(HedgeCo.Net) The cryptocurrency market is under renewed pressure today after Bitcoin slipped below the psychologically critical $90,000 level, triggering a broader pullback across digital assets and reigniting debate over whether the market is entering a deeper consolidation phase or simply pausing after a historic run.

The move lower has rippled through major altcoins, derivatives markets, and crypto-linked equities, underscoring how tightly sentiment, macro forces, and leverage dynamics are now intertwined in the digital-asset ecosystem.

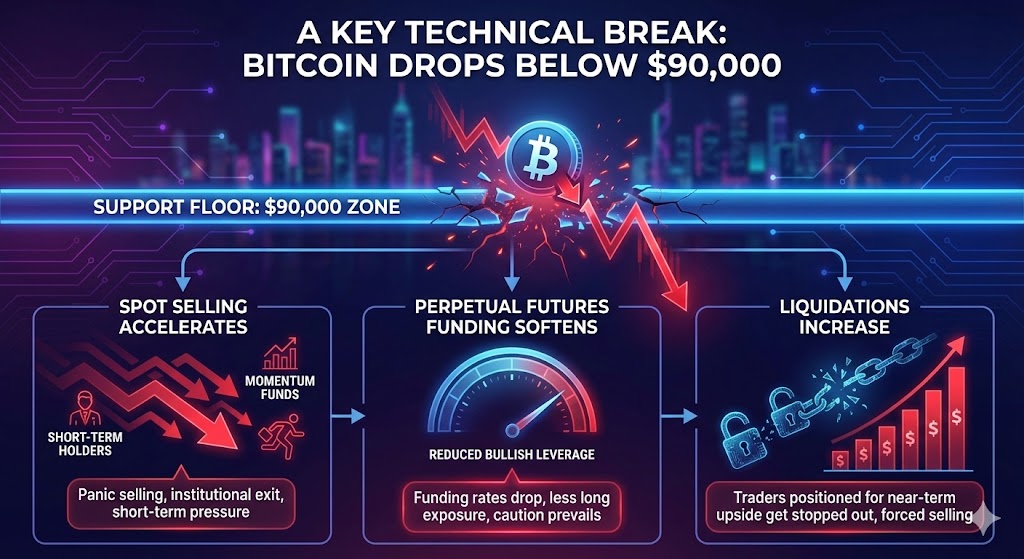

A Key Technical Break

Bitcoin’s drop below $90,000 is significant less for the absolute price level and more for what it represents psychologically. For much of early 2026, the $90K zone had functioned as a support floor and confidence marker for traders, institutions, and systematic strategies alike.

As prices slipped through that level during today’s trading session:

- Spot selling accelerated, particularly from short-term holders and momentum-driven funds

- Perpetual futures funding rates softened, indicating reduced bullish leverage

- Liquidations increased, especially among traders positioned for near-term upside

While Bitcoin remains far above its long-term averages, the breach of a widely watched threshold has shifted market tone from “buy the dip” to “wait and reassess.”

Macro Pressure Meets Crypto Reality

Today’s crypto decline did not occur in isolation. Instead, it reflects a broader risk-off environment across global markets.

Several macro forces are converging:

1. Tighter Financial Conditions

Bond yields have remained elevated, keeping pressure on risk assets. For crypto — which increasingly trades like a macro-sensitive asset — higher real yields reduce the appeal of non-yielding stores of value in the short term.

2. Strong Dollar Dynamics

A firmer U.S. dollar has historically weighed on Bitcoin and other cryptocurrencies, particularly during periods when global liquidity tightens.

3. Equity Market Volatility

Equity indices have shown increased volatility in recent sessions, prompting portfolio de-risking that often spills into crypto allocations, especially among multi-asset funds.

Crypto’s maturation as an institutional asset class has brought deeper capital pools — but also greater correlation with traditional markets during stress events.

Sentiment Turns Defensive

Market sentiment today has clearly shifted.

Crypto sentiment indicators have moved decisively toward fear, reflecting growing caution among traders who entered the market during late-2025’s strong rally. Social-media chatter, options positioning, and on-chain flows all suggest a defensive posture:

- Traders are reducing leverage

- Options activity is skewing toward downside protection

- Short-term holders are more likely to sell into weakness than accumulate

Importantly, long-term holders appear far less reactive — a dynamic that suggests the current move may be more about positioning resets than structural abandonment.

Altcoins Feel the Weight

As is typical during Bitcoin-led drawdowns, altcoins have underperformed.

Ethereum, while holding key longer-term support levels, has drifted lower alongside Bitcoin. High-beta tokens — including smaller Layer-1 networks, DeFi governance tokens, and speculative meme assets — have seen sharper percentage declines as liquidity thins and risk appetite fades.

