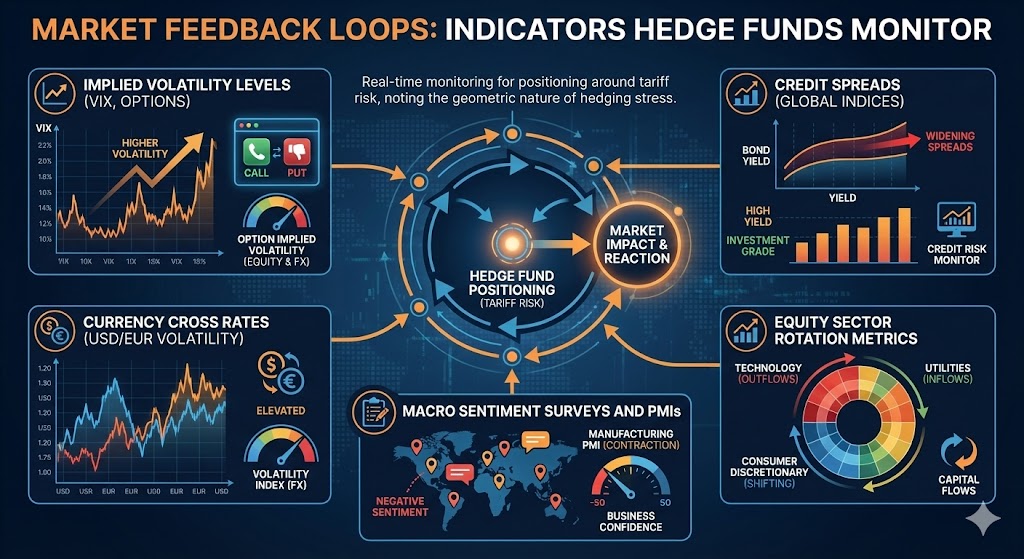

When positioning around tariff risk, hedge funds rely on real-time indicators including:

- Implied volatility levels (VIX, equity and FX options)

- Credit spreads, especially in global credit indices

- Currency cross rates (e.g., USD/EUR volatility)

- Equity sector rotation metrics

- Macro sentiment surveys and PMIs

Given the geometric nature of hedging stress, funds are increasingly adding multi-factor hedges that combine equity shorts, FX risk reversals, and commodity “safe haven” overlays.

Potential Outcomes and Trade Scenarios

Hedge fund strategists generally consider several staging scenarios:

Scenario A — De-escalation Through Diplomacy

If trade tensions ease through negotiation, risk assets may rebound sharply — forcing short squeezes in sectors deeply shorted by hedge funds. In this case:

- Euro and other developed market currencies strengthen

- Industrial and consumer sectors recover

- Volatility contracts

Scenario B — Tariffs Take Effect Gradually

This is the base case hedge funds are pricing now:

- 10 % tariffs initially, rising to 25 % by mid-year

- European retaliation adds risk premium

- Earnings forecasts adjust downward

Hedge funds would prefer to be positioned ahead of adjustment rather than behind it.

Scenario C — Escalation and Global Trade War

In an extreme escalation, hedge funds could see:

- Deep selloffs in global equities

- Currency safe-haven rallies in USD, CHF, and JPY

- Surge in precious metal prices

Such a scenario favors funds with macro hedges and volatility strategies, as opposed to those that remain heavily weighted in crowded equity longs.

Hedge Funds and Risk Management Culture

Crucially, the heightened tariff narrative is not simply about opportunistic positioning. Hedge funds are simultaneously reinforcing risk controls:

- Stop-loss thresholds on directional equity exposure

- Trailing protection collars on currency positions

- Dynamic macro models that adjust hedge ratios as real-time data shifts

This emphasis on protective architecture demonstrates how structural risk, not just discretionary trade, is shaping hedge fund portfolios in 2026.

Implications for Investors and Markets

The hedge fund community’s active positioning on tariff risks has several broader implications:

- Increased volatility in both equities and FX markets

- Greater divergence between policy risk and classical valuation drivers

- Heightened need for dynamic hedging tools

- Potential mispricing opportunities for nimble allocators

By integrating tariff risk into foundational strategy frameworks, hedge funds are signaling that political catalysts now carry similar weight to economic data releases in market pricing.

Conclusion: A Different Kind of Macro Shock

Hedge funds preparing for Trump’s tariff onslaught reflects a broader evolution in macro investing — one where political risk is no longer a back-burner consideration but a central driver of asset allocation and risk management. Whether tariffs lead to deep market disruption or ultimately fade through negotiation, today’s positioning highlights how complex and interconnected global markets have become — and how hedge funds continue to adapt to shifts at the intersection of geopolitics and economics.