This pattern reinforces a familiar hierarchy during market stress:

- Bitcoin first

- Ethereum next

- Altcoins last — and hardest

For many investors, today’s move has reinforced Bitcoin’s role as crypto’s relative safe haven, even during broad selloffs.

Leverage and Derivatives: A Quiet Culprit

One of the less visible — but highly influential — drivers of today’s move is the derivatives market.

In recent weeks, open interest across Bitcoin futures had climbed steadily as traders positioned for further upside. When prices began to slip:

- Stop-losses were triggered

- Margin thresholds were breached

- Forced liquidations added to selling pressure

This dynamic often creates self-reinforcing price moves, where relatively modest spot selling cascades into larger declines through leverage unwinds.

Notably, the reduction in open interest today may ultimately improve market health, flushing out excess leverage and setting the stage for more sustainable price action.

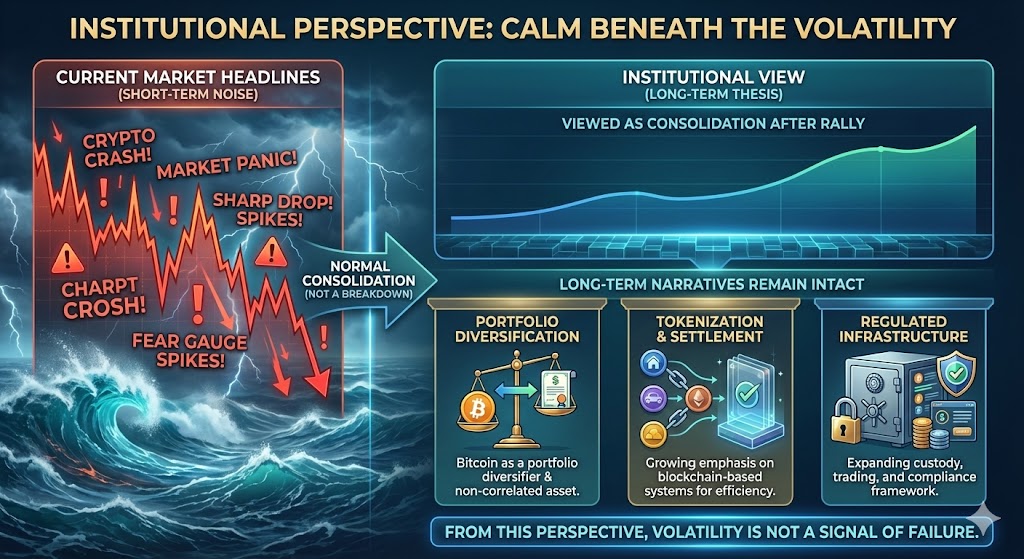

Institutional Perspective: Calm Beneath the Volatility

Despite the sharp headlines, institutional commentary around today’s move has been notably restrained.

Large asset managers and crypto-focused funds generally view the drop as a normal consolidation following an extended rally rather than a fundamental breakdown of the crypto thesis.

Several long-term narratives remain intact:

- Continued institutional interest in Bitcoin as a portfolio diversifier

- Growing emphasis on tokenization and blockchain-based settlement systems

- Expanding regulated infrastructure for custody, trading, and compliance

From this perspective, volatility is not a sign of failure — but a feature of a maturing, globally traded asset class.

Is This the Start of a Deeper Correction?

The critical question for markets is whether today’s drop below $90,000 marks:

- A temporary shakeout, or

- The beginning of a broader correction

Historically, Bitcoin has experienced multiple 15–30% drawdowns even within strong bull cycles. These corrections often:

- Reset sentiment

- Clear leverage

- Shift ownership from short-term traders to longer-term holders

What matters next is follow-through:

- If prices stabilize and reclaim $90K, confidence could return quickly

- If selling persists and support levels fail, markets may enter a longer consolidation phase

For now, price action suggests caution, not panic.

What Investors Are Watching Next

Market participants are focused on several near-term signals:

1. On-Chain Activity

Wallet flows and long-term holder behavior will indicate whether conviction remains strong beneath the surface.

2. Macro Data

Upcoming inflation prints, central-bank commentary, and bond-market moves could heavily influence crypto direction.

3. Regulatory Developments

Any progress — or setbacks — in crypto market-structure regulation could shift institutional sentiment rapidly.

4. Volume Trends

A decline on low volume may suggest exhaustion; heavy volume would imply deeper distribution.

A Familiar Crypto Moment

Bitcoin’s fall below $90,000 today is a reminder that crypto markets remain volatile, sentiment-driven, and deeply connected to global liquidity conditions — even as they mature.

For traders, today’s move has reinforced the importance of risk management.

For long-term investors, it has reopened conversations about accumulation, patience, and conviction.

For the broader industry, it underscores that crypto is no longer a fringe market — but a core component of the global risk landscape